Why you need to start investing when you’re young

Post on: 16 Март, 2015 No Comment

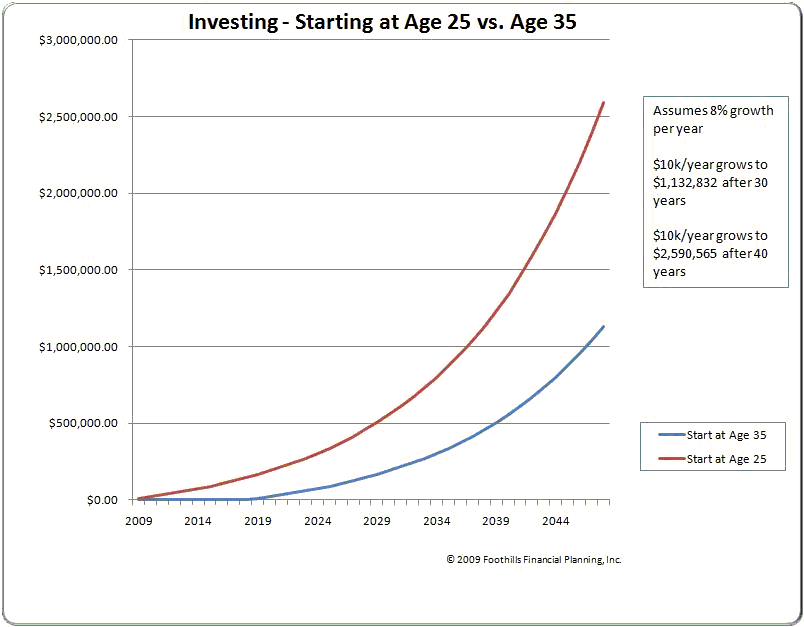

One of the key ingredients to building wealth is to start as early as possible. At this point, most blogs will tell you all about compound interest and how starting early will give your money more time to grow. That’s true, but lately, I’ve been thinking there is something else about starting young that gives you even more advantage than compound interest.

The power of compounding

Let’s go over compound interest quickly first. Compound interest is awesome. Everyone loves compound interest and it’s easy to see why. If you invest $1,000 and gain 10% interest per year, you’ll have $1,100 after one year. The investment earns $100 in interest over the one year period. The following year is even better because you’ll earn the $110 in interest. You earn the interest on your initial principle AND any interest you accrued so far. Every year you will earn more and more interest. See, what’s not to love?

You can easily see that the earlier you start investing, the longer you will be in the game. Time is the secret ingredient in compounding. The more time you have to invest, the wealthier you will be.

What’s more important than compound interest?

When finance bloggers talk about compound interest, they usually make some unrealistic assumptions. In What if you always maxed out your 401(k). I showed that an investor could have accumulated $727,518 if they maxed out their 401(k) contribution since 1988 (25 years.) That’s awesome, but the problem is most people can’t (or won’t) max out their contribution when they first start working. Early money is the biggest contributor to the nest egg and if you contribute lightly during the early years, your retirement funds will be quite a bit lighter than $747,518.

I’m just saying most people can’t save much when they are young, so compounding may not be the most important factor contributing to wealth. Lately, I’ve been thinking that the experience you get from investing is even more important compounding.

Experience is key

Most of us learn best from experience. Sure, we can read and learn from books and the vast amount of material on the internet. However, it’s not the same as going through various situations personally. I started investing when I got my first full time job at 22. Like any new investors, I flailed around for a few years and made many mistakes. Here are just some of them.

- Invested with my bank’s financial advisors. I didn’t know they were just glorified salesmen out to make commissions.

- Purchased a bunch of company stocks in my 401(k).

- Bought mutual funds based on last year’s return chasing performance.

- Didnt max out my 401k contribution in the first few years although I could have.

- Didnt know much about asset allocation or diversification.

These days, there is so much more information on the internet and young investors should have an easier time avoiding these pitfalls. However, the learning experience from my mistakes was invaluable and I knew more and more with every stock market cycle the stock market.

The stock market looks rosy now, but now I know there will be a bear market in the future. I’m preparing for that by diversifying into more bonds and other investments. It’s a learning process and we can all get better the longer we invest. I’m not saying that I’m a better investor than other young folks. I’m just saying that I’m a lot smarter now than I was in 1996.

Start investing as young as you can

I wish I knew more about the stock market when I was in high school or college. That way I could have had 5 or 6 additional years under my belt. I think everyone should learn to invest young and figure out how the stock market works.

Of course, as alluded to earlier, many young folks don’t have any money to invest. These days, new graduates have a ton of student loans to deal with, too. I still think it is very important to start investing even if you have debt. The easiest thing to do when starting out is to contribute to your 401(k) at least enough to get all the company matching. That’s 100% gain which you don’t want to leave on the table.

Contributing to the 401(k) is a great way to start, but investing in the retirement plan usually is limited to mutual funds. They are great when you are a beginner, but you need to learn about individual stocks too.

As a parent, I will encourage our kid to start investing as soon as he can understand the concept. I’m sure it will start out very small with $50 from his grandparents or something like that. He can put it into an index fund and later on I’ll teach him how the stock market works through virtual trades. I can’t wait until he’s old enough! Maybe when he is 14 or so?

When did you start investing in the stock market? Do you think you could have done better if you started earlier?

If you need help keeping track of your finances, try using Personal Capital to manage your budget and net worth. It can help you keep track of your income, expenses, and net worth, all in one place. Personal Capital is geared for investors and has many great tools. See my review of Personal Capital and how they helped me reduce what I’m paying in investment fees.