Bond Basics Corporate versus Sovereign Risk

Post on: 1 Сентябрь, 2015 No Comment

Share | Subscribe

In a previous post, I took a closer look at the significance of duration. which measures the sensitivity of a bond’s price to changes in interest rates. When you buy a bond you take on interest rate risk; the higher the duration the more interest risk you have. You also take on what is known as default risk, which is the risk that the issuer will be unable to fulfill its debt obligations. For today’s post, I’m going to explain how default risk applies to different types of bonds, starting with corporates.

Corporate Bonds and Default Risk

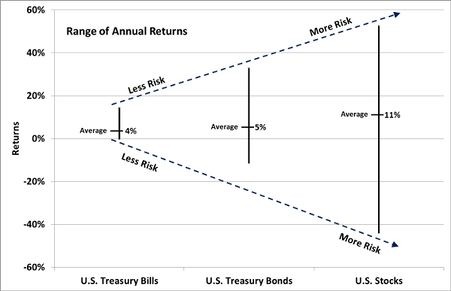

When you buy a corporate bond you are lending money to a corporation, with the understanding that they will make interest payments to you at regular intervals, and then return the principal amount that they borrowed at maturity. Corporate bonds are usually issued at a par value of $1,000 with a stated interest rate known as the coupon. When an investor buys a corporate bond they are primarily taking on 2 kinds of risk — interest rate risk and default risk. The yield an investor receives is compensation for both of these risks. Most investors consider US Treasury debt to be free of default risk, or at least the least likely issuer to default. For this reason people commonly use US Treasury securities as the reference point for measuring a corporate bond’s level of interest rate and default risk. The amount of yield a corporate bond investor receives for taking on interest rate risk will be similar to the yield on a similar maturity Treasury security.  The corporate bond investor will then be paid additional yield over and above the comparable Treasury rate; this primarily is for taking on default risk. The riskier the corporate bond issuer, the higher level of additional yield investors will be paid.

Ratings agencies like Standard & Poor’s and Moody’s evaluate the credit quality of bond issuers. Bonds rated BBB-/Baa3 and higher are considered to be investment grade and have a lower default risk than non-investment grade bonds, or junk bonds (those with a rating of BB or Ba and lower). The below table shows how the ratings scales of two widely followed rating agencies compare. The table also shows the average additional yield that a bond of a specific credit quality will pay. Not surprisingly, as you move down the table, the yield spreads increase.

*Source: Barclays as of 12/31/2013.  Average credit spread of each rating bucket within the Barclays US Corporate Index and Barclays US High Yield Index.

Sovereign Bonds & Default Risk

As with corporate bonds, bonds from sovereign issuers also carry default risk. Each sovereign issuer has a common short name that is used in the market. For example, the U.S. issues Treasuries, the U.K. issues Gilts, and Germany issues Bunds. The French even issue Oats. When you buy a sovereign bond you are essentially lending the government money that will be paid back to you at a later date. As with corporate bonds, between the date of purchase and maturity you will receive regular interest payments followed by a repayment of principal. And like corporate bonds, most sovereign debt is rated by one or more of the ratings agencies.

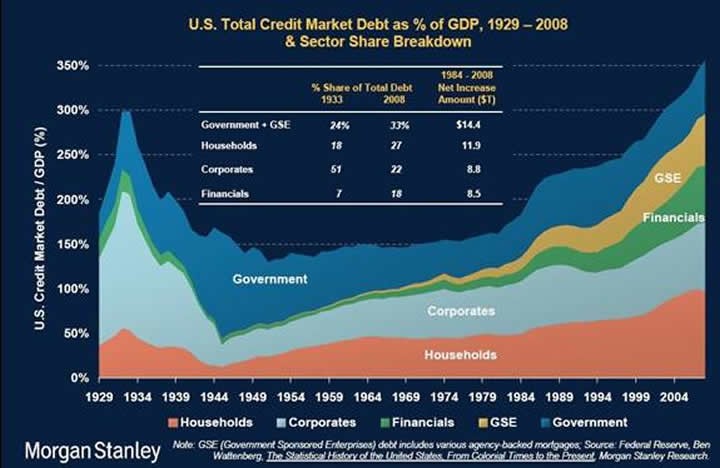

Bonds issued by developed economies tend to have a higher credit rating than emerging market sovereign bonds. This is intuitive as more stable governments would be expected to be more reliable borrowers. When evaluating sovereign debt it is important to consider the political and economic climate of the issuer. If the country in which you own sovereign bonds is facing some kind of strife or turmoil, it may be unwilling or unable to pay back its debt. This can lead to a decline in bond price, non-payment of coupons, and even a loss of principal if there is a default. Sometimes countries will attempt to restructure their debt, leaving the bondholder with lower interest and principal payments, and sometimes extended maturity dates. Sovereign bonds can be issued in local or foreign currency, and fluctuating currency values can have a major impact on your total return.

To help investors think about and evaluate sovereign risk, BlackRock has developed the BlackRock Sovereign Risk Index (BSRI). The index ranks the level of credit risk in each sovereign issuer by looking at their fiscal position, willingness to pay, external financial position, and financial sector health. Click here or on the graphic below for the most recent scores and rankings.

Matt Tucker, CFA, is the iShares Head of Fixed Income Strategy and a regular contributor to The Blog . You can find more of his posts here .

20Blog%20%7C%20Global%20Market%20Intelligence&el=Bond%20Basics:%20Corporate%20versus%20Sovereign%20Risk /%