You Can Absolutely Positively Retire Earl

Post on: 16 Март, 2015 No Comment

Summary

- Retiring at a younger age requires discipline and focus, as well as investing for the long term.

- Do you have the guts to make it happen?

- For most investors, a dividend growth investment strategy is the more conservative approach for long-term financial security, but not the only strategy.

The only reason anyone invests, no matter what strategy is employed, is to make as much money as quickly as possible to be able to have complete financial independence for a lifetime.

To me, that means to live life on my own terms without having to work at a job to pay for my lifestyle. I have said it often enough that everyone knows that my personal strategy to achieve that ONE goal is dividend growth investing. I maintain that anyone who desires to retire at a younger age can absolutely, positively make it happen. maybe.

Why Do I Say Maybe?

I have had requests from many readers of mine to put together an article like this for those younger folks (or the kids and grandkids of folks my age) to offer a road that could take an average person from point A to point B with a goal of an early retirement. Here is but one example of the messages I receive, but this one happened to be a comment, so I will paste it here:

RS, really like the series and learn a lot with each article. I was wondering if you have ever written an article, or would consider writing an article on building a good portfolio that will allow someone under 20 to retire early.

It is not enough to just want something. Achieving a goal of early retirement takes discipline, focus, commitment. and amazing determination. If you have what it takes, you can do it, but if you are just a wishful thinker, then be prepared to work for a very long time.

Confidence levels are declining for the average investor to retire at all!

While statistically speaking, many folks are unsure, I will stand by my opinion at its ingredients to make retiring early a realty rather than just a dream.

Even those folks who have already retired are not sitting squarely in the driver’s seat, as more folks than ever rely on Social Security to live quite frugally upon in the golden years:

To me, most folks retired today never even had a plan or a strategy in place. Or circumstances made it difficult or impossible to achieve a more secure financial future throughout their lives.

Hopefully, enough folks will read this and at the very least begin traveling a path towards success, rather than one that leads to reliance on others for a secure future.

You Need To Be Invested

I am pretty sure that my readers were not born into massive wealth, nor are you superstars earning $50 million a year, guaranteed for life. If you are anything like me, you are either young and working and trying to achieve your financial goals, or are close to, if not already in, retirement, and desire to have your money last for as long as you live, without living in a box under I-95!

Here are the dividend growth stocks that I have selected for the FMBP:

I developed this portfolio at a time when many folks believed that the markets were toppy. I am managing it here on Seeking Alpha to display my approach towards future financial security, and I am no brain surgeon. While there are thousands of stocks to choose from, I believe that a young investor dedicated to making their dreams happen can achieve a goal of future financial security by investing in these stocks and managing the portfolio for a lifetime.

Here is where my portfolio stands right now:

Let me take this one step further and reduce the size of the portfolio to make it realistic for much younger investors. Just by dropping the last digit, you can have a better snapshot of what a starting portfolio might look like with about $20,000 to start:

This chart does not look very compelling to an investor in their 50 s. but at age 20. this is a great start! As my previous article using popular valuations shows, investing in these stocks right now is not offering significant value. Some might even say these stocks are overvalued, or at best, fully valued:

I maintain that time in the market overrides timing the market . and if you are 20 years old, then waiting for valuations to be better simply does not make sense when compounding and reinvesting is factored in over a long period of time.

Saving Early, Saving A Lot, And Saving For A Long Time Can Make An Average Investor More Financially Secure For A Lifetime

Here is what $1,000 would look like at various rates of growth, reinvested over time:

At a minimum of 3% growth in value per year and a 3% yield compounded over time, a 20-year old today would be looking at roughly $5,700 for each $1,000 invested. Use your own multiplier to find the number you could reach.

Of course, investing and compounding are the magic ingredients, but the basic ingredient is socking money away as early as possible for as long as possible, and then letting the magic of compounding do its thing.

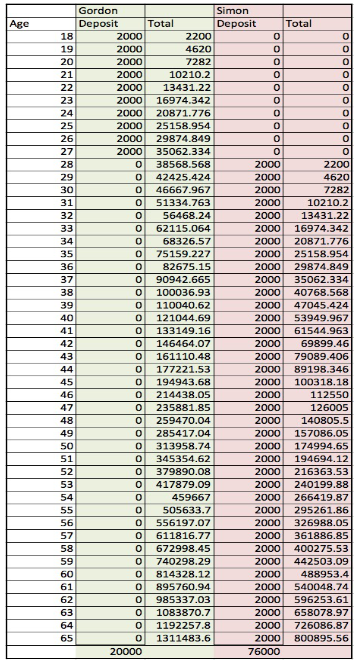

The following chart is one of my favorites, and quite frankly, is more compelling than any individual stock:

If one were to combine both Gordon and Simon together, and NOT stop saving at age 27, the Simon side would have over $35,000 at age 28, and by continuing to add just $2k per year at a 10% compounded rate of growth, the bottom line number could very likely be twice that of the $1.3 million that Gordon has at age 65!

Once again, use a number that fits your budget, and make it a stretch — with increased savings every year for as long as possible — and the end result numbers would put the average young investor in a rather secure financial position that much sooner.

Those are the ingredients of an early retirement, and I have used the following graphic to boil it all down in a nutshell:

Keep your income up and your expenses down, be invested for the longer term, and your overall financial wealth will always increase.

So, now you have somewhat of a road-map to get to where you want to go; but if you do not have the following, then your goal will just be a dream:

- DISCIPLINE

- FOCUS

- COMMITMENT

- DETERMINATION

The Bottom Line

There are many different strategies to employ when an investor wants to reach a goal of early retirement. Many investors seek out the best potential growth stocks to hit it out of the park with one mighty swing from the heels, or even many mighty swings from the heels, and I have seen those investors come and go my whole life.

The successful ones are few and far between.

I prefer my strategy of keeping it slow and steady as she goes, and take as little risk as I can to get where I want to go. I am not suggesting that I am right or wrong, nor am I suggesting that it should be my way or the highway. I am suggesting that I have found my approach to be more successful for me.

What approach is successful for you?

Disclaimer: The opinions and strategies of the author are not recommendations to buy or sell any security, nor to follow his approach. Choose your own path, do your own research and decide what is right for you, prior to making any investment decisions.

Disclosure: The author is long AAPL, COP, CVX, F, GE, JNJ, KO, ORI, PG, T, WBA, XOM. (More. ) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article.