Will I Have to Pay Tax on Dividends If I Reinvest Them into Buying More of That Stock

Post on: 19 Июль, 2015 No Comment

Dividends are the periodic bonus payments that many publicly-traded companies make to their shareholders. While most American companies choose to pay dividends on a quarterly basis, many foreign companies pay out on a semi-annual or annual basis to avoid the tax implications of disbursing payments to large numbers of non-native shareholders. If you own a mutual fund or individual stocks in your retirement portfolio, it's likely that you earn some of your investment income from dividends.

Unlike the capital gains generated by the sale of a stock, the IRS considers dividend income to be regular income and levies taxes on it accordingly. While a recent tax break temporarily reduced the income tax rates that investors must pay on dividends, it's likely that rates will rise in the near future.

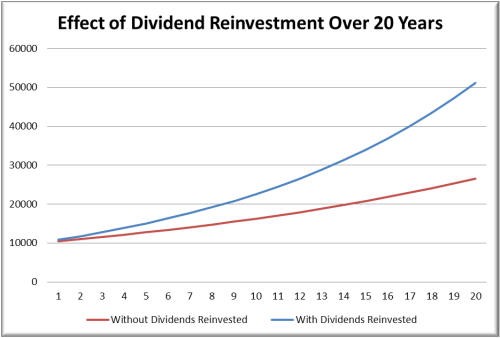

Most financial gurus encourage long-term investors to reinvest any dividends that they earn. If you own a tax-sheltered retirement account that produces significant amounts of dividend income, this is sound advice. Studies have shown that reinvested dividends can magnify long-term investors' gains.

To facilitate the reinvestment of dividends, many companies offer dividend reinvestment programs. Known as DRIPs, these useful tools automatically reinvest each dividend payment into fractional shares of the stock that made the payment. For instance, reinvested dividends worth $220 can be used to purchase 5.5 shares of a dividend-bearing stock worth $40 at the time of the reinvestment transaction.

Despite the fact that they're unusable for any purpose other than purchasing more shares of stock, reinvested dividends are still subject to taxation at the standard income tax rate. For high-income investors, this rate is currently set near 40 percent. This tax applies whether the dividends are reinvested automatically through a DRIP or used to purchase shares of a different dividend-bearing stock.

If you wish to avoid losing up to 40 percent of the dividends that you earn to the IRS, consider isolating your dividend-bearing investments in a tax-protected account like an IRA or 529 savings plan. Under these plans, both dividends and capital gains may accumulate tax-free. You'll only need to pay taxes on the investments contained in these accounts when you begin to withdraw funds in preparation for retirement or other major expenses.

In spite of the fact that they're subject to taxation, reinvested dividends can still boost your income by substantial margins. After all, non-reinvested dividends are equivalent to cash and produce no additional earnings after being taxed.