Why You Should (And Shouldn t) Ditch Your Financial Advisor For A Computer

Post on: 28 Апрель, 2015 No Comment

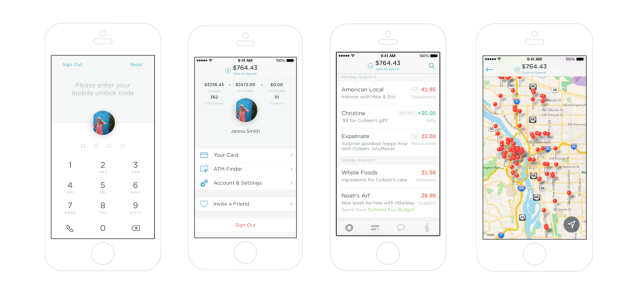

It’s no secret that technology has taken the place of humans in a number of different forms over the years. The EZPass has replaced toll booth collectors, military drones have replaced human soldiers, and technological innovations have been replacing farmers for years. Are financial advisors and active investors next?

Unlike us, software doesn’t get emotional. Software doesn’t see other people buying second homes in Florida on highly leveraged options trades or worry about losing its hard earned investment gains in a market crash. So it doesn’t try to time the market. Instead, software stays invested through market cycles, weathering the good and the bad without blinking.

Software program or human advisor: Which would you prefer to manage your money? Here are some arguments for each side:

To be fair, this article was written by TechCrunch. so it may be a little biased. Essentially, the author argues that passive investing, using Modern Portfolio Theory, is more efficient and effective than active investing using human advisors. He makes some interesting points:

- Software isn’t greedy or fearful.

- It avoids human cognitive tendencies like overweighting losses, anchoring, confirmation and hindsight bias, and herd behavior.

- “Software doesn’t have to worry about the tradeoff between investing and spending time with family and friends.”

- “Software doesn’t have conflicts of interest or look for ways to create and hide fees.”

Having said that, here are three shortcomings I see with this strategy:

First, software lacks instinct. Sure, sometimes a intuition can do more harm than good, but I can say from experience that some of my most profitable investment decisions have stemmed from a gut instinct that a company was in good hands or from a sense that the rest of the market was just a little overly optimistic. Software-based investment services lack this intuition that often serves human investors well.

Second, these software programs invest primarily in ETFs and index funds as opposed to individual stocks. To each his own, but personally I’d rather own individual companies that I know and like. I tried out one of these software-based investment services (Wealthfront.com), and with multiple inputs it always put most of my money in Vanguard funds. Vanguard is great, but it sure didn’t give me a ton of options. I couldn’t even change the investments myself—I had to change the risk preference for my entire portfolio first, then the website would assign me new investments.

Third, it may be true that software isn’t greedy or fearful, but it’s also true that your computer can’t sense these emotions in the rest of the market. That means it will be unable to capitalize on those investors who let greed and fear get the best of them, which to me is a major disadvantage. Instead, software sells when prices go up and buys when prices go down. Not exactly a groundbreaking strategy.

I’ll admit that my first instinct was to discredit this article as just another piece attacking hedge funds and investment advisors. But it actually makes some good points. I’m not completely sold, but it definitely got my attention. The author insists, “Software is better at investing than 99% of active investors.” Maybe the trick is just to find that other 1%.

So there’s a case to be made for both sides. What would it take for you to trust a computer to manage your investments?

- The only thing that interferes with my learning is my education. Albert Einstein