With Correlation So High Why Are Hedge Funds Underperforming By So Much

Post on: 24 Май, 2015 No Comment

Hedge funds should not be compared to the S&P 500 and their dispersion of returns across different strategies makes such comparisons in accurate, says institutional fund manager

A recent Goldman Sachs Group Inc (NYSE:GS ) Hedge Fund Trend Monitor led its report by addressing a perplexing question in the hedge fund community. The report noted that in 2014 hedge fund performance by their measure was a paltry 1 percent at a time when the S&P 500 average was up 13.7 percent.

Even given the slightly higher performance of the BarclayHedge Hedge Fund Index, which was up just 2.89 percent in 2014, Hedge Funds dramatically underperformed stocks last year when compared to the S&P 500, the Goldman report noted. The oddity is that hedge funds in general are correlated to stocks by a magnitude of nearly 0.80 depending on the indexes being compared. They exhibited high correlations during the 2008 market crash, as the BarclayHedge Hedge Fund Index was down nearly 21 percent that year. With correlations so high, why did hedge funds underperform the benchmark in 2014 when stocks were up?

Strategy shift in light of under performance

In light of what appears to be under performance some funds have been anecdotally reported to be adding broader exposure by purchasing a significant degree of stock index funds or futures contracts to place alongside their individual stock picks. Other hedge fund managers are said to be adding algorithmic trend following strategies on top of their discretionary stock picking investment models.

While some funds are looking at corrective measures to boost hedge fund performance, the performance gap between the S&P 500 and hedge funds can be explained. Don Steinbrugge, chairman of Agecroft Partners. a large institutional hedge fund placement firm, notes four primary issues with the performance gap.

Steinbrugge: S&P 500 Index Is Not The Appropriate Hedge Fund Benchmark

The most significant reason for the performance divergence with the S&P 500 is that is not the appropriate benchmark. “There are almost no institutional investors who use the S&P 500 as a benchmark for a diversified portfolio of hedge funds,” Steinbrugge explained in an interview with ValueWalk. “Even for Long short equity most managers are investing part of their portfolio in investments are outside of the S&P 500,” often in small cap stocks or niche markets where a security stands a better chance of being mis-priced.

Steinbrugge, who wrote an article on hedge fund benchmarking. says the ideal performance benchmark would be a mix of 60 percent stocks and 40 percent bonds. He also noted comparing the S&P 500 to hedge fund performance is misleading because of the strong strategy diversity in the category, from fixed income and managed futures strategies to long / short hedge funds and other strategies that don’t often directly correlate to that of the generally efficiently priced S&P 500. He says when benchmarking hedge funds the measure of equity exposure should have some smaller cap stocks and global weightings in addition to the S&P 500

“While the S&P 500 posted strong numbers in 2014, let us not lose sight of the fact that the US economy experienced much better growth in 2014 than either the eurozone or many emerging markets,” said Sol Waksman, chief executive officer of BarclayHedge, a leading data provider that monitors the performance over 10,000 hedge funds, in an interview with ValueWalk. “Perhaps a better number to look at would be the MSCI World Index which was up 4.9%.”

Both Waksman and Steinbrugge point to different benchmarks which generally reflected performance near 5 percent on the year. Steinbrugge notes that when you subtract nearly 2 percent performance fees from the 5 percent the more globally focused and small cap indexes delivered then the average hedge fund performance reported by BarclayHedge of 2.69 percent in 2014 starts to become more understandable.

Bigger issue is too much mediocrity

Steinbrugge echoed larger issues with hedge fund performance, saying “seventy five percent of hedge funds are not worth their fees.” As the BarclayHedge database tracks more than 10,000 funds, Steinbrugge says that a small core of hedge funds outperform the markets – much as is the case in the mutual fund industry. The issue is identifying these managers.

For Waksman, the 2014 market environment was also challenging for hedge traders. “There was quite a bit of volatility, both up and down, that is always hard for active managers,” Waksman noted. Some hedge fund managers found difficulty in the October 14, 2014 volatility where risk management protocols forced liquidations on the sell-off and did not fully capitalize when the quick rebound occurred days later. “In the end, HFs were not able to keep up with the equity markets when they took off, but out-performed when those markets sold off.”

Apple Computer exposure significant issue

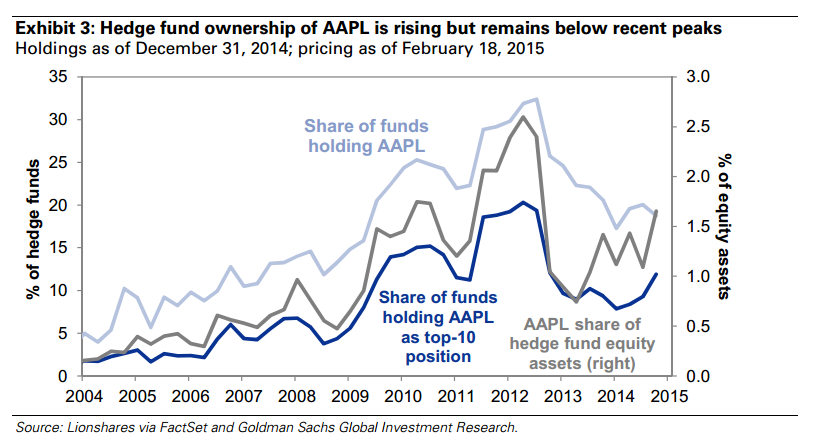

Another potential reason for the under performance of hedge funds versus the S&P is the lack of inclusion of Apple in most hedge fund portfolios. Apple Inc. (NASDAQ:AAPL ) is currently the largest hedge fund position, with Goldman Sachs reporting that 12 percent of hedge funds hold the stock in their top 10 holdings. While this is a high level, looking at it from a different angle 82 percent of the hedge fund universe didnt make Apple a top pick and they paid for it in lost performance. Apple is the largest corporation in the world with a market cap twice that of the second most valuable firm. Year to date the stock is up 17 percent and has contributed 27 percent to the S&P 500s 2.3 percent total return in less than two short months, highlighting its relative impact on the performance of the S&P.

Like this article? Sign up for our free newsletter to get articles delivered to your inbox