Your Returns What Should You Expect When Investing in Stocks

Post on: 25 Июль, 2015 No Comment

Posted on Jun 24, 2013

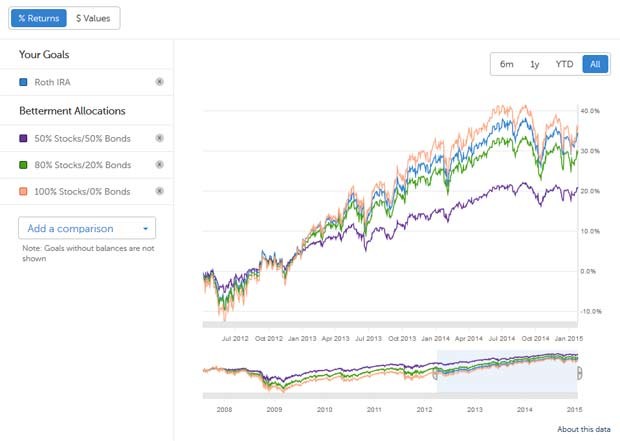

How often do you look at your returns? Whether you have money in a 401(k) or invest on your own, it can be a confusing game indeed to find out just how much your money is growing—or not.

And investors have been on a roller coaster ride ever since the financial crisis.

Consider that the Standard & Poors 500-stock index—the bellwether benchmark that tracks the 500 largest stocks in the U.S.—plunged 37% in 2008, had double-digit gains of 26% and 15% in 2009 and 2010, respectively, and then, in 2011, went almost flat at 2.1%.

Last year, it surged again by 16%. So far this year, its up 15%.

What Does the Rise and Fall Mean For Me?

These erratic zig-zags can make you wonder what a reasonable expectation is when it comes to your stock market returns. And thats important to know because what you expect to earn from stocks will determine how you build your portfolio. If your predictions are too rosy, you wont have enough saved for retirement. If your forecasts are too grim, youll make unnecessary sacrifices to your lifestyle today.

The experts in the investing community are divided on what will happen from here on out. Some believe volatile stock market returns since the financial crisis will revert to long-term averages. Others think weve entered an extended period of lower returns on assets because of the debt loads and aging populations of developed countries. Mohamed El-Erian, CEO and co-CIO of PIMCO, the company that runs the worlds biggest bond fund, popularized the term New Normal to describe this potentially bleak future for investors.

The New Normal or Just Normal?

One way to make an educated guess about the future is to look to the past. Obviously, past performance doesnt guarantee future results. But knowing the average returns of stocks over long periods can help you figure out if you have the right expectations for your portfolio.

RELATED: Ready to dip a toe in the market? Take our Start Investing Bootcamp

Fortunately, Ibbotson, an investment research division of Morningstar, has performance records for different types of stocks going back to 1926. Stocks of large companies—such as General Electric, IBM and Microsoft—have returned an average of 10% per year from 1926 to 2012. Stocks of small companies did slightly better with an average annual return of 12% from 1926 to 2012.

Financial analysts say small-company stocks (stocks with a market value between $300 million and $2 billion) tend to return more than the large-company stocks over time because they can have more investment risk and typically have higher growth rates.

Based on those figures, you could assume a stock portfolio could expect an average 10% annual return over a 20- to 30-year period of saving for retirement. But that estimate may be too optimistic.