Will Strong Auto Sales Drive AutoZone Earnings Higher (AZO)

Post on: 6 Май, 2015 No Comment

September 23, 2013 | Comments (0)

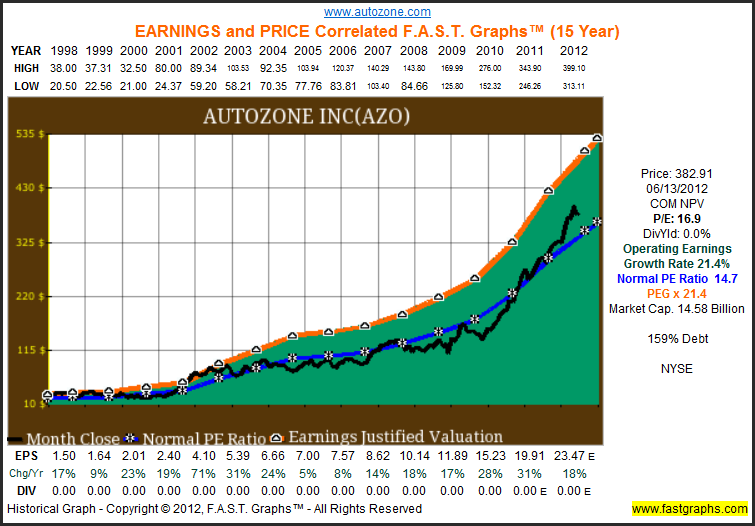

AutoZone ( NYSE: AZO ) will release its quarterly report on Wednesday, and investors have had mixed reactions to prevailing trends over the past few months, sending the stock to new all-time highs in late July before giving back some of its gains in recent months. The big uncertainty about AutoZone earnings is whether the big jumps in new car sales that we’ve seen from Ford ( NYSE: F ) and General Motors ( NYSE: GM ) indicate a major shift in thinking among car owners that will lead them to reverse their trend toward owning cars longer and incurring greater maintenance costs.

Source: Yahoo! Finance.

How far can AutoZone earnings climb this quarter?

In recent months, analysts have cut their views on AutoZone earnings, but only by the tiniest of margins. August-quarter estimates are a penny per share below where they were three months ago, while full-year fiscal 2014 projections have fallen by just 0.2%. The stock ended up just about where it left off last quarter, falling less than 1% since mid-June.

AutoZone has a strong presence within the auto-parts industry, especially among do-it-yourself car owners. That focus has served the company well during the recession, when car owners were willing to do just about anything to save money. Now, though, General Motors and Ford have seen huge rebounds in their business, posting their best new-car sales growth in years. Some worry that Ford and GM’s success reflects changing economic conditions that could drag on AutoZone’s do-it-yourself business.

As a result, AutoZone has recognized the need to make a bigger splash among commercial customers like repair shops, to which many car owners turn when they have somewhat more disposable income. In that space, rival O’Reilly Automotive ( NASDAQ: ORLY ) has a substantial lead. helping it post much stronger same-store-sales growth of 6.5% in its most recent quarter. Advance Auto Parts ( NYSE: AAP ) has also made a push into the commercial segment. with its store expansion efforts starting to bear fruit in developing a more comprehensive network of locations.

The biggest source of potential growth that AutoZone is looking at comes from e-commerce, where its purchase of AutoAnything should help bolster results. E-commerce is a tiny part of AutoZone’s total business, but the convenience and efficiency involved could help promote solid growth for the future.

In the AutoZone earnings report, watch for the company’s breakdown between do-it-yourself and commercial customers. As Ford and GM get healthier, AutoZone will want to emphasize both of its potential revenue sources to maximize its business.

A stock for all seasons

Through recessions and recoveries, all good investors want to build that perfect portfolio that they can set and forget forever. Fortunately, it’s easier than anyone ever knew. We’ve uncovered the pillars of such a portfolio today and we’re willing to share The Motley Fool’s 3 Stocks to Own Forever. Simply stated, we think they’re the best stocks for true long-term investors to know about, and you can uncover them for free today, instantly; just click here now .

Click here to add AutoZone to My Watchlist, which can find all of our Foolish analysis on it and all your other stocks.