Your Retirement Investments Stocks V

Post on: 16 Март, 2015 No Comment

Financial planners used to recommend that you use 100 as the oldest age you might live to for the purpose of determining the stocks-to-bonds mix of your retirement investments. Now it is recommended to use 110 or even 120. This is due to people living much longer, on average, than they once did.

Using the 110 figure, the stocks vs. bonds calculation is done as such:

- Current Age: 65 | Bonds: 65/110 = 59% | Stocks: (110-65)/110 = 41%

- Current Age: 45 | Bonds: 45/110 = 41% | Stocks: (110-45)/110 = 59%

This isn’t the only method for determining your stocks-to-bonds mix but it is a simple one and it works well for any current age. The concept of holding both stocks and bonds is partially rooted in the fact that the trading values of stocks and bonds tend to move in opposite directions. When stocks rise, bonds tend to fall. When bonds rise, stocks tend to fall. The concept is also rooted in basic diversification, which lessens risk. Simply put, you want certain variety in your investments.

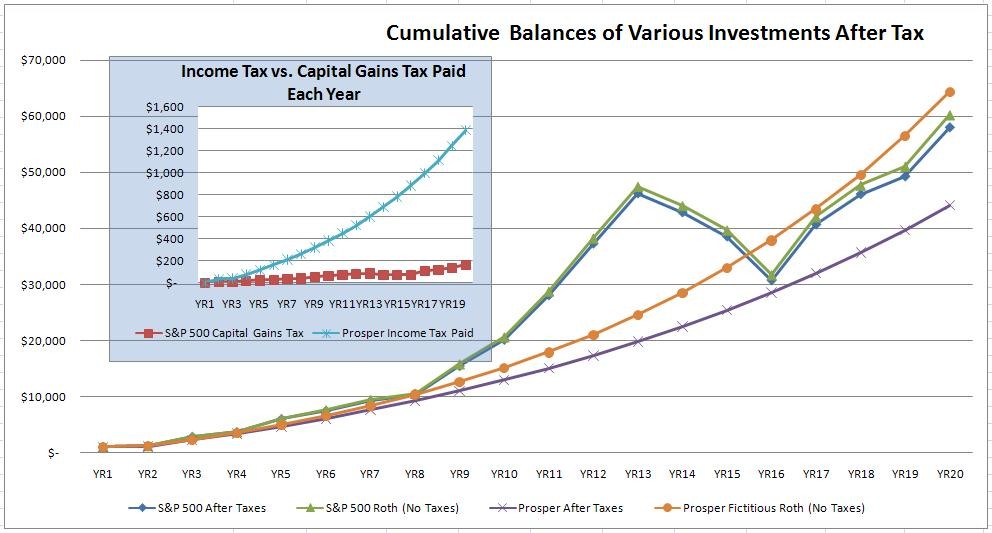

The older you are, the more bonds you are supposed to hold in your portfolio. The younger you are, the more stocks you are supposed to hold in your portfolio. This is because bonds exhibit more price stability over time whereas stock prices are more volatile, though stocks generally have a higher CAGR (compound annual growth rate) than bonds, with dividends included. For example, from 1871-2011, the CAGR of the S&P 500, with dividends included, was 8.88%. (6.66% less inflation.) As of 9/18/12, 10-year U.S. Treasury notes were yielding 1.81% and 10-year U.S. Treasury notes do not appear to have yielded more than 8.88% since 10/11/90. 10-year U.S. Treasury notes serve as a good benchmark because 10 years is a middling bond term and the U.S. is viewed as extremely unlikely to default on these notes, so very little adjustment is made to the yield to accommodate for potential loss of principal in figuring average expected total return.

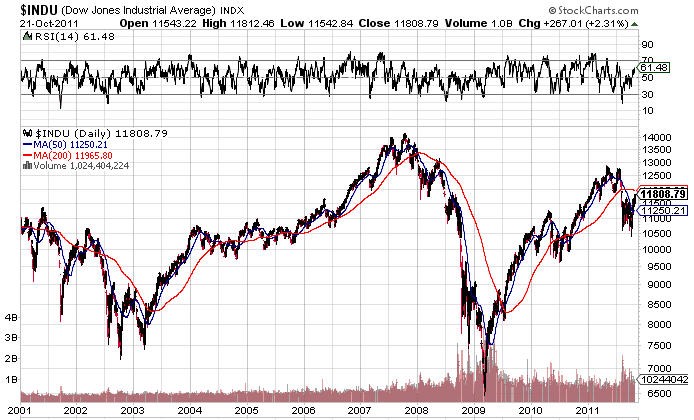

As you age, you should take fewer risks with your retirement investments so you don’t run out of money too soon. The fact that the S&P 500 index dropped from 1565.15 to 676.53 (i.e. -57%) due to the last U.S. recession well illustrates the greater risk in investing in stocks. When you are younger, you should lean more toward stocks due to their greater appreciation potential. The appreciation in stocks is due to dividends and capital gains and has been fairly consistent when measured over certain longer time periods.