Zerocoupon Bonds Zerocoupon Municipal Bonds Treasury Zerocoupon Bonds Your

Post on: 9 Апрель, 2015 No Comment

When you think of bonds. what is the first thing that comes to mind? The first thing that comes to my mind is the interest that they pay. However, not all bonds pay interest.

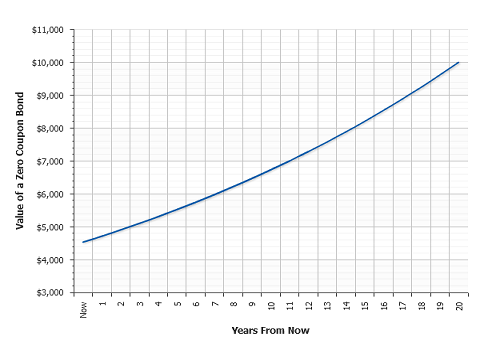

One common term among bond investors is a coupon. It refers to interest paid on bonds. Therefore, zero coupon means no interest. Zero coupon bonds don’t pay interest to the investor while they are maturing. The interest accrues and the value of the bond increases. The investor can then sell it for the face value once it matures..Zero coupon bonds are issued by municipalities, the federal government, and corporations. Like with all bonds, they issue these so that investors can loan them money for immediate use and the investors are then later repaid. The amount loaned is called the principal.

When figuring the yield of the bond, you divide the par value and the purchasing price. You then account for the time until maturity. This will allow you to have an idea of what your annual return would be.

Advantages Zero coupon bonds have some really attractive features to them. One is that you buy zero coupon bonds at a deep discount. This means that you pay much less than the bond’s par value, the amount it is worth at maturity. As the bond matures, the interest is accrued and the bond increases in value. Because the interest isn’t paid out yearly, the bonds can be issued at a deep discountZero coupon bonds also offer investors predictability for the long-term. Zero coupons are volatile investments but they still provide a predictable return for investors who want a lump sum of money paid by a specific date.One last advantage of zero coupon bonds is that they also benefit whoever issues them. Because they don’t pay periodic interest, they allow corporations, municipalities, and the government to continue using the loan amount without having to pay back interest.

Disadvantages Zero coupon bonds also have a few drawbacks. The first big drawback is that they are extremely volatile investments. Interest rates changes can swing the price of the bond in either direction. This means that if you want to sell it before it matures, you aren’t guaranteed to make a profit. However, if you hold it until maturity, you won’t have to worry about this. As with stocks, long-term investing in zero coupon bonds is the best way to go.Another major drawbacks is that you still have to pay income taxes on the bonds while they are maturing. With regular interest-yielding bonds, you would have to pay income taxes on the amount of interest you earned. Well, with zero coupon bonds, you have to pay taxes each year on the amount of interest you would have earned. One way to get around this is to invest in tax-free zeros, such as municipal zeroes. Or you can find a qualified tax-deferred retirement plan and put the zero coupon bonds in there.One final drawback to investing in zeroes is that they are callable. What this means is that the issuer can say that they want to repay the bonds before maturity at a certain percentage rate. This really makes your taxes complicated because if the IRS thinks you made more than you should have, you would have to pay a capital gains tax as well.Zero coupon bonds offer investors one more way to invest in bonds and they do have advantages. For those who understand them, they provide an excellent way of investing for the long-term. Just because they are bonds, that doesn’t mean they don’t carry their own risks. We encourage you to weigh the risks and rewards before investing.