Archive for Март, 2017

CalPERS Might Switch to Passive Investment Strategy

CalPERS Might Switch to Passive Investment Strategy

CalPERS, the second-largest pension fund in the United States, is considering a switch to an all-passive investment portfolio, which could be a watershed moment

16 Март, 2015 No Comment Read More

Active vs passive investing which is right for your charity Your Money

Active vs passive investing which is right for your charity Your Money

Active vs passive investing: which is right for your charity? What do we mean by active investing? Professional investment managers are responsible for creating

16 Март, 2015 No Comment Read More

Active vs passive debate A new twist for ETF investors

Active vs passive debate A new twist for ETF investors

In an interesting post. financial analyst Matthew Salter sheds some fresh light on the ongoing debate between those who favour active management, and the

16 Март, 2015 No Comment Read More

OppenheimerFundsVoice Rethinking Active Share and Tracking Error

(Photo credit: iStock) When I purchased my first iPad three years ago, I took advantage of the opportunity to engrave two words on the

16 Март, 2015 No Comment Read More

Active Share Your New Best Friend

Active Share Your New Best Friend

A metric that quantifies active management, ferrets out closet indexers December 11, 2013 It has been seven years since Martijn Cremers and Antti Petajisto

16 Март, 2015 No Comment Read More

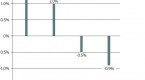

Active Share and Tracking Error

Active Share and Tracking Error

BPV’s Research department recently brought you a high-level view on a relatively recent investment metric: active share. During that piece, we also discussed the

16 Март, 2015 No Comment Read More

Active Share What is it and why is it important to investors

Active Share What is it and why is it important to investors

As an investor, you pay a fund manager to invest your hard-earned savings. You pay for their skill. But how can you measure that

16 Март, 2015 No Comment Read More

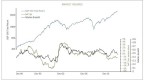

Windhaven misses its 12month benchmarks again but still hits assetgathering mark

Windhaven misses its 12month benchmarks again but still hits assetgathering mark

More advisors are using Schwabs ETF manager but some of them dislike the companys tactical approach Thursday 11.17.11 by Lisa Shidler Brookes Note: There

16 Март, 2015 No Comment Read More

Active Portfolio Management A Quantitative Approach for Producing Superior Returns and Controlling

Active Portfolio Management A Quantitative Approach for Producing Superior Returns and Controlling

This new edition of Active Portfolio Management continues the standard of excellence established in the first edition, with new and clear insights to help

16 Март, 2015 No Comment Read More

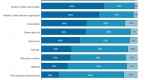

Investment Funds – Active v Passive Management Juno Wealth Management

Investment Funds – Active v Passive Management Juno Wealth Management

If you want to put your money into an Investment Fund, there are two main strategies you will come across: Actively managed investment funds,

16 Март, 2015 No Comment Read More

Follow Us

Sidebar Post

- Most Popular

- Recent Comments

-

Bollinger Bands Strategy With 20 Period ...

-

Pay Off Your Mortgage Prior To Retiremen...

-

You Say You Want A Dissolution An Overvi...

-

Pay Down the Mortgage Before Retirement ...

-

Volume indicator

-

Uncover Value Opportunities Using the Pr...

-

The Strategic Sourceror Top Tips for Rec...

-

How to pay off debt

-

Recessionproofing retirement

-

Frontier Markets The New Emerging Emergi...