Working with a Strategy for Optimal Stock and Bond Allocation

Post on: 7 Апрель, 2015 No Comment

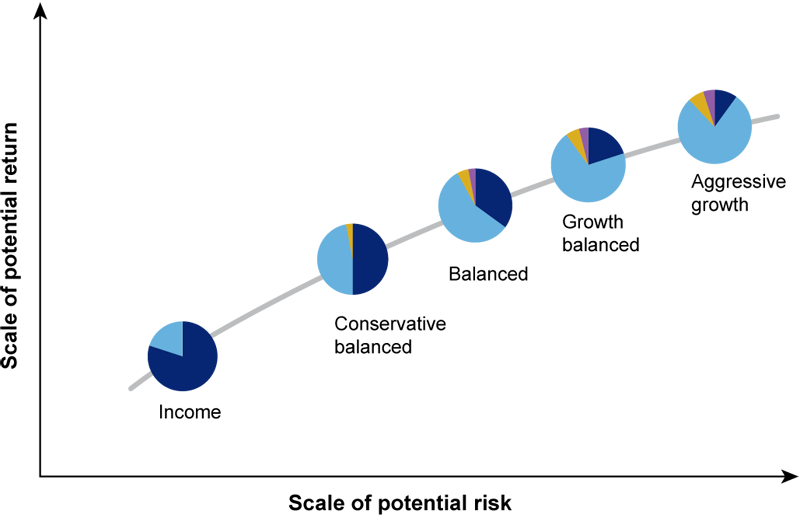

For beginning investors, one of the most immediately difficult parts of investing is understand when to time their investments, understanding when to move in and out of the market. Buying and hold strategies can still be viable, but they are not entirely foolproof, and can end up causing trouble for investors who plan on working solely with them. In recent years, in particular, individuals may find it difficult to employ such standard strategies, and, as such, there are several concerns that need to be taken into consideration. To begin with, investors need to ask themselves how a major downturn can be avoided in order to improve performance. Once that has been answered, individuals need to understand how they can ensure that, reducing risk and providing the highest guarantee for peace of mind in the future. A strategy for optimal stock and bond allocation is known as the Best of Two strategy, and it can help provide a large amount of hedge against risk in the future.

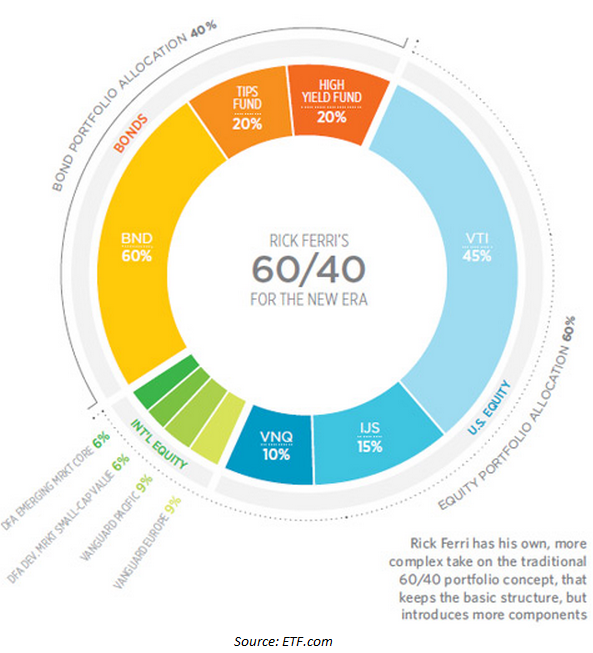

The strategy is able to work because the basic idea revolves around focusing on past trends in order to determine when a sound investment balance can be applied for the future. What this does not mean, however, is that all investors will be able to predict the future based on signals from the past. If anything, the exact opposite can be expected. Allocating to stocks and bonds will only work according to fixed mathematical settings and criteria that do not rely on the investors active management. Individuals will not need to pick any individual stocks, as the stocks and bonds are held in accordance to index investments, include general exchange traded funds. Given the constant dangers that are inherent to stock picking, individuals do not need to worry about trying to predict the market. In such a way, this can be a very effective hedge to risk because there is no room for error on the investors part.

Such a strategy for optimal stock and bond allocation focuses on working with option price theory in order to calculate how to appropriately move the funds into two asset classes. Because there are no suitable standardized options available, there are many OTC ones that can end up having some significant disadvantages in case replication is used. This can end up enabling an investment in two asset classes as they work with the right proportions. As such, the strategy can be especially ideal for those who enjoy relying specifically on a fixed formula. As with most such strategies, it will not perform well with equity investments in a pure bull market, but there is also a large amount of protection that comes with it. It can end up working much better over a period of time than most rigid types of equity bond allocations, which can be ideal for planning ahead well into the long term.