2013 Outlook Emerging Market Bonds

Post on: 1 Август, 2015 No Comment

Click Here to See the 2014 Outlook for Emerging Market Bonds

Executive Summary

- The long-term story for emerging market bonds remains positive, but low yields limit the possibilities for further price appreciation.

- Investors need to temper their expectations given the outstanding recent performance of emerging debt and the potential for rising risk in 2013.

Outstanding Past Performance

Emerging market bonds have been one of the best performing segments in the bond market during 2012, and with good reason. At a time in which investors were desperate to find investments with decent yields, emerging market debt was a logical choice given the robust underlying fundamentals of the asset class. Strong performance for the emerging debt is nothing new: in the ten years through October 31, 2012, its average annual total return was 11.34%, based on the JP Morgan EMI Global Diversified Index. This return was good enough to make the emerging markets the best-performing fixed income asset class in the period, and it was also well ahead of the 6.90% return of the S&P 500 stock index.

Low Yields Limit the Upside

Now, investors face a conundrum as they try to assess the outlook for emerging market bonds in 2013. While the fundamentals remain strong, yields on investment-grade segments of the market fell to all-time lows in the fourth quarter, as did yields on below-investment grade – or high yield – corporate bonds. At the end of November, the 30-day SEC yield on the iShares JPMorgan USD Emerging Markets Bond ETF (ticker:EMB) had fallen to 3.3%, near the lowest in the history of the ETF. This indicates that investors aren’t getting paid nearly as much for the risks as they were one, two, or three years ago.

What’s more, emerging market bonds have delivered outstanding returns in recent years, which puts a lid on additional further upside. Consider the returns of the EMB ETF in the past four calendar years:

- 2009: 15.4%

- 2010: 10.8%

- 2011: 7.6%

- 2012: 16.6%

Foundations for Performance Remain in Place

The combination of low yields and strong past performance points to a logical conclusion: the potential upside is limited in 2013. Still, the emerging markets continue to be supported by a number of positive, long-term factors that should provide a solid underpinning for the asset class in 2013 and beyond:

- Continued yield advantage. Yields, while lower than they have been at quite some time, remain attractive relative to yields in the developed markets. As long as the Federal Reserve and other global central banks maintain their policies of ultra-low interest rates. demand for higher-yielding assets should remain firm.

- Stronger growth. While economic growth is slowing in the emerging markets, most notably for China and Brazil, growth remains much more robust than it is in the developed world, where Europe is in recession and Japan and the United States are teetering on the brink. (Keep in mind that while stronger growth typically hurts the performance of bonds in the developed markets, the opposite is true in the emerging markets.) In addition, emerging economies in are becoming increasingly diverse, with a growing focus on services and consumer spending rather than commodities.

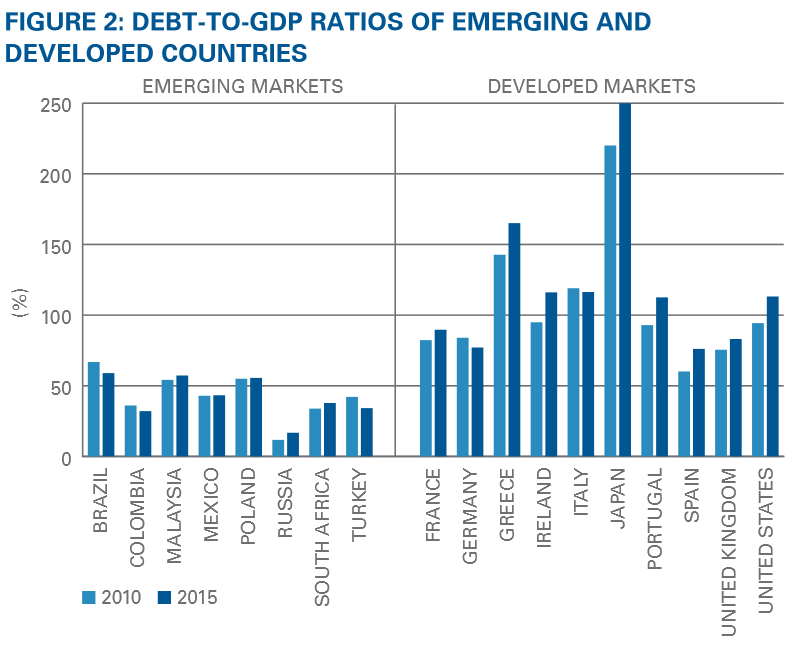

- Lower debt. The United States, Europe, and Japan may be saddled with massive amounts of government debt, but the opposite is true for the emerging markets (as a group). According to Barron’s, the average debt- to-GDP ratio for countries in the developed world is at 114% and rising, while in the emerging markets it is just 34% and falling. This indicates much stronger fiscal health, and supports a continued decline in emerging markets’ yields relative to the developed world.

- Reduced political risk. Political risk (in other words, the chance that political issues will upset the markets) is much less of a factor now than it was a decade ago. While in the past elections often resulted in volatility in the emerging bond markets, the political process is now in fact quite stable in the majority of countries.

- A deeper market. Rising demand has fueled a boom of issuance in the emerging markets. Barron’s reports that the total size of the bond market has doubled in the past four years. In addition, the total value of the emerging corporate bond market has topped $1 trillion and is now equal to the size of the entire U.S. high-yield bond market.

Risks Remain in Place, as Ever

Any discussion of the 2013 outlook for emerging markets needs to include this warning: even though the fundamentals are much stronger now than they were ten or 15 years ago, emerging debt is still very sensitive to developments in the broader world economy. During the times when investors lose their appetite for risk, emerging market bonds will almost undoubtedly underperform. Factors that could derail the asset class in the year ahead include a worsening of the economic slowdown in the United States and/or China, a resurgence of the European debt crisis. or conflict in the Middle East, not to mention risks as yet unknown.

In short, the outlook for emerging market bonds remains subject to shifting headlines no matter how favorable the developments on the local level – especially with yields at record lows.

Investors Need to Have Realistic Expectations

As long as the global environment remains stable, emerging market bonds can continue to provide solid return potential and diversification for longer-term investors. If the headlines remain favorable, it would be reasonable to expect returns in the mid-single digits in 2013 – with a few extra percentage points of price appreciation tacked on to yields of 3-4%. On the other hand, if the headlines take a surprising turn for the worse, expect emerging markets debt to lag the rest of the bond market by a wide margin.

The takeaway: the asset class continues to offer longer-term opportunities, but maintain realistic expectations for 2013. With yields at these levels, it’s unlikely we’ll see performance as strong as it was in 2009-2012.

What the Experts are Saying

All parentheses are mine, included to reduce jargon :

Tristan Hanson, head of asset allocation at Ashburton Asset Management in South Africa: “(Yield) spreads on (dollar-denominated emerging market) bonds are now approaching the pre-(financial crisis) lows achieved during the mid-2000s credit bubble. Low rates make EM bonds a riskier proposition going forward. Global bond investors may need to tread carefully over the next year or two.

JP Morgan: (Emerging market) corporates had a landmark year in 2012, with total return of 13.7%, which is one of the highest among the various asset classes including equities. In addition, new issuance exceeded US$300 billion while the (total amount of bonds in the market) crossed US$1 trillion mark. Given the strong return and substantial growth in the asset class during 2012, it is perhaps not surprising to expect that it will be difficult to beat such a performance in the coming year. Nevertheless, we still think (emerging market) corporates will have a decent year in 2013, with total returns at a respectable 7.5-8.5%.

More on What to Expect in 2013 :

Disclaimer. The information on this site is provided for discussion purposes only, and should not be construed as investment advice. Under no circumstances does this information represent a recommendation to buy or sell securities. Always consult an investment advisor and tax professional before you invest.