WISER Women Stocks Bonds and Money Market Investments

Post on: 4 Май, 2015 No Comment

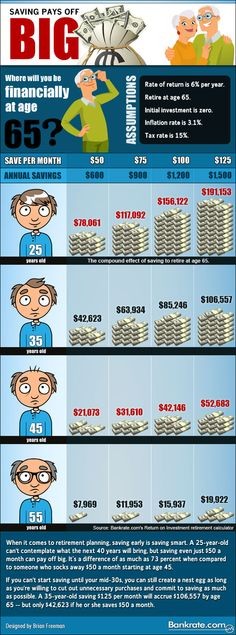

Your assets are an increasingly important part of your retirement plan, so it is important to start saving early and to invest wisely. This means choosing investments that are appropriate for your age, tolerance for risk and current need for funds.

What are stocks?

- Stock represents ownership of a piece of a company and is traded in units called shares.

- Shares of stocks are bought and sold on the stock market. If many people want to buy a certain stock, the share price will rise. If more people want to sell the stock, the share price will fall.

- For example: Company X needs $2 million to update its production machinery to remain competitive with other companies in the U.S. and overseas. To do so, they can either borrow money from a bank, sell bonds or sell stock in their company to investors. People who buy the stock actually acquire partial ownership (shares) in the company.

- A stock mutual fund is a mutual fund that invests in the stock market.

Are there different kinds of stocks?

- Yes, common and preferred.

- Preferred stock provides a fixed dividend, it may have a fixed maturity date and does not participate in the growth of the company; in this regard, it is more like a bond.

- Common stock provides part ownership in the company and may or may not provide a dividend.

How do I make money by purchasing stocks?

1. First, you can buy stock that you or your broker believes will increase or appreciate in value.

For example, Company P stock sold for $10 per share today and in two weeks the price jumped to $20 per share. At that point, you would sell the stock for a profit of $10 per share. But, you should remember that just as the value of the stock can go up, it can also go down!

2. The other way to purchase stock is to hold it for a longer period of time and hope to earn a profit. For example, Company P had a great year and made a profit of $5 million. The board of directors of Company P can, at its discretion, pay each shareholder a dividend a certain amount per share every quarter based on the performance of Company P.

What are bonds?

- Bonds are IOUs issued by companies, governments or other institutions. The issuer agrees to pay back the face value of the bond — known as the principal — over a fixed period of time. In return for this loan, the issuer also agrees to a pay a fixed rate of interest (called a coupon rate) to the bondholder for the life of the bond.

- Bonds are bought and sold on the bond market. Their value fluctuates according to two main factors: interest rates and the financial health of the issuer.

- A mutual fund that invests in bonds is called a bond mutual fund .

- Bonds are less risky than stocks, but may be less lucrative.

What are money market instruments?

- Money Market Instruments are IOUs as well, but have much shorter terms than bonds.

- Funds that invest in these are called Money Market Funds .

- Because they generally invest in large, stable institutions, they are considered quite safe, but they offer relatively modest returns on your investment.