Why you can t hedge tail risk

Post on: 16 Март, 2015 No Comment

Why you cant hedge tail risk

By Felix Salmon

July 1, 2011

Azam Ahmed’s big article on tail-risk funds got a lot of play in the NYT yesterday, but I don’t know why.

data-share-img= data-share=twitter,facebook,linkedin,reddit,google data-share-count=true>

Azam Ahmeds big article on tail-risk funds got a lot of play in the NYT yesterday, but I dont know why he gives us no evidence to believe that theyre large, important, or even growing particularly fast. There arent many hard numbers in the piece, but the ones he does supply seem small to me:

Products linked to an index known as the market’s “fear gauge” total nearly $2.5 billion. And in the last year, the amount of money managed in dedicated tail-risk accounts by the bond giant Pimco has doubled to $23 billion.

Boaz Weinstein, a former trader at Deutsche Bank who lost more than $1 billion of the bank’s money during the financial crisis, began raising money for his own Armageddon fund late last year. It has since grown to $400 million of mostly institutional money, part of the $3.3 billion he has raised for his hedge funds.

The only remotely significant number here is Pimcos $23 billion in dedicated tail-risk accounts but Im a bit suspicious of that number, given that Ahmed claims it has doubled in the past year. If you go back to last years iteration of this article, from Bloomberg. it was pretty clear that the dedicated accounts hadnt even launched yet:

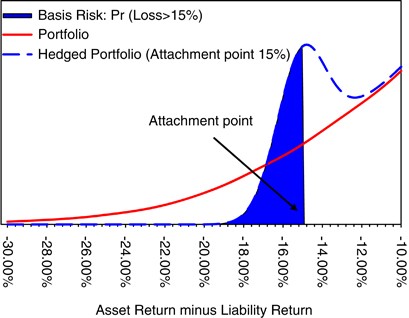

The Pimco Tail Risk Hedging Fund 1 will be the first in a potential series of partnerships, according to a private placement filed with the U.S. Securities and Exchange Commission on June 23. The initial fund will be designed to protect investors from a drop of more than 15 percent in a benchmark index that Bhansali declined to identify.

So it looks as though Ahmed is including, here, funds which are designed to go up in value in good times and which simply incorporate a certain amount of tail-risk hedging funds like the Pimco Global Multi-Asset Fund. Thats emphatically not a dedicated tail-risk account which offers costly insurance against extreme market events.

Ahmeds article, then, insofar as it purports to be reporting actual news, rests mainly on very vague statements about how investment professionals have a new pitch, or what clients are suddenly realizing, or that Wall Street lawyers say money manager clients have approached them in recent months about forming new funds aimed at providing protection.

And as an analysis of tail-risk funds, its weak. There are pro forma to-be-sure grafs about how protection does not come cheap and occasionally fails to work, but theres no indication that tail risk hedging is, conceptually speaking, pretty much impossible. Emanuel Derman gives one reason why: tail risk is not a simple and identifiable thing which can be insured against.

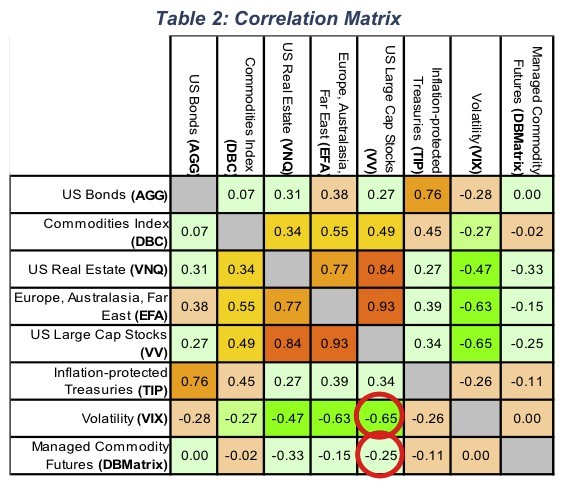

The value of a portfolio can be substantially destroyed by more than one cause. Portfolios can be ruined by equity crashes, credit spread widenings, bond defaults, high interest rates, sustained inflation, increases in volatility, illiquidity, etc. To protect your portfolio against so-called tail risk may require spending money on insurance against all these risks, and there is no panacea here.

David Merkel gives another: if youre buying insurance, you need to be sure of your insurers ability to pay out in the event of a catastrophe. But in the markets, your insurer is precisely the sort of institution which is likely to be going bust as a result of some unexpected tail event. Writes Merkel:

In order for tail risk to be mitigated fairly, someone must keep a supply of slack high quality assets. Rather than the insurer doing that, why not have the investor do so? The insurer brings along his own cost structure. Why not self insure and bring down the risk level directly. Someone has to hold high-quality assets to mitigate risk; let the investor be that party; embracing simplicity and enjoying reduced risk without the possibility of counterparty failure.

This is pretty much the same conclusion I came to last year: the best way to hedge against tail risk is to put 90% of your assets in Treasury bills or other super-safe assets. This is not an extreme strategy at all; indeed, it makes perfect sense for anybody whos both rich and conservative, including Suze Orman (I have a million dollars in the stock market, because if I lose a million dollars, I don’t personally care.)

The problem with tail-risk hedging is that everybody doing it wants to get healthy returns during good years and then have very little downside risk during bad years. Its an impossible combination to achieve, and although Wall Street will happily sell tail-risk hedging products to those who want them, theres absolutely zero evidence that they actually work in practice.

So if and when Universa comes out with a black swan ETF this month, my advice will be to stay well away. Indeed, insofar as it helps makes investors overconfident, on the grounds that theyre hedged, its likely to be positively dangerous just as portfolio insurance was in 1987. Tail risk, it turns out, is just too amorphous to hedge. Sorry.