Why you should favor largecap stocks for the next six weeks

Post on: 22 Июль, 2015 No Comment

MarkHulbert

CHAPEL HILL, N.C. (MarketWatch) — Don’t sell any of your large-cap stocks, and don’t buy any small-caps. Wait until the end of December to do so.

That’s because of seasonal cross-currents that occur around the turn of the year. Surprisingly, most investors are only aware of a big trend in January, when small-caps typically trounce large-caps. They even have a name for this: the January Effect.

But there is a December Effect too, even if few investors know about it and no one has bothered to name it as such. And these end-of-year seasonal winds blow in the opposite direction of the New Year’s pattern.

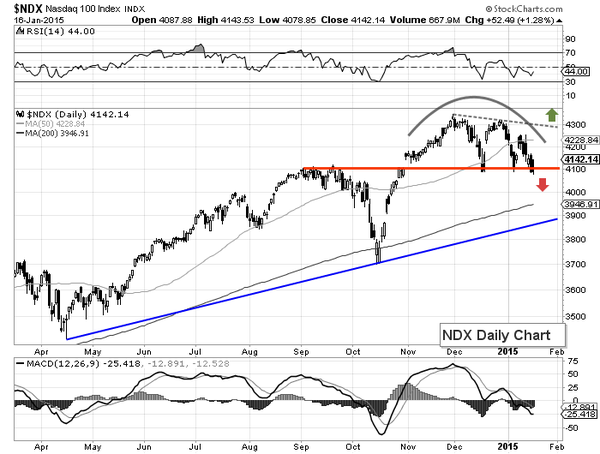

Consider the average amount by which small-cap stocks outperform large-caps. The accompanying chart is based on data extending back to 1926; for the purposes of its construction, a stock is considered in the small-cap category if its market cap is below the median of all NYSE-listed stocks, and in the large-cap category if above it.

Notice the distinct downtrend in small-caps’ advantage as the year progresses: January is by far the strongest month of the year for small-caps relative to large-caps, while the fourth quarter is the worst.

What accounts for this? One academic study suggests it has to do with the compensation incentives under which institutional money managers operate, incentives that lead them to favor large-caps as the year comes to a close and small-caps right after New Year’s.

I know this sounds far-fetched, but please follow along:

Consider a money manager whose year-to-date performance right now — six weeks before Dec. 31 — is ahead of the S&P 500 (or another index dominated by large companies). He knows that, so long as he holds on to his lead through the end of the year, he is likely to earn a handsome bonus. And he can lock in that lead by shifting his portfolio holdings to primarily large-cap stocks, and in the process reducing small-cap holdings.

Once January arrives, however, this manager’s compensation slate will be wiped clean, and his willingness to undertake risk will be at its highest. That appetite for risk will translate into a preference for small-cap stocks over large-caps.

No wonder large-caps often turn in their best relative performance near the end of the year and their worst in January.

A not dissimilar situation exists for a manager who currently is behind the S&P 500 for year-to-date performance, according to the study’s authors. To be sure, such a manager is not currently slated to earn any bonus for beating his benchmark. But he does have another incentive, one that could be just as powerful, if not more so: to avoid ending the year’s rankings at or near the bottom, which might very well cost him his job.

So as the year comes to a close, he will increasingly want to play it safe and invest in the larger-cap stocks that dominate the S&P 500, thereby locking in his mediocre, but not awful, relative performance.

The bottom line: Large-cap relative strength should peak at the end of December, along with small-cap relative weakness. That’s when you might want to sell the former and buy the latter.

For those of you who are taken by this theory, here are the large-caps that currently are recommended by the greatest number of advisers I monitor who have beaten a buy-and-hold strategy in the stock market over the past 15 years:

Stock

Number of market-beating advisers with ‘buy’ recommendations