Zero Coupon Bonds Explained Lock in Long Term Profits

Post on: 10 Июль, 2015 No Comment

Unlike other bonds, zero coupon bonds do not pay periodic interest during the life of the bond. Why would an investor want to purchase a bond that does not make interest payments? Keep reading to learn about the unique characteristics of zero coupon bonds which make them an ideal savings vehicle for achieving specific financial goals.

What Is a Zero Coupon Bond?

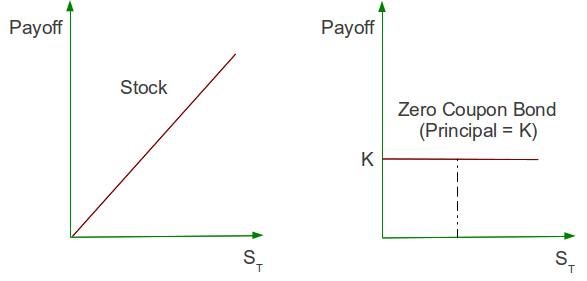

A zero coupon bond is issued at a discount from face value and pays no interest over the life of the bond. At maturity the investor is paid the face value of the bond. The difference between the original purchase price and the face value equals the interest earned. For example, a zero coupon bond purchased for $600 matures in 30 years. At maturity the investor receives payment for the full face value of $1,000 with $400 representing the interest earned over the term of the bond.

How Can Zero Coupon Bonds Be Used To Meet Financial Goals?

Zero coupon bonds are uniquely suited for funding a fixed future obligation since the investor knows at the time of purchase the exact amount of money to be paid at maturity. Due to this feature, the return or yield-to-maturity is known at the time of purchase and there is no reinvestment risk. An investor purchasing regular bonds that make periodic interest payments cannot know how much money will be available at maturity due to the risk that interest payments will not be reinvested at the same interest rate of the original bond purchase. For example, an investor purchasing a bond that pays six percent would be unable to reinvest the interest payments at the same rate if interest rates decline. Zero coupon bonds are the only bonds that have no reinvestment risk since there are no periodic coupon payments that need to be reinvested.

Due to the certainty of what a zero coupon bond will be worth at a specific future date allows an investor to reduce portfolio risk. Many investors saving for retirement allocate savings between stocks and bonds. A big risk to meeting

retirement goals would occur if both stocks and bonds decline significantly when approaching a projected retirement date.

To avoid the risk of a large decline in a retirement portfolio, an investor planning ahead could purchase long term zero coupon bonds at a steep discount to maturity value and know with certainty what the value of the bonds will be at a future date. For example, an investor with a $200,000 retirement account could purchase 25 year zero coupon bonds for $100,000 that have a face value of $200,000 and invest the remaining $100,000 in a diversified stock portfolio. Regardless of what happens to the stock and bond markets, the investor would still have at least $200,000 in the account when the zero coupon bonds reach maturity.

Zero coupon bonds would not be a suitable investment for an investor seeking annual income payments.

Are Zero Coupon Bonds Risky?

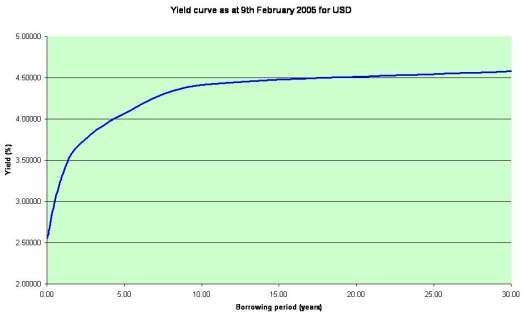

U.S. Treasury zero coupon bonds have zero credit risk since they are backed by the full faith and credit of the U.S. government. There is, however, a very high interest rate risk since zero coupon bonds have a duration equal to their maturity which can be 30 or 40 years. Duration is a measure of interest rate risk and bonds with long durations can fluctuate dramatically with changes in interest rates.

An investor forced to liquidate zero coupon bonds prior to maturity would face losses if interest rates rose from the time of purchase. For example, a 30 year zero coupon bond has a duration of 30 and an increase of one percent in interest rates would result in a 30% decline in the market value of the zero coupon bond.