Writing Covered Calls

Post on: 28 Апрель, 2015 No Comment

Learn how to make the most of the options you write

12 Tips for Writing Covered Calls

Many investors think writing options (i.e. covered calls) is an easy way to generate cash. But theres more to it than meets the eye.

There are many decisions for investors to make before they get into covered call writing. For example, what kind of stocks should they purchase to maximize their call writing potential? What are their profit targets for the options they write? How can they maximize profits without losing their shares? And so on, and so on.

Looks like its not as easy as it seems, and it requires some study in order to improve your chances of success.

Follow my plan and learn how to make the most of the options you write.

#1 Maximize Income and Reduce Risk

I believe that when you begin writing option contracts that there are two objectives that are paramount to every covered option writer: maximizing income and minimizing risk.

First, in order to maximize the flow of income from writing covered options, the writer should attempt to extract at least a 20% annual return on the value of the shares held in their portfolio.

The second objective is to continually gather enough premium to reduce the downside risk of holding common stock, and to sell off positions that become unattractive because of changes in their inherent price trend.

Of course, many investors already own a portfolio of common stock that they definitely plan to keep for tax reasons or other considerations. But others will have the freedom to select stocks that are more conducive to option writing.

#2 Select High-Volatility Stocks

Many option players believe that stocks with low volatility are far easier to handle, are assigned less often, and require less watching. But stocks that maintain a low volatility normally have poor premiums, and it would be difficult to use these types of stocks in your portfolio and attain the goals we have set for ourselves.

On the other hand, you will find that stocks with high volatility have much-higher premiums in their listed options. These stocks normally have better liquidity, as do their listed options. Normally, stocks with high volatility also act in a much healthier and more predictable manger. Further, volatile stocks will create a good income flow one that can generate up to a 30% to 40% return per year.

#3 Select Stocks in a New Uptrend

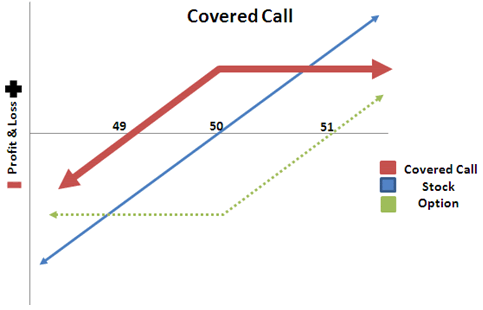

In covered option writing, we buy stock and sell call options against each 100 shares of stock. Therefore, its important to insure that the stocks that you do purchase are in a new uptrend.

Volatile stocks provide good premiums, and normally you can write options fast enough to protect some of that downside risk, although it is very difficult to protect all of it when stocks are falling rapidly in a bear market.

Investors locked into a situation where they cannot afford to divest themselves of stock positions must, of course, take their losses during the periods when their stock is moving down significantly. But it is far better to be writing options during this period than to sit around praying for the next bull market.