Ahead of the herd

Post on: 12 Май, 2015 No Comment

Opinion | 12 December 2014

The resource-rich Africa and trade power house Asia continue to evoke interest and de-risking strategies have resulted in global banks exiting emerging markets. However. with the right approach these markets can reap benefits. Rahul Jayakar explains the resulting challenges and opportunities

There has been a lot of discussion among banking circles about the increasing bilateral trade between Asia and Africa.

With the International Monetary Fund prediction (based on the 2011-2015 growth rate) that by 2020 Asia will account for 60% of the global trade market and by 2015 Africa will account for seven of the worlds ten fastest growing economies, 1 such interest is hardly surprising. And in financial institution transaction banking, working with these emerging markets does demand a hands-on approach. Of course there are plenty of challenges, but these can be turned into opportunities with early and effective identification.

Inter-continental dynamics

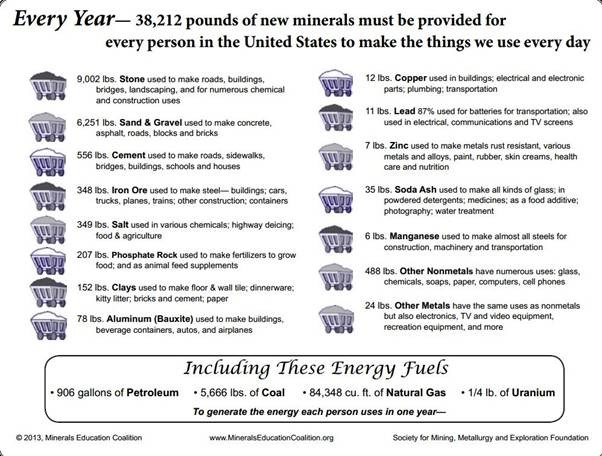

GDP growth in sub-Saharan Africa 2013

The basis for the potential that lies within this geographical nexus is evident in the facts. In sub-Saharan Africa, economic growth is rising — from 5% in 2013 to a projection of 5.8% this year. Excluding South Africa, these figures are 6.1% and 6.8% respectively. East and West Africa recorded the fastest growth in 2013 at 6% and above. South Africas GDP growth during the same period was 1.9% in 2013 and projected to 2.7% in 2014. Development is taking place rapidly in Africas smaller economies.

Though Asia will make up 60% of the worlds trade flows in under a decade, the percentage of imports from Africa is currently less than 5%. Asia is currently the third largest export market for Africa — with trade flows largely dominated by China and India. There is hence an enormous gap to be bridged in the coming years — between Africas growth rate and Asias dominance of global trade flows.

Shift in strategy

Post-2008 and the global financial crisis, an increasing number of banks have opted for a back-to-basics approach to their business. Services that have sticky demand (and consume low levels of capital) are now the focus and are a gateway to cross-selling.

In the transaction banking sections of the Boston Consulting Groups Global Payment reports, transaction banking (corporate and financial institution banking is estimated at around US$ 220bn and expected to rise to US$ 350bn during the next eight years — a 60% jump. 2

The other strategic shift borne out of the financial crisis was that of large global banks recalibrating their capital and liquidity requirements. As a result, ambitions in developing markets were restrained. Some European banks in particular who were active in soft commodity and energy finance pulled back from doing that business in Africa and Asia. 3 This left a chasm that is being filled by active regional and local banks. African and Middle Eastern banks have stepped up to the plate in trade finance across Africa. This trend of increased regional bank activity is visible in Asia as well.

Access to finance

African banks face major challenges in gaining access to financing and dollar liquidity. There are multiple reasons for the same — political stability, disproportionate ratio of government bonds on their balance sheets, lack of transparency on quality of assets, and concentration risk on corporate exposures — to name a few. It is one or a combination of these factors that is unpalatable to the risk appetites of counterparty banks. This is a concern especially considering that SMEs will be the growth engines of the continent going forward. 4 The share of global trade by SMEs is expected to grow from 13% in 2013 to 20% in 2020. Development banks and risk underwriters in Africa are doing all they can to take on risk, but trade growth must keep pace with credit exposures. This is essential for growth to be sustainable and to maintain financial inclusion.

Asia is however a different story. 5 Generally speaking, stronger regulatory frameworks are in place catering to large bank exposures. There is greater access to credit. With regard to African trade, Asian banks collaborate through various mechanisms for hedging African risk either by documentary credit or working closely with the multilateral development banks and other development banks. Given that commodities trade forms the bulk of Africas exports to Asia, one option is for financial institutions is to take exposures on counterparty risk by collateralising the underlying goods in trade. This structure can work for financing both Islamic banks (commodity murabaha ) and conventional banks with the right level of checks and balances through collateral managers.

Open account vs documentary credit

There is a greater demand from Asian importers to reduce the cost burden associated with the traditional letters of credit. Trade in Asia and Africa will continue to have a large part of documentary trade in it, because of the need to mitigate counterparty risk. So, while the overall share of documentary trade will shrink, the sheer increase in trade itself will ensure the sustainability of documentary credits. According to the ICC Banking Commissions Rethinking Trade and Finance 2014, 6 the share of open account in global trade is set to increase from 82% in 2011 to 91% by 2020.

Uncertainty of correspondent banking services

Many local emerging market banks found themselves somewhat abandoned after large global banks adopted a de-risking strategy and withdrew their presence or services from a number of emerging economy countries. Rising operational costs of conducting the mandatory KYC and other compliance checks are a reality. And high profile fines to some large multinational banks 7 have hardly helped confidence in the regions either. The banks that now facilitate trade in these sectors have long track records and confidence in these markets and look to counterparty banks as partners. While central banks and regulators are doing what they can to mitigate the impact of the departure of multinational banks, there is a long way to go. One of the pressing issues is a lack of standard guidelines by service-providing banks.

Collaboration not competition

According to Afreximbank. trade will continue to be a major driver of Africas growth and it expects this to rise by 7% per annum to reach US$21.trn by 2020 (see note 5). It also estimates that the main corridors will be south-south trade with India and China — accounting for 40% of all African trade. And banks that understand their role in the financial ecosystem will flourish over those trying to compete at every leg of the business.

The law of comparative advantage is as applicable as ever in financial institution transaction banking. It is a business that has evolved; from pure correspondent banking to being a part of the working capital aspirations of local banks. Banks that provide a wider variety of products (such as nostro clearing and network solutions) will play a vital role in transaction banking in emerging markets. Moreover, they will command a greater piece of the immense opportunity that lies within the Asia-Africa corridor. One cannot ignore the largest trade between the fastest-growing and the largest trade geography.

Rahul Jayakar heads transaction banking for international busienss covering coporates and financial institutions at Mashreqbank PLC.

References:

on.bcg.com/ 1DkegaD

3. This was summed up in the Financial Times Banks pull back from lending to EM groups (7 April 2013)