WYCKOFF LAWS AND TESTS

Post on: 20 Август, 2015 No Comment

and

Dean and Professor of Finance

Benard Belletante

Wyckoff is a name gaining celebrity status in the world of Technical Analysis and Trading.

Richard D. Wyckoff, the man, worked in New York City during a “golden age” for technical

analysis that existed during the early decades of the 20th Century. Wyckoff was a contemporary

of Edwin Lefevré who wrote The Reminiscences of A Stock Operator. Like Lefevré, Wyckoff

was a keen observer and reporter who codified the best practices of the celebrated stock and

commodity operators of that era. The results of Richard Wyckoff’s effort became known as the

Wyckoff Method of Technical Analysis and Stock Speculation.

Wyckoff is a practical, straight forward bar chart and point-and-figure chart pattern

recognition method that, since the founding of the Wyckoff and Associates educational enterprise

in the early 1930’s, has stood the test of time.

Around 1990, after ten years of trial-and-error with a variety of technical analysis systems

and approaches, the Wyckoff Method became the mainstay of The Graduate Certificate in

Technical Market Analysis at Golden Gate University in San Francisco, California, U.S.A.

During the past decade dozens of Golden Gate graduates have gone to successfully apply the

Wyckoff Method to futures, equities, fixed income and foreign exchange markets using a range of

time frames. Then in 2002 Mr. David Penn, in a Technical Analysis of Stocks and Commodities

magazine article named Richard D. Wyckoff one of the five “Titans of Technical Analysis.”

Finally, Wyckoff is prominent on the agenda of the International Federation of Technical

Analysts (IFTA) for inclusion in the forthcoming Body of Knowledge if Technical Analysis.

The Wyckoff Method has withstood the test of time. Nonetheless, this article proposes to

subject the Wyckoff Method to the further challenge of real-time-test under the natural laboratory

conditions of the current U.S. Stock market. To set up this “test,” three fundamental laws of the

Wyckoff Method will be defined and applied.

THREE WYCKOFF LAWS

The Wyckoff Method is a school of thought in technical Market analysis that necessitates

judgment. Although the Wyckoff Method is not a mechanical system per se, nevertheless high

reward/low risk opportunities can be routinely and systematically based on what Wyckoff

identified as three fundamental laws (see Table #1):

1. The Law of Supply and Demand – states that when demand is greater than supply,

prices will rise, and when supply is greater than demand, prices will fall.

Here the analyst studies the relationship between supply vs. demand using price and

volume over time as found on a barchart.

2. The Law of Effort vs. Results – divergencies and disharmonies between volume and

divergences reveal an exhaustion in supply and the rising dominance of demand or accumulation.

Page 3

The bullish price trend during 2003 was confirmed by the steeply rising OBV index;

accumulation during the trading range this continued upward as the price rose in 2003. Together

the Laws of Supply and Demand and Effort vs. Result revealed a powerful bull market underway.

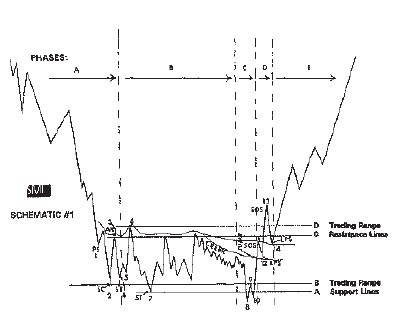

THE “NINE CLASSIC BUYING TESTS” OF THE WYCKOFF METHOD

The classic set of “Nine Classic Buying Tests” (and “Nine Selling Tests”) was designed to

diagnose significant reversal formations: the “Nine Classic Buying Tests” define the emergence

of a new bull trend (See Table #2). A new bull trend emerges out of a base that forms after a

significant price decline. (The “Nine Selling Tests” help define the onset of a bear trend out of top

formation following a significant advance.) These nine classic tests of Wyckoff are logical,

timetested, and reliable.

Page 4

As the reader approaches this case of “Nine Classic Buying Tests,” he/she ought to keep in

mind the following admonitions from the Reminiscences of a Stock Operator (See Appendix):

“The average ticker hound – or, as they used to call him, tapeworm – goes wrong, I suspect,

as much from overspecialization as from anything else. It means a highly expensive inelasticity.

After all, the game of speculation isn’t all mathematics or set rules, however rigid the main laws

may be. Even in my tape reading something enters that is more than mere arithmetic. There is

what I call the behavior of a stock, actions that enable you to judge whether or not it is going to

proceed in accordance with the precedents that your observation has noted. If a stock doesn’t act

right don’t touch it; because, being unable to tell precisely what is wrong, you cannot tell which

way it is going. No diagnosis, no prognosis. No prognosis, no profit.

“This experience has been the experience of so many traders so many times that I can give

this rule: In a narrow market, when prices are not getting anywhere to speak of but move within a

narrow range, there is no sense in trying to anticipate what the next big movement is going to be –

up or down. The thing to do is to watch the market, read the tape to determine the limits of the

get-nowhere prices, and make up your mind that you will not take an interest until the price

breaks through the limit in either direction. A speculator must concern himself with making

money out of the market and not with insisting that the tape must agree with him.

“Therefore, the thing to determine is the speculative line of least resistance at the moment of

trading; and what he should wait for is the moment when that line defines itself, because that is

his signal to get busy.”

Point #4 on the charts identifies the juncture when all Nine Wyckoff Buying Tests were

passed. The passage of all nine tests confirmed that an u[trending or markup phase had begun.

The passage of all Nine Buying Tests determined that the speculative line of least resistance was

to the upside.

FUTURE: A MARKET TEST IN 2004

The authors as academics are intrigued by the natural laboratory conditions of the stock

market. A prediction study is the sine quo non of a good laboratory experiment. The Wyckoff

3) Activity bullish (volume increases on rallies and

decreases on reactions)

4) Downward stride broken (i.e. supply line penetrated)