Your Core Portfolio How to choose the right ETFs

Post on: 16 Март, 2015 No Comment

Share | Subscribe

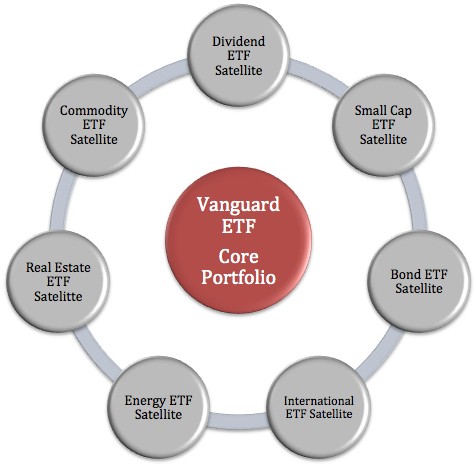

In my post on ETFs in the Core in May , I mentioned that the goal of most investors is to manage risk, seek income, and achieve long-term growth. These goals, of course, need to be built on a solid foundation: the core of a portfolio. The idea of the core is to establish the right mix of exposures and investments, at an attractive price point, that seek to drive value over the long term.

With over 5,000 ETFs to choose from, building your core with ETFs does require a framework. Institutional investors have extensive due diligence processes for selecting investment products and in many cases, a whole staff to do the work. Based on my extensive work with institutions I propose using a simplified approach when selecting ETFs for the core of your portfolio.  Here are the five key questions you should be asking:

2. Exposure — Can you get the exposure you want?

ETFs, even within a particular asset class or segment of the market, can vary significantly. Pay attention to the index and ask your financial advisor questions about differences between products and its ability to track a core index or benchmark. Understand the exposure you want and ensure the ETF you select is capturing that.

3. Structure — Are there risk & cost implications from the ETF structure?

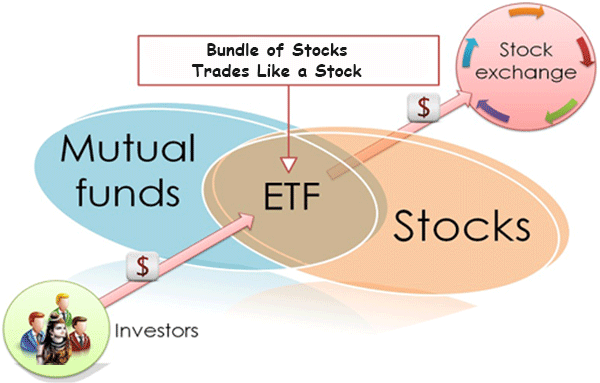

Look for ETFs whose product design balances desired exposure with cost and tax efficiency, as well as liquidity. In general, the ETF structure can help minimize the unintended tax consequences .  Generally speaking, ETFs tend to have lower turnover relative to actively managed funds, which can help minimize annual capital gains taxes .

4. Liquidity — Can you trade when you need to?

Because ETFs trade on exchange, liquidity is a huge factor in why many investors utilize them.  Even for core holdings, which are by definition more long-term in nature, you still want to ensure you have the ability to trade when it’s time to dial up or down your exposure. However, be sure to examine the liquidity of the ETF itself, as well as liquidity of underlying securities.

5. Costs — What is the total cost of ownership?

Expense ratios are important, however all implicit costs including trading and market impact, should be factored in. Your financial advisor can help you estimate the impact of your trade before it’s placed.

iShares now offers 20 low-cost Core ETFs that are a great starting point to consider as core holdings for your portfolio.  In my next Blog post, I will explore a number of sample core portfolios to demonstrate building an investment strategy for the long haul.

Daniel Gamba, CFA, is Managing Director and head of BlackRock’s iShares Americas Institutional Business. He is also a member of BlackRock’s Global Operating Committee. He is a regular contributor to The Blog and you can read more of his posts here .

There can be no assurance that an active trading market for shares of an ETF will develop or be maintained.

iS-12782

20Blog%20%7C%20Global%20Market%20Intelligence&el=Your%20Core%20Portfolio:%20How%20to%20choose%20the%20right%20ETFs /%