Demystifying the benefits and risks of ETFs

Post on: 16 Март, 2015 No Comment

Demystifying the benefits and risks of ETFs

Page 1 of 2

Arian Neiron is the managing director of Market Vectors Australia .

A lot has been written about the rapid growth of Australia’s exchange-traded funds (ETF) market, which recently passed $9 billion in assets. As a result of strong growth, the spotlight has been focused on the benefits of ETFs, as well as the risks.

In Australia most ETFs, and particularly equity-based ETFs that trade on the Australian Securities Exchange (ASX), are backed by a portfolio of listed securities.

Typically, an ETF aims to track the performance of an index or a benchmark. It might track an entire market or just a sector of the market. An ETF can offer investors instant exposure to a range of shares, delivering instant diversification with one trade.

There are ETFs covering a broad range of assets including property, fixed interest, currencies and commodities.

The most widely known benefits of ETFs are their transparency and relative cost efficiency. Since the global financial crisis (GFC), transparency is one of the most discussed topics in the financial services industry.

Investors want to know what they are invested in at any given point in time. That is, investors can find out exactly what assets the ETF holds as well as an indicative price of the ETF, as represented by the intraday net asset value (NAV) or iNAV. In addition, generally an ETF is less costly than actively managed funds.

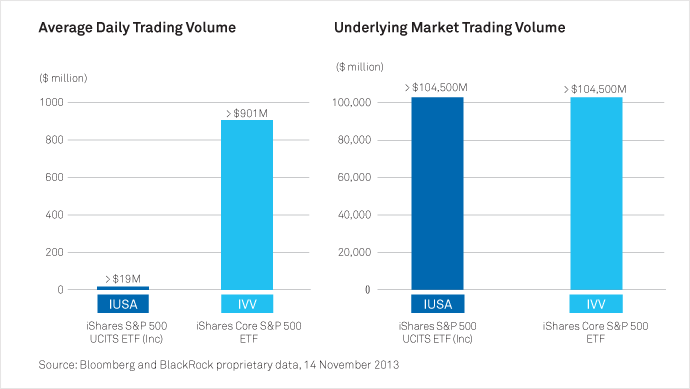

Unlike their unlisted managed fund counterparts, ETFs also offer high liquidity, allowing investors to trade an ETF just like any other stock on the Australian share market throughout the trading day. Two sources of liquidity help to improve the buying and selling of an ETF.

The first is liquidity created through trading ETFs between buyers and sellers on exchanges such as the ASX. The second is through market makers and authorised participants, who ensure there are enough ETF units supplied for the demand and that the ETF’s price stays relatively close to its NAV.

Typically, ETFs are relatively more tax-effective than actively managed funds as they have reduced portfolio turnover and are therefore less likely to generate capital gains, which are distributed to investors.

While the benefits stand out, like any investment product ETFs do come with risks. The main risk of owning units in an ETF is investment risk of the underlying securities, that is, that the value of the ETF’s underlying securities will rise and fall in line with market movements.

This is a risk inherent in all investments, particularly with growth assets such as shares, where prices can rise and fall depending on investor sentiment and other market factors.

Another potential risk of ETFs is tracking error. The ETF unit price or net asset value (NAV) may not exactly follow the price of the underlying index they are designed to track. Fees, taxes and other factors such as the liquidity of the underlying securities may cause this tracking error.

A common misconception is that ETFs and market makers create volatility in financial markets. Recent studies provide solid evidence that volatility in share markets is driven by macroeconomic factors such as GDP, inflation and interest-rate movements rather than the buying or selling of underlying assets by market makers.

Indeed, share market volatility has been a characteristic of markets well before ETFs emerged.

We feel it is likely that strong growth of Australia’s ETF market will continue into 2014 given rising demand from direct investors and self-managed superannuation funds (SMSFs) who are using ETFs to broaden their portfolios to either remove stock selection risk or include investment opportunities that they couldn’t previously access.