Why You Should Buy Junk Bonds

Post on: 25 Июнь, 2015 No Comment

RobertPowell

Also See:

Stocks Resources

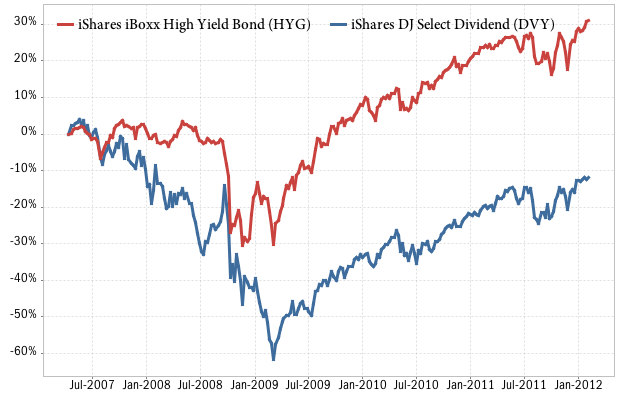

Analysts who are bearish say the ratio that looks at earnings as a percent of stock prices compared to the yield on junk bonds favors stocks right now. Plus, pundits are suggesting that junk bonds have had a fairly good run over the past 12 months (such funds are up nearly 17% over the past year) and that it’s time to take profits especially in light of the correction.

And indeed many an investor is doing just that: There was $1.6 billion in outflows from mutual funds investing in junk bonds in just one week in early June, the biggest outflow in more than a year.

There are those in between such as Kevin Flanagan, the chief fixed income strategist for Morgan Stanley Smith Barney. According to Flanagan, high-yield bonds are likely to underperform investment grade bonds over the near-term, and earlier this month he reduced the percent invested in high yields to 5% from 10%.

We continue to see the prospects for a further correction in the high-yield space, and feel investors have less potential downside risk in investment grade credit, Flanagan wrote in a recent issue of Basis Points, the firm’s monthly report on fixed income investing. In our view, spreads in both high-yield and investment grade credit have room to widen further in the short-term.

And, on the bullish side of the street, analysts are saying that now’s the time to give commit some capital to junk bonds. Why so? Well, from his vantage point, Steven Huber, manager of the said there are at least two good reasons to give high-yield bonds a look-see. Spreads are low and fundamentals have improved.

Others agree. From my perch as an outsider, it seems that the arguments for investing now are the fact that corporate balance sheets are healthy, free cash flow and margins remain strong, and yields/spreads are attractive relative to Treasuries, said John Novak, a distress debt specialist.

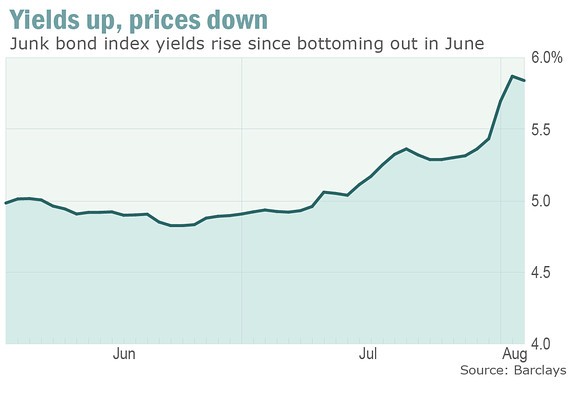

According Huber, spreads over Treasuries have widened by nearly 100 basis points, or one percentage point, over the past 2½ months. And that widening is providing additional compensation vs. lower yielding alternatives, such as Treasuries, he said.

At the moment, the JNK, -0.54% has a yield of 7.59%; by contrast the yield on the U.S. 10-year is 3%, which translates into a spread of 459 basis points. The other large ETF in this sector, the HYG, -0.50% has a yield of 7.55%.

To be sure, that spread is below the historical average of 550 basis points. But Aran Gordon, a fixed-income specialist, suggests the difference is partly due to demand. While high-yield spreads are just inside their long-term average, it is important to highlight that asset managers have shown great demand for new issues, particularly in the higher quality part of the high-yield bond market, BBs and Bs, Gordon said.

In fact, he noted that year-to-date new issuance has been rampant, with 347 bond deals worth $162 billion brought to market. Plus, there’s been about $320 billion in high-yield and bank-loan issuance in the first five months of 2011, which is about 70% of the total issuance for all of 2010.

For his part, Matt Freund, co-portfolio manager of the noted that the high-yield bonds are more attractive than Treasuries, if only because you are getting paid more. Yes, you are more exposed to the economy, he said. But you are less exposed to rising interest rates.

The other reason to be bullish on junk has to do with fundamentals, which according to Huber, have improved, with balance sheets are in much better shape as new issue markets have enabled companies to raise cash and refinance debt.

For his part, Flanagan is bullish on high-yield bonds over the longer term. Currently we would take a cautious approach to the market and look to add to positions on dips. We continue to recommend BBBs over single-A and double-AA non-financials. We also like the 7-10 year maturity range given the additional yield pick-up vs. shorter maturity corporates. We would focus on higher quality credits in high-yield, preferring double-BBs over single-Bs and triple-CCCs. We would also focus on shorter duration securities given the relatively flat curve in high-yield credit.

Separate and apart from the tactical issues, analysts suggest that investing up 10% of one’s portfolio in high-yield bonds would not be imprudent.

The high-yield bond market is a fascinating asset class and one that should be considered a strategic allocation within an investor’s investment strategy, said Gordon. Today, the high-yield bond market is about $1 trillion, having grown significantly over the past 15 years and is considered a strategic asset class for investors by investment advisers.

Gordon said one aspect of the high-yield bond market that investors should be aware of is the importance of the income component of the total return for high yield. Over the past 20 years, the long-term average annual rate of return for high-yield is about 9%, he said. And much if not all of that 9% return is directly attributable to income, not capital appreciation. This fact alone surprises many investors because they view the high-yield market as a risky asset class when it is important to dissect the market and understand that it is the CCC-rated (about 23%) part of the index that gives high yield the label ‘junk,’ he said.

In fact, Gordon said almost one in four CCC-rated companies default in any given calendar year. But year-to-date there have been only eight high-yield bond and loan issuers that have defaulted. Those bonds rated BBs and Bs in stark contrast are a fraction of that default rate and offer significantly higher returns on a return per unit of risk metric, or Sharpe Ratio, said Gordon.

To be sure, there is a scenario when investing in junk bonds might not so wise. If the U.S. growth slowdown proves not to be temporary and European periphery issues deteriorate further, the general selloff in risk assets could accelerate, said Huber.

When you look at the actual fundamentals, we don’t expect a double-dip recession, corporate balance sheets have improved, and actually instead of seeing the trend toward more downgrades than upgrades, it’s been the other way around, said Flanagan.

Robert Powell has been a journalist covering personal finance issues for more than 20 years, writing and editing for publications such as The Wall Street Journal, the Financial Times, and Mutual Fund Market News.