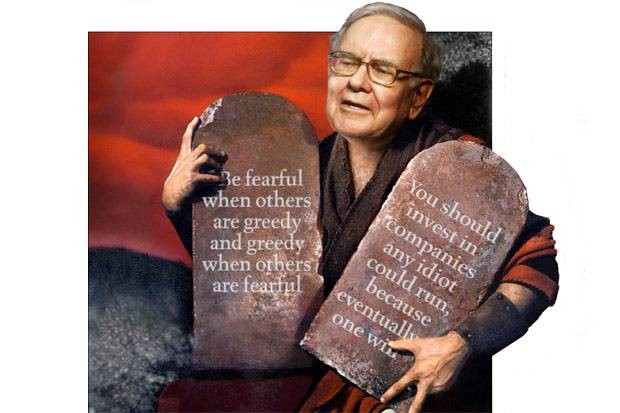

Why You Should Listen to Warren Buffett

Post on: 3 Август, 2015 No Comment

In both my view and the view of many others, Warren E. Buffett, chairman and CEO of Berkshire Hathaway Inc. (NYSE/BRK.A, BRK.B), is one of the best stock managers in history, which is why he is one of the wealthiest people in the world today.

Looking back, I remember that during the strong tech markets in the late `90s and early 2000 there were those (and there were many) that criticized both the conservative investing philosophy of Warren Buffett and his failure to invest in tech stocks.

The shares of Berkshire Hathaway fell to just above $40,000 in early 2000 when investors began to abandon Buffett and his investment philosophy. But, as we all know, he who thinks long- term is who profits most.

Berkshire Hathaway stock has more than doubled in the last five years, outperforming the Dow, S&P 500, and NASDAQ over the same period. In fact, if you bought a share of Berkshire Hathaway (class A) when they debuted on January 12, 1990 at $8,200, you would have made nearly 10 times your investment to date.

It’s no wonder that investors listen to and carefully monitor the investment strategies of Warren Buffett!

One interesting fact about Buffett is his reluctance to overpay for stocks. He will never buy a company that is worth more than its intrinsic value. So, what is he currently buying, with about $47 billion at his disposal?

Special: An Important Message from Michael Lombardi:

I’ve identified six time-proven indicators that now all point to a stock market crash in 2015. You can see my latest video, Six Time-Proven Indicators Now All Pointing to a 2015 Stock Market Crash, which spells out why we’re headed for a crash and what you can do to protect yourself and even profit from it, when you click here now.

According to publicly available information at the Securities and Exchange Commission, Buffett has been accumulating shares of retail powerhouse Wal-Mart Stores Inc. (NYSE/WMT) and brewery Anheuser-Busch Cos. (NYSE/BUD). I’m not fond of Anheuser-Busch’s valuation, but I do believe that Wal-Mart offers investors an excellent addition to their long-term portfolios.

Other positions that Buffett has a major stake in include H&R Block Inc. (NYSE/HRB), Wells Fargo & Co. (NYSE/WFC), and Diageo plc (NYSE/DEO).

You may never become as rich as Buffett, but you can definitely benefit from his vision of the markets!