Asset Allocation Funds Strategies Calculators and Models

Post on: 1 Апрель, 2015 No Comment

Today Im going to discuss this basic investing concept that everyone should be familiar with: asset allocation.

We all learned about it in our economics classes in high school and college, but I know how quickly we forget.

So, I thought Id give a bit of a refresher as well as share some new trends in investing using asset allocation strategies.

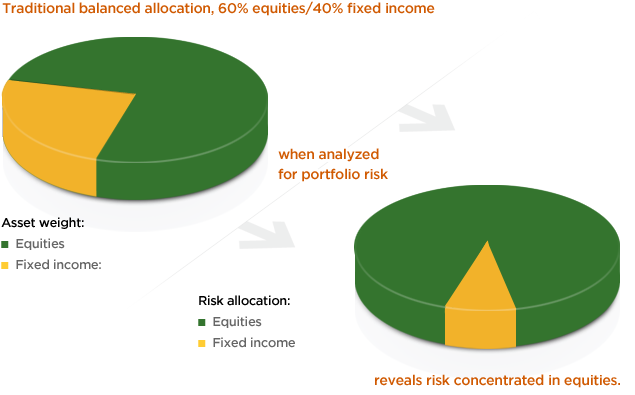

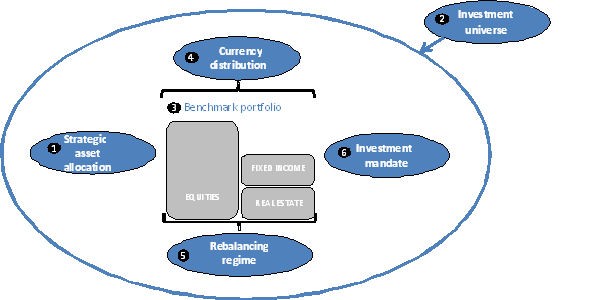

Asset allocation is the process of splitting up your investment portfolio into the different asset classes. Chiefly, this involves putting different amounts of money into the major three classes of assets: stocks, bonds, and cash. Other asset classes include real estate, commodities, precious metals, and equity holdings. You can also split your assets up even further into different types of stocks. Or cut it the other way and split it up between different industries. If you keep drilling down, you can allocate your funds across thousands of different asset types.

Asset allocation is used primarily for those people investing for retirement or college savings. Why? Because they are looking for long term growth with less risk. But there is no proper asset allocation. The asset allocation you choose depends on your own goals, your age, and your risk tolerance. Its entirely up to you.

Asset Allocation vs Diversification

As a point of clarification, I need to add that asset allocation doesnt equal diversification (i.e. not putting all your eggs in one basket). Diversification is the act of spreading out your investments into different asset classes, industries, and even countries to achieve a balance of risk and reward. A better way of explaining the difference might be to say that you can have an asset allocation strategy that is not diversified.

For instance, if your investment portfolio is made up of $50,000 worth of your companies stocks, and $25,000 worth of gold bars, you have allocated your assets: two-thirds into stocks of one company, and the other third into a particular commodity. But this portfolio isnt very diversified. If something negative were to happen to your company, then two-thirds of your portfolio would be at risk. Not good.

Asset Allocation Models

Just because asset allocation is left up to individual choice, it doesnt mean that people dont try to come up with the perfect asset allocation model. Do a Google search for asset allocation model and youll find a hundreds of different models. There are also a few asset allocation calculators out there that will help you find your perfect allocation.

Asset Allocation Strategies

A common strategy is to use a combination of mutual funds, a bond fund, and some cash (via MMA). Most of the models Ive seen use this strategy and typically look like this for someone in their 30s: 80% stocks, 10% bonds, 10% cash. Another strategy is to use one fund, a tactical asset allocation fund, which can give you an asset allocation across the three asset classes from one fund. Finally, there are target date retirement funds. These funds expand on the tactical asset allocation fund idea by changing the mix of asset classes to a more conservative approach as the fund ages. I use a single target date fund in my Rollover IRA. An advantage to using this type of fund is that I dont have to re-balance my portfolio each year.