Why You Shouldn’t Listen to Analysts Investment U

Post on: 3 Август, 2015 No Comment

by Marc Lichtenfeld. Chief Income Strategist, The Oxford Club Wednesday, December 17, 2014. Issue #2439 Wisdom of Wealth

After 18 years in the business, you’d think nothing could amaze me. But every time some clown upgrades or downgrades a stock or puts out a research note that moves the share price, I’m surprised.

These opinions and price targets put out by sell side analysts are worthless. Believe me, I used to be one. I know how the game is played.

First of all, there are two kinds of equities analysts, buy side and sell side.

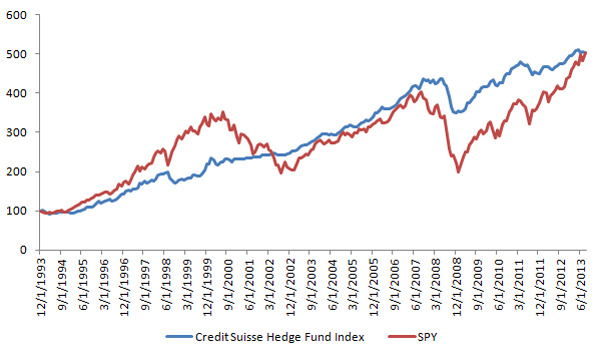

The buy side are institutions that buy stocks — hedge funds, mutual funds, pension funds, etc. If someone from the buy side says he or she likes a stock, I pay attention. They’re at least putting their money where their mouth is.

The sell side — you guessed it, sells stocks — brokerages and investment banks. The upgrades and downgrades come from the sell side.

Sell side analysts publish research reports on individual stocks and sectors. The analysts are usually very smart and do a thorough job, particularly on industry statistics.

However, they get it wrong, a lot.

Here’s a recent example.

Better Than the X-Ray

You need to see this right away. Its the most important medical advancement since the X-ray.

Find out here how it will help doctors defeat many diseases, including ones that are frequent, severe, and difficult to treat.

In late June, the analyst from Sun Trust Robinson Humphrey upgraded Miller Energy Resources (NYSE: MILL) to “Buy.” The stock was trading at about $6. On Monday, with the price having been beaten down to $1.24, it was downgraded to “Hold.” Anyone who bought the stock on the analyst’s recommendation lost 80%. By the way, you can check out my thoughts on the safety of Miller Energy’s Preferred Stock dividend at Wealthy Retirement later today.

There are several reasons why analysts are wrong so often:

1) Creative thinking is not rewarded. Analysts make a lot of money. Typically, at least $300,000 per year. Probably more if they’re at a larger bank. Some stars of the analyst world take home seven figures. If they deviate from the norm in a recommendation and tell clients to sell when everyone else says buy and they get it wrong, they’re going to have to explain to their research director why everyone else on Wall Street got it right and they didn’t. There’s not a lot of upside in sticking their necks out and jeopardizing that well-paying job.

2) It doesn’t matter if they get it right. Analyst track records are not based in reality. For example, let’s say a stock is at $50 and the company misses earnings and is slated to open at $40. If the analyst who had a buy recommendation downgrades it before the stock opens, his buy is considered removed at $50, not $40.

I once had a conversation with an analyst in a similar situation, only the stock was going to open 40% lower. After his downgrade in the morning, when I expressed my sympathy, he said, “It doesn’t matter, I get out at yesterday’s close.”

I’m sure his clients who listened to his advice think it matters.

3) There is still a conflict of interest between banking and research. During the dot-com boom and bust, analysts peddled stocks they knew to be garbage because they were compensated with huge bonuses from their firm’s investment banking business. After the collapse, a wall was supposed to go up between banking and research. In other words, bankers are not supposed to influence an analyst’s research or rating.

No such wall exists.

What do you think would happen if an investment bank was pitching a company to handle a big acquisition, but the research analyst has a sell rating on the stock? I’ll tell you what would happen. The business would go to someone else.

I’ve seen it firsthand. Several years ago, when I was interviewing for an analyst position, the director of research told me he was going to run the investment banking division too, although not officially. That’s a conflict of interest and is illegal. And you can be damn sure it tainted the company’s research.

I mentioned earlier that I was once a sell side analyst. That said, I worked for an uber contrarian firm. We were not allowed to initiate coverage on a stock unless it went against the consensus. My research director let us hear it if we got it wrong because we had no investment banking arm. Our value to our clients was research.

So although I was once a sell side analyst, I didn’t fall into the traps that make much of their research useless.

But I learned the game and I’m here to tell you that you should ignore them.