Will Plan Sponsors Leave the Under 30 Crowd Doomed to Repeat 401k History

Post on: 12 Июль, 2015 No Comment

(Part one in a three part series)

T here was a time when a whole generation sang the hosannas of “don’t trust anyone over 30.” Then something wonderful happened – they grew up. Soon, they began to jokingly suggest not to trust anyone under 30. Age tends to do that to you. Funny thing is, when it comes to 401k investing, they may be on to something – and more.

First, a quick review of the survey results. The Hartford survey revealed 95% of those under 30 prefer to have a guaranteed income option for their retirement assets. It gets worse. About 90% of those in their 30’s and 40’s prefer the same thing. The Blackrock survey found that 85% of all current workers prefer their company retirement plan offer a guaranteed income option. Worse (and we’ll see why in a moment), that same survey says 86% of the plan sponsors surveyed agree that participants would benefit from an in-plan, guaranteed retirement income stream. Those 401k plan sponsors may be about to step into the bottomless pit of fiduciary liability.

In the face of decades of investment reality suggesting fixed income is often the worst investment for long-term investments, why would young investors feel otherwise? “Can you blame them? They’ve seen their parents and grandparents get hurt by Wall Street’s empty promises, and they don’t want to get burned,” says Brian Solik, CRPC, President and Founder, Wealth Preservation Strategies of NJ in Toms River, NJ.

Curt D. Knotick, CEO at Accurate Solutions Group in Butler, Pennsylvania, echoes Solik. He says, “I strongly believe that the under 30 investors not only have seen the recent volatility of the markets, but they also understand through their employers that they do not have a pension plan, that they will be responsible for their own pension income and that their 401K will be their supplemental income in retirement.”

Michael D. Greaney, Director, ESOP Administration Services, Equity Expansion International in Washington, DC, agrees. He says, “Given the current market volatility, it makes very good sense to go for securities with a bit more, well, security. This is driving the move among younger people into fixed income securities.”

Many, like Mathew Goldberg, President of Manhattan Wealth Management Group in New York City, point to the incessant pessimism that more malleable members of society must contend with. He believes “young investors feel this way from the ongoing negative sentiment in the media regarding stocks since the financial crisis of 2008.”

Timothy R. Yee, Green Retirement Plans, Inc. Oakland, California expressed a similar theme when he says, “The issue I am seeing is that young people were burned by the crash of 2008. Add to that, they are tech savvy and follow this stuff more than earlier generations and you get a generation that is afraid of sitting on a stove for fear of being burned. Add in the twenty-four hour news cycle and folks like Cramer and you have a group of people who are scared of their own shadows. Perhaps they are not that different from the kids of the Great Depression.”

Could there be a simpler reason? Courtenay Shipley of Shipley Capital Advisory, in Nashville, TN and Alexandria, Virginia, says, given the “lousy time in the market, usually any investor of any age values a guarantee or a situation where they dont have to be the one bearing the risk.”

But others take a much broader view. “There has been a lot of disappointment in the markets and this especially runs true for those that are just entering the investment landscape,” says John E. Hommel of Private Client Asset Management, Inc. in Garden City, NY. He further explains, “They have not had the opportunity or experience to watch their investments grow over time. We have developed into a here and now society and many are not willing to stick with a program that is intended to be a long term solution to retirement savings needs.”

Indeed, the specific events of the last few years have conspired to skew the attitudes of young investors, perhaps in a way that places them in peril. Rich Winer, President and CEO of Winer Wealth Management in Woodland Hills, California explains this when he says, “They are frightened about their financial future as a result of the stock market having its first losing 10 year period since The Great Depression (2000-2009). The 2008 bear market and last year’s volatility have scared many investors away from stocks. The young (and old) investors’ fears are often irrational and fueled by their lack of investment experience or sophistication.” Winer also expresses concern these young investors may “have bought the story provided by insurance agents and companies who are more interested in selling them fixed insurance products than in doing what is ‘right’ for them. Their sole objective is to tell the story, create irrational fear and sell fixed insurance products.”

Some advisers prefer to take a more psychoanalytical view when it comes to explaining this apparent disconnect between young investors and market history. “Young investors view of the markets is generally either a repudiation or an overt acceptance of their parents views,” says Nick Richtsmeier, Regional Vice President at Trilogy Financial Services in Denver, Colorado. “I would say that any uptick in an interest in guaranteed products reflects the second. They have watched their parents fret over market volatility for the past decade plus, and in the process absorbed an inherently negative view of markets. In many cases their parents may not have been able to retire at the ideal time or had to face some other planning setback due to undue risk in their portfolio. It is unfortunate that late career investors who had too much market risk in their portfolios are now in many cases causing public pressure for younger investors to not have enough.”

From the Freudian to the behavioral, it appears the attitudes uncovered by these surveys can best be justified by understanding the deeper psychology to which they speak. “It’s a combination of lack of education and normal emotions,” says Hilary Martin, Financial Planner, of The Family Wealth Consulting Group in San Jose, California. “People got burned by stocks if they sold out of the market during the financial crisis, and human beings suffer from something called Recency Bias, which means we use recent examples, not necessarily the most representative ones, to make choices. Watching our portfolio values decline almost 50% was not fun. However, for those of us who held on, the long term returns in the stock market far exceed any other investment vehicle available to individual investors. The same thing happened to folks who suffered through the Great Depression. They were so burned on stocks, for some of them no amount of empirical data could convince them that their retirement portfolios would have benefitted greatly from staying invested!”

Charles C. Scott, President of Pelleton Capital Management, Ltd. in Scottsdale, AZ is more sanguine. He says, “Basically we are a nation of financial illiterates. Sound financial principles are not taught in school, so you learn mostly from your parents, and they probably don’t know either. And the biggest concern we have as planners/advisors is getting people to be honest enough to acknowledge that they don’t know, and be willing to ask for help.”

But with the Blackrock survey and the IRS’ and DOL’s recent “longevity” policy, annuities may soon be headed for a 401k plan near you. In the next two installments of this series, we explore if this really makes sense and how it might actually backfire for 401k plan sponsors.

Part I: Will Plan Sponsors Leave the Under 30 Crowd Doomed to Repeat 401k History?

Interested in learning more about this and other important topics confronting 401k fiduciaries? Explore Mr. Carosa’s new book 401(k) Fiduciary Solutions and discover how to solve those hidden traps that often pop up in 401k plans.

One response to Will Plan Sponsors Leave the Under 30 Crowd Doomed to Repeat 401k History?

May 23, 2012 at 7:43 am | Permalink

The survey is an interesting devise. How a question is presented is very important. The question that comes to mind around this topic is:

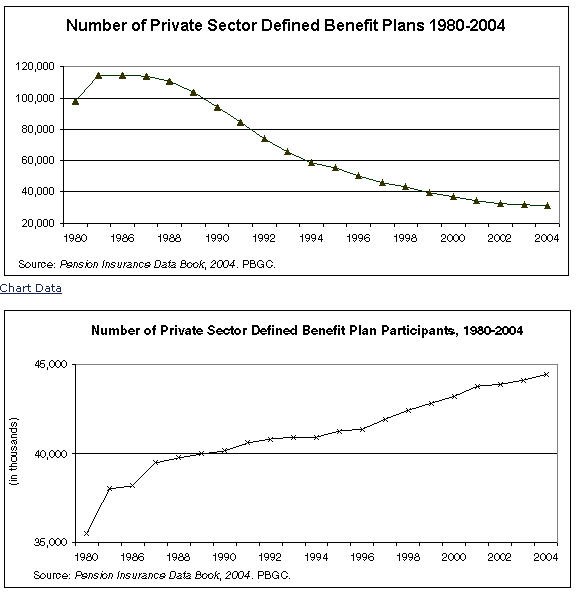

Are Hartford and Blackrock interpreting responses to mean participants want a PRODUCT when, in fact, respondents are saying they want a Defined BENEFIT Plan?

In other words, they want a known income stream a PENSION and really are NOT asking for an annuity product to be added to the 401k.