Bond Basics Price and Yield US News

Post on: 26 Январь, 2017 No Comment

Bonds are a part of most portfolios, but investors still don’t always know how they work.

Miranda Marquit

One of the ways that many investors shore up their portfolios is by adding bonds, particularly U.S. government bonds. Treasury securities can provide investors with a reasonable expectation of safety for their principal (even though there is still the risk that the government will default at some point) and a set rate of return — albeit a small one.

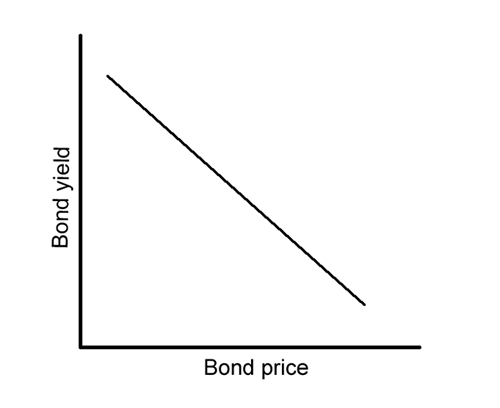

What many beginning bond investors don’t fully realize, though, is the relationship between bond prices and bond yields. The two have an inverse relationship, meaning that when bond prices rise, bond yields drop, and vice versa. So what does that mean for you? It helps to understand how it works.

Bond Prices and Bond Yields.

Say you want to purchase a $5,000 10-year bond with a yield of 2.6 percent. If you purchase the bond at face value, that bond is going to pay you $130 per year.

But what happens if prices rise or fall? That $5,000 bond is always going to pay $130 a year. But the price you actually pay for that bond can be higher or lower than that depending on demand for such bonds. If demand is high, and bonds are trading at a premium to their issue value (known as par value), you might have to bid $5,200 in order to purchase the bond. However, since the interest paid is on the face value of the bond, and not what you paid for it, you’re still getting $130 a year. That means that your yield is actually figured by dividing $130 by the $5,200 that you paid, resulting in a 2.50 percent yield. The yield has dropped with the increase in price.

Conversely, if demand falls off, the bond might sell at a discount. So, you might only pay $4,800 for the bond with a $5,000 face value. You still get the $130 a year, though. Your yield then increases to about 2.71 percent. As the price of the bond drops, the yield rises.

(iStockPhoto)

What Happens with the Taper?

The next question many have about bonds is what happens when the Federal Reserve starts tapering off its asset purchase program. Right now, yields are relatively low because, with the Fed buying up to $85 billion in Treasuries each month, there is demand for the bonds. This keeps the prices somewhat high and the yields low. (And that means that other interest rates, which are influenced by the 10-year yield, like mortgages, remain fairly low as well.)

But now there is talk that the Federal Reserve will start tapering off its asset purchases. With less buying going on when it comes to Treasuries, prices will drop — and yields will rise. At that point, many investors are likely to start getting interested in government bonds again. After all, if prices drop so that yields end up rising to 3 percent or 4 percent, bonds will become more attractive. It might also mean that some investors will abandon their dividend investing plan (or at least shift some of their money around) in order to take advantage of what might be considered safer returns.

Another reality is that mortgage rates are likely to begin rising once Treasury prices drop and yields head higher. For those looking to buy a home, the taper might result in higher interest prices on mortgages. In fact, just the speculation surrounding the taper, and when it might happen, has resulted in higher mortgage rates in the last few weeks. Investors and others try to get ahead of the situation, and that can get things moving before the Fed makes any official announcements.

Understanding the relationship between bond prices and bond yields, and having an idea of how they might be impacted by other things happening with the economy, can help you formulate a plan for when to buy or sell bonds, and what the consequences might be.

Miranda Marquit is a freelance financial journalist. She writes about beginning investing, low cost index funds and dividend stocks for a variety of financial websites. Her own blog is Planting Money .