Will ETFs Replace Mutual Funds The Wallet

Post on: 16 Март, 2015 No Comment

By WSJ Staff

Journal reporter Jane J. Kim writes:

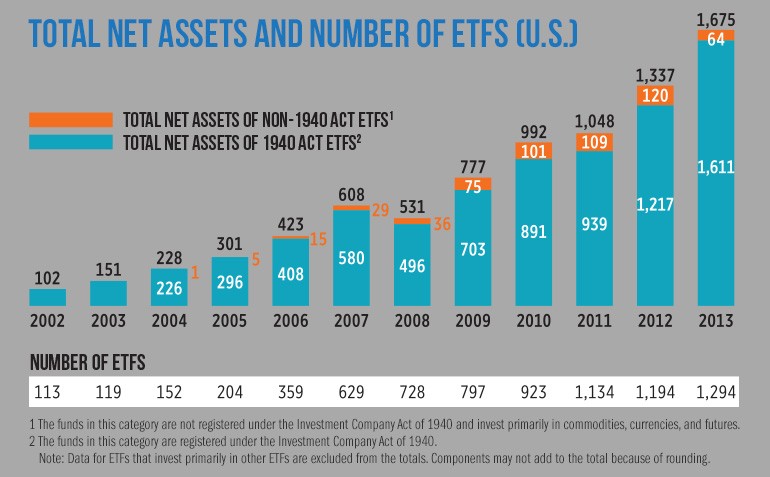

Despite a difficult market environment, exchange-traded funds are continuing to grow.

Investors worldwide poured $268 billion into ETFs last year, pushing total assets to roughly $730 billion at the end of 2008, according to a new report by Strategic Insight. a New York fund research and data firm. Assets worldwide are expected to hit $1 trillion in two years.

Much of that growth will be driven by broader acceptance of these investment vehicles, which resemble traditional index mutual funds but trade throughout the day like stocks. While institutions are already big users of ETFs, individual investors and financial advisers are increasingly turning to them to gain exposure to specific asset classes and to hedge their portfolios.

Strategic Insight surveyed 85 registered investment advisers in the U.S. and found that among advisers who use ETFs, 70% plan to increase that use. Many advisers said they employ ETFs as a replacement for individual stocks, mutual funds and bonds. Some are shifting certain clients, such as high-net-worth investors concerned about tax efficiency, to all-ETF portfolios.

Investors like ETFs because they’re typically cheaper, more transparent and more tax-efficient than most actively-managed mutual funds. “A lot of these people believe you can construct a good buy-and-hold portfolio” using ETFs, says Loren Fox, senior research analyst at Strategic Insight.

The explosion of ETFs in recent years has helped investors gain exposure to everything from U.S. large-cap stocks, international markets and fixed income to sectors such as commodities and currencies. Last month, for example, Barclays Global Investors rolled out exchange-traded notes (essentially ETF-like debt instruments) that follow the VIX index. which tracks volatility in the Chicago options market.

Strategic Insight estimates that roughly 70% of individuals who use ETFs are using them as a replacement for stocks and separately-managed accounts, and not as a replacement for actively-managed mutual funds. But as more advisers use ETFs, and amid the emergence of “actively managed” ETFs, that could soon change.

Wallet readers. do you prefer ETFs over stocks or funds? Whats your ETF strategy?

Recession-Proofing Your Relationship Next

Loose Change: 2/20/09