Yearend tax strategies can ease your burden

Post on: 4 Апрель, 2015 No Comment

Updated: 15 November 2013 09:59 PM

With less than two months to go before the end of the year, now is the time for some quick maneuvers so your tax return doesn’t make you sick early next year.

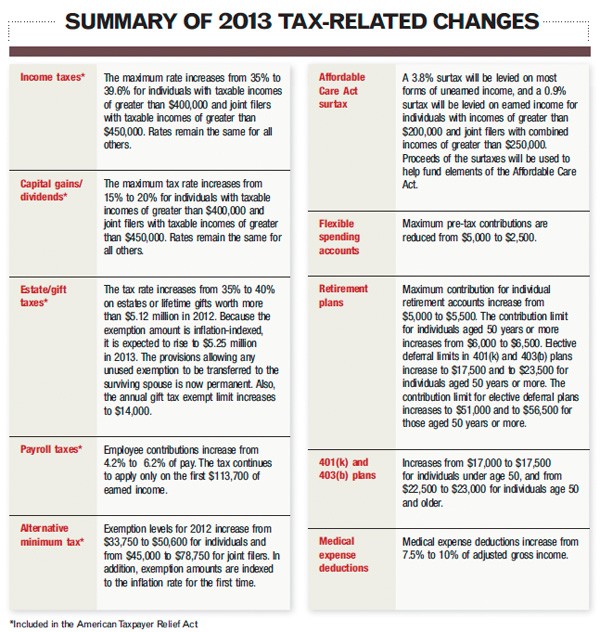

There are major changes this year for individuals with adjustable gross incomes over $200,000 and married couples at over $250,000. And for couples over $450,000 and individuals over $400,000, there’s a higher tax rate: 39.6 percent.

Throw in the new 3.8 percent surtax on investments for high earners, and possibly another 0.9 percent change, and the total tax liability can go to 44.3 percent. Further, capital-gains and dividend taxes for high-income people can go to 20 percent.

Being attentive now is especially important if you are affluent. But it pays for everyone to use tax-cutting strategies. Here are some things taxpayers can do right now to get ready for what’s ahead and possibly save money:

Get organized. Start gathering receipts and other items needed to support your 2013 returns. Day care receipts, health expenses and pay stubs all act as supporting documents for your returns.

Review the past. Sit with your old tax returns and current pay stubs and do an estimated tax return for 2013. If you can’t do it yourself, spend about $50 to have a professional do it for you. The objective is to get an early idea of your tax liability so you can make proper adjustments.

Clean the closets. If you use deductions, a simple tax-saving step is to clean the closets and give items to charity. Just make sure you get signed paperwork that lists each item and its value. But be warned: A few $25 donations and a couple of Goodwill receipts are probably not going to help you much.

Pay for college. If your child or you are in college or technical training, you may be able to get up to a $2,500 American Opportunity Tax Credit. Income cutoffs for the maximum are $160,000 for couples and $80,000 for singles. So if you are within those thresholds and haven’t paid enough for college to qualify for the max this year, pay bills now to boost that credit.

Spend money to save money. If you are just above an income cutoff for a juicy credit like the college credit, child tax credit or dependent care credit, don’t let those money-savers get away from you. An easy way to whittle a good chunk of income is to put more money into a 401(k), 403(b) or other retirement savings plan at work.

Increasing your 401(k) payments in these next few months requires you to pay pretax money, but it lowers your adjusted gross income, or AGI. The lower your AGI, the less you owe the government. The maximum you can contribute to a 401(k) this year is $17,500 if you are under 50, $23,000 if you’re over 50.

Go to the doctor. One unpleasant surprise for people with a lot of medical bills this year is a change that makes it tougher to claim a deduction. Previously, you could get a deduction when your medical expenses totaled more than 7.5 percent of your adjusted gross income. But now that’s up to 10 percent unless you or your spouse is 65 or older. You might be able to get over the 10 percent threshold by seeking dental care, vision care or medicine now that you might have otherwise delayed. Just realize you can only claim the amount over the hurdle.

A hodgepodge of fees. Whether you pay a tax preparer or run up expenses for your job that aren’t reimbursed by your employer, you might be able to get a deduction. Items like unreimbursed travel for work, depreciation on a computer, union or professional dues, lawyer fees and others fall within “miscellaneous” deductions. But they have to total at least 2 percent of your adjustable gross income.

Rush a state tax bill. If you have a state income tax bill to pay early in January, you can pay it in 2013 and increase your itemized deduction total for this year. Think ahead, however. If you will need the deduction in 2014, you might not want to rush to take it this year. And if you might be subject to the alternative minimum tax this year, you will waste the benefit of paying higher state taxes now.

Give to charity. Seniors can give directly to charity from their individual retirement account and, depending on the amount, can cut the requirement to take distributions and pay taxes on them. At the end of 2013, this benefit disappears. For anyone, a good way to give is to donate stocks, bonds, mutual funds or other assets worth a lot more now than when they were bought. For people worried that their holdings have soared too far too fast, giving shares to charity allows a valuable donation, and you don’t have to sell the asset and pay capital gains taxes.

Sell losers. If you have capital gains on assets that you sold in 2013, you can cut your tax burden. Sell an asset that’s lost money. Any loss you have on those will offset other gains. And if you have more than a $3,000 loss, you can carry the extra over to offset gains in the future.

Know the law and act accordingly. It helps to be aware of tax law changes in any given year. Two new taxes to help finance the 2010 health care law — a 3.8 percent surtax on investment income and 0.9 percent added levy on wages — will apply to income of more than $250,000 a year for married couples and $200,000 for individuals.

In addition, the forgiveness debt on home foreclosures, sales tax deduction, private mortgage insurance deduction, classroom supplies deduction, tuition and fees deduction, and residential energy tax credit are good only for 2013. Taking action in these areas before the end of the year will put you in a position to take those deductions.

Consider the power of three. There is nothing wrong with doing your own taxes, Brodie said, but every three years it’s a good idea to have a professional complete or review your work. That way, if you missed something, you will still have time to file an amended return.

Chicago Tribune,

The Atlanta Journal-Constitution