Best Vanguard Funds 2014

Post on: 18 Октябрь, 2015 No Comment

2014 list of 10 best Vanguard mutual funds with top ratings. Highest performing, recommended funds for IRA/brokerage account investors in the last 10 years: VASVX, VGENX, VTENX, VMATX, VWNFX, VWIGX, VIPSX, VIMSX

Best Vanguard Funds for 2014

Vanguard is the world’s largest mutual fund company, based in Valley Forge, Pennsylvania, with about $2 trillion invested in the U.S. in more than 170 index, active, and exchange-traded funds. It offers mutual funds and other financial products and services to retail and institutional investors in the United States and abroad. Company has several international offices in Netherlands, Australia, UK, Australia, France, Singapore, Japan, Canada and Switzerland. Founder and former chairman John C. Bogle created the first index fund available to individual investors. With his help Vanguard starts to operate as a new kind of firm, in which the mutual funds own the management company, and fund shareholders pay only what it costs Vanguard to operate the funds.

Below we will show you the 10 best Vanguard mutual funds in 2014 for individual investors. Our choice was guided by the following criteria:

1. Past performance.

2. Mutual fund’s ability to outperform its peers in the nearest future.

3. Professional skills of the Vanguard fund managers.

In our research of top ten performing Vanguard funds we used all well-known mutual fund rating agencies — Morningstar, Zacks, TheStreet.com and others.

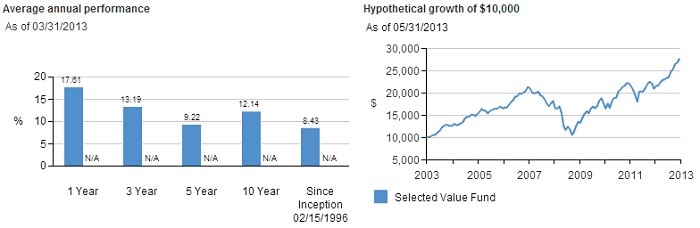

Vanguard Selected Value Fund (VASVX)

This fund focuses on mid-sized companies. The fund’s two advisors buy stocks they view as being significantly undervalued and out of favor with investors. Because of the size and characteristics of the stocks the fund holds, performance can vary significantly from that of the broad stock market. The fund is typically concentrated in a small number of stocks and, therefore, can be subject to significant volatility. Investors in this fund should have a long-term horizon and may consider the fund complementary to an already diversified portfolio. The top ten holdings are XL Group, Royal Caribbean Cruises, Omnicare, Hanesbrands, Pentair. CA, Micron Technology, Cardinal Health, Rockwood Holdings, Fifth Third Bancorp. Minimum initial investment in Vanguard Selected Value Fund is $3000, and an expense ratio is 0.38% that is 70% lower than the average expense ratio of funds with similar holdings. The fund returned 32.16% in the last one year period.

Vanguard Energy Fund Investor Shares (VGENX)

This actively managed fund offers investors low-cost exposure to U.S. and non-U.S. companies that are engaged in various aspects of the energy business. Unlike similar funds, which may invest in companies that explore for and distribute additional commodities, this fund focuses purely on energy, such as oil, natural gas, and coal. The fund is narrow in scope, investing solely within the energy sector. In addition, the fund may be invested up to 100% in foreign securities, which can be more volatile than domestic holdings. Returns may vary widely from year-to-year, so this fund may be considered complementary to an already diversified portfolio with a long-term time horizon. The top ten holdings are Exxon Mobil, Royal Dutch Shell, Chevron, BP, Total, Schlumberger, Anadarko Petroleum, Cabot Oli & Gas, Occidental Petroleum, Eni. Minimum initial investment in Vanguard Energy Fund Investor Shares is $3000, and an expense ratio is 0.31% that is 80% lower than the average expense ratio of funds with similar holdings. The fund returned 21.7% in the last one year period.

Vanguard Target Retirement 2010 Fund (VTENX)

Vanguard Target Retirement Funds offer a diversified portfolio within a single fund that adjusts its underlying asset mix over time. Once a fund has passed its designated date, such as the 2010 Fund, its allocation is gradually adjusted to match that of the Target Retirement Income Fund and it may merge with that fund in seven years (2017 for this fund). The 2010 Fund invests in five Vanguard index funds, holding approximately 59% of assets in bonds and 41% in equities. You may wish to consider this fund if you’re planning to retire in 2014. Investors in this fund should be able to tolerate the volatility of the stock and bond markets. Asset allocation of fund on 04/30/2014: stocks 41.93%, 55.93% bonds, 2.14% short-term reserves. Minimum initial investment in Vanguard Target Retirement 2010 Fund is $1000, and an expense ratio is 0.16% that is 70% lower than the average expense ratio of funds with similar holdings. The fund returned 11.04% in the last one year period.

Vanguard California Intermediate-Term Tax-Exempt Fund Investor Shares (VCAIX)

This low-cost municipal bond fund seeks to provide federally tax-exempt and California state tax-exempt income and typically appeals to investors in higher tax brackets who reside in California. The fund typically has an average duration of about 5–6 years and invests in high-quality California municipal bonds across the yield curve. Risks of the fund include the fact that changes in interest rates, both up and down, can affect the fund by resulting in lower bond prices or an eventual decrease in income for the fund. Investors who are looking for a fund that may provide federal and California state tax-exempt interest income and can tolerate moderate price and income fluctuations may wish to consider this fund. Minimum initial investment in Vanguard California Intermediate-Term Tax-Exempt Fund Investor Shares is $3000, and an expense ratio is 0.2%. The fund returned 3.15% in the last one year period.

Vanguard Massachusetts Tax-Exempt Fund (VMATX)

This low-cost municipal bond fund seeks to provide federally tax-exempt and Massachusetts state tax-exempt income and typically appeals to investors in higher tax brackets who reside in Massachusetts. The fund holds high-quality long-term Massachusetts municipal bonds with an average duration of approximately 6–10 years, making its share price considerably more susceptible to changes in interest rates than shorter-term bond funds. Investors who are looking for a fund that may provide federal and Massachusetts state tax-exempt interest income and can tolerate interest rate risk may wish to consider this fund. Minimum initial investment in Vanguard Massachusetts Tax-Exempt Fund is $3000, and an expense ratio is 0.16%. The fund returned 2.11% in the last one year period.

Vanguard Windsor II Fund Investor Shares (VWNFX)

Like many individuals making a big purchase, Windsor™ II Fund’s investment managers are mindful of price. While this large-cap value stock fund carries the same risk associated with the stock market, this “value” conscious approach may provide a less bumpy ride. That said, the fund may not keep up in a strong bull market. If you have a long-term investment goal and want less market volatility than might be present in a more aggressive investment, the fund could be a good fit for you. Minimum initial investment in Vanguard Windsor II Fund Investor Shares is $3000, and an expense ratio is 0.35%. The fund returned 29.85% in the last one year period.

Vanguard International Growth Fund Investor Shares (VWIGX)

The International Growth Fund focuses on non-U.S. companies with high growth potential. Created in 1981, the fund employs an aggressive approach that attempts to capitalize on global economic expansion. For example, an attractive investment opportunity could be a non-U.S. consumer-products company that is experiencing rapid earnings growth. Because it invests in non-U.S. stocks, including those in developed and emerging markets, the fund can be more volatile than a domestic fund. Investors may wish to consider investing in this fund as a complement to an already diversified stock portfolio. Minimum initial investment in Vanguard International Growth Fund Investor Shares is $3000, and an expense ratio is 0.49%. The fund returned 26.72% in the last one year period.

Vanguard Inflation-Protected Securities Fund Investor Shares (VIPSX)

This fund is designed to protect investors from the eroding effect of inflation by investing in securities that seek to provide a “real” return. The fund invests in bonds that are backed by the full faith and credit of the federal government and whose principal is adjusted quarterly based on inflation. In addition to typical movement in bond prices, income can fluctuate more in this fund because payments depend on inflation changes. Investors with a long-term time horizon may wish to consider this fund as a complement to an already diversified fixed income portfolio. Minimum initial investment in Vanguard Inflation-Protected Securities Fund Investor Shares is $3000, and an expense ratio is 0.2%. The fund returned -1.85% in the last one year period.

Top mutual funds research firm: Trade free for 60 days + get up to $600.