Checklist How to Spot a Bubble in Real Time

Post on: 4 Декабрь, 2016 No Comment

Checklist: How to Spot a Bubble in Real Time

Print This Post

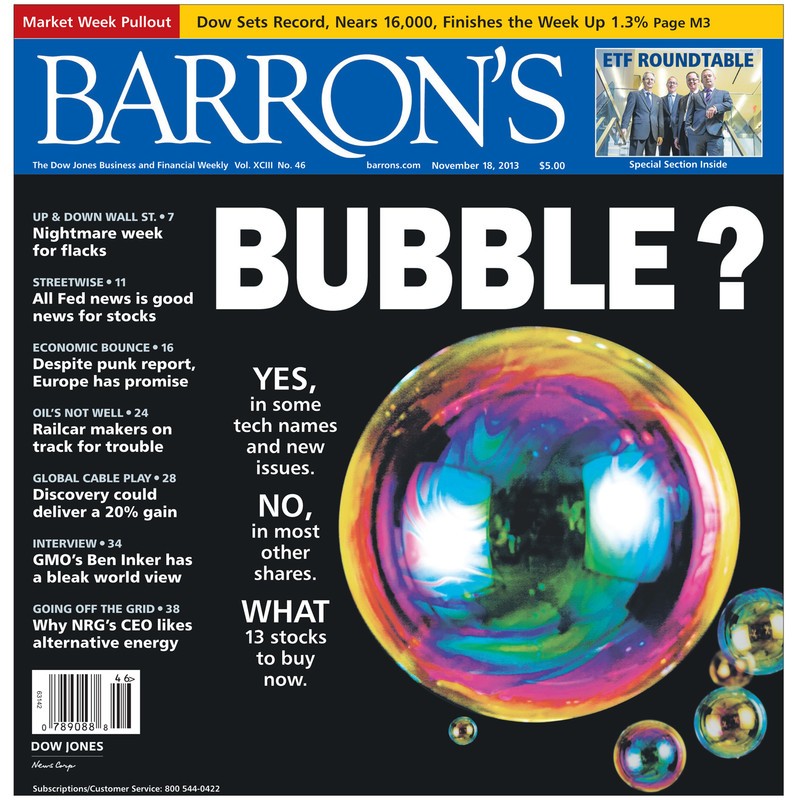

Are the Linked In/Groupon IPOs proof we have a new bubble in Tech? Are US Treasuries a bubble? Commodities?

There have been numerous attempts by many Fed economists to argue that bubbles cannot be seen as they happen, and they we can only spot them after the fact.

I believe they are incorrect. We can spot bubbles as they happen, so long as we rely on a variety of data points.

Consider these 10 elements a checklist to identifying bubbles in real time:

1. Standard Deviations of Valuation. Look at traditional metrics – valuations, P/E, price to sales, etc. — to rise two or even three standard deviations away from the historical mean.

2. Significantly elevated returns : The S&P500 returns in the 1990s were far beyond what one could reasonably expect on a sustainable basis. The years around Greenspan’s Irrational Exuberance speech suggest that a bubble was forming:

1995 37.58

1996 22.96

1997 33.36

1998 28.58

And the Nasdaq numbers were even better.

3. Excess leverage. Every great financial bubble has at its root easy money and rampant speculation. Find the leverage, and speculation wont be too far behind.

4. New financial products. This is not a sufficient condition for bubble, but it does seems that each major bubble has new products somewhere in the mix. It may be Index funds, derivatives, tulips, 2/28 Arms.

5. Expansion of Credit : This is beyond mere speculative leverage. With lots of money floating around, we eventually get around to funding the public to help inflate the bubble. From Credit cards to HELOCs, the 20th century was when the public was invited to leverage up.

6. Trading Volumes Spike. We saw it in equities, we saw it in derivatives, and we’ve seen it in houses: The transaction volumes in every major boom and bust, almost by definition, rises dramatically.

7. Perverse Incentives. Where you have unaligned incentives between corporate employees and shareholders, you get perverse results — like 300 mortgage companies blowing themselves up.

8. Tortured rationalizations. Look for absurd explanations for the new paradigm: Price to Clicks ratio, aggregating eyeballs, Dow 36,000.

9. Unintended Consequences. All legislation has unexpected and unwanted side effects. What recent (or not so recent) laws may have created an unexpected and bizarre result?

10. Employment trends : A big increase in a given field — real estate brokers, day traders, etc. — may be a clue as to a developing bubble.

11. Credit Spreads. Look for a very low spread between legitimately AAA bonds and higher yielding junk can be indicative of fixed income risk appetites running too hot.

12. Credit Standards. Low and falling lending standards are always a forward indicator of credit trouble ahead. This can be part of a bubble psychology.

13. Default Rates. Very low default rates on corporate and high yield bonds can indicates the ease with which even poorly run companies can refinance. This suggests excess liquidity, and creates false sense of security.

14. Unusually Low Volatility. Low equity volatility readings over an extended period indicates equity investor complacency.

The Fed has previously suggested that spotting bubbles in real time a black art; I believe that it can be more science than art, so long as we quantify the various data points and consider them objectively.

Note: This was adapted from material previously published on TBP on October 22nd, 2008 and December 2nd, 2009 .

Please use the comments to demonstrate your own ignorance, unfamiliarity with empirical data and lack of respect for scientific knowledge. Be sure to create straw men and argue against things I have neither said nor implied. If you could repeat previously discredited memes or steer the conversation into irrelevant, off topic discussions, it would be appreciated. Lastly, kindly forgo all civility in your discourse. you are, after all, anonymous.