African Sovereign Bonds Behind The Risk And Reward

Post on: 1 Сентябрь, 2015 No Comment

Thinkstock

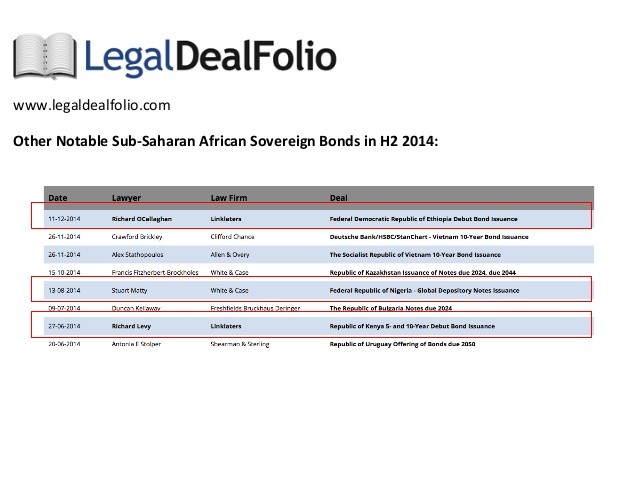

African sovereign bond issuance reached record highs this year, according to the Financial Times. with the continent raising $6.9 billion in 2014. Earlier this year, IMF managing director Christine Lagarde cautioned that some African countries “have gotten a bit ahead of themselves,” in raising funds.

So is the rise in borrowing in Africa a reasonable shift, or does it reflect a growing level of unmanageable debt?

“We need to differentiate between the different sovereigns,” says Antoon de Klerk, portfolio manager for Africa fixed income at Investec. By most measures, he points out, debt levels are healthy and risk levels are low.

Of course, there are exceptions. “The very obvious exception at this point in time is Ghana The fact that it is paying the highest dollar interest rate of all African sovereigns should give you an indication that this is where most of the risks lie,” he says

According to de Klerk, the nation is spending more on interest payments than infrastructure, owing to high debt levels and accordingly high interest rates. But other nations have not been so free in issuing bonds; de Klerk sees the risk of a series of African defaults as “way below global average risk” levels.

Those same fundamentals could provide an important source of stability for African borrowers in the event of global shocks, or crises.

A recent IMF working paper demonstrates that increased financial integration between an emerging market economy and the rest of the world can make a nation’s asset prices more sensitive to shifts in investor demand. To reduce the risks that come with major shocks, authors Nasha Ananchotikul and Longmei Zhang recommend that governments take measures to keep inflation and current account deficits manageably low.

In other words, managing these potential sources of risk can help minimize the effect that global asset flows will have on bond prices.

So are African countries accomplishing this goal? It is notable that, for all the attention to their activities, African sovereigns are not really borrowing all that much, which is good news for those concerned about credit risk.

“I think we should expect more, [but] I don’t think we’re going to see the same rate of issuance that we’ve seen in the past two years, simply because most of the countries don’t really have appetite to issue more, de Klerk said.

There is also the issue of U.S. dollar versus local-currency bonds, each of which comes with its own set of sensitivities to the global markets.

Ananchotikul and Zhang explained the distinctions in an email, which they caution does not necessarily reflect the views of the IMF. “U.S. dollar-denominated bonds would be more vulnerable to global market shocks,” which could include drops in liquidity or an increase in risk aversion.

This is partially because “U.S.-dollar denominated bondholders are likely global investors who are potentially more sensitive,” to changes in global conditions, they say.

Again, however, de Klerk notes that the make-up of African borrowing provides a level of insulation from such potential risks. He notes that while a change in U.S. Treasury yields would of course impact interest rates, the potential rise that he forecasts would not be “a show-stopper.”

This is especially the case because the African economies are simply not very reliant on dollar-denominated bonds.

This feature of African sovereign debt markets also has important implications for currency risk. That’s because issuing bonds in dollars presents, for most countries, a mismatch: the government earns revenue in the local currency but pays its debt in dollars.

In the event of a panic, Ananchotikul and Zhang point out that heightened correlation between asset prices and exchange rates “implies that U.S. dollar denominated bond issuers would be affected by both market risk and currency (mismatch) risk while local-currency denominated bonds are virtually free of currency risk.”

In other words, maintaining relatively low levels of dollar bonds can help offset the sometimes major risks that come from mismatches in currency.

But could African bond issuers still face risks with respect to global demand and liquidity even in their local-currency markets?

“There Africa is an exception, since so little of African local currency bonds are held by offshore investors,” de Klerk noted. Those same globally sensitive investors are simply not a major feature of the African local-currency bond market.

In other words, de Klerk says, “The risk is tiny for Africa.” Of course, there are exceptions to this rule as well, with both South Africa and Nigeria experiencing the pressures of changing risk appetites among global investors.

But that doesn’t mean local-currency bonds should be underestimated —in fact, they might just be a key part of ensuring long-term stability.

“If there’s one thing I keep banging the drum about, it’s the importance of local currency bond markets Governments don’t generally default on local currency bonds, they default on dollar debt,” emphasizes de Klerk.

“To have a modern economy, you need a well-developed local currency bond market It gives resilience to financial systems.”

That is to say, African economies focused on issuing in their own currencies are on the right track, and while the dollar-denominated market is growing, it is still far from becoming a major source of risk.