Why Trading Monty Pelerin s World Monty Pelerin s World

Post on: 16 Июнь, 2015 No Comment

Markets are now dominated by government interventions more so than economic events. These interventions are continuing, growing larger and occurring more frequently. That likely will be the case until the economy and financial markets collapse.

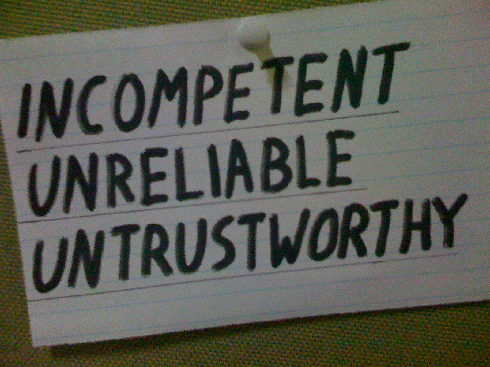

Decades of these interventions have corrupted the functioning of markets. Uncertainties, distortions, mis-pricing, capital mis-allocations and discontinuities are evident. Economic forecasting and traditional investing rules make no sense when markets are routinely disrupted by economic and regulatory interventions.

We await an economic Armageddon. No one knows when it will take place. Investing under these conditions is foolish. If markets and governments were honest, you should stand aside and wait for the correction to occur. However, in a government-manipulated economy anything can happen in advance of the day of reckoning. Being on the sidelines might be more expensive than continuing to participate. Liquidity has the potential to drive stock markets higher even when an economy is broken. Liquidity also has the ability to create very high prices on all goods. Stocks could provide some protection should inflation take off. Holding cash in an inflationary environment is a sure loser.

Stepping aside may not be safe. Overstaying you welcome in markets is also a mistake. You may be damned if you do and damned if you dont. No one knows the future. Stocks can rise for a long time, even when economic fundamentals do not support their value. At some point there will be a painful correction, perhaps like 2001 or perhaps like 2008. Those were slow-motion collapses which allowed people to get out (most did not). The collapse could be sudden, like 1987 where about 20% was lost in a single day. Or it could be worse! Or, it might not happen at all!

One cannot be an investor in the face of such ruinous possibilities. But nor should one leave the market prematurely. You must become more like a trader, nimble and quick and unafraid to buy and sell when conditions dictate. You must have a mechanism which provides you proper signals regarding where to put your funds and when to take them away.

A momentum-based trading strategy is appropriate for such conditions. It moves you towards sectors that are outperforming and away from the under-performers. More importantly, it can get you out of markets quickly when conditions warrant.

Premium membership to this site provides you the selections that a momentum-based strategy chooses. The strategy trades only ETFs and uses proprietary methods to make its selections. Backtesting has shown this strategy to outperform a buy and hold strategy and the results of this testing can be seen in some of the Momentum articles on this site. There is now almost a quarter of a year of live results based on the selections. These can also be viewed on the site.

Backtesting is different from live trading. Emotional reactions, timing, good or bad fills on trades, commissions, etc. are not encountered in backtesting. Furthermore, past performance is often not repeatable. Hence:

NO REPRESENTATIONS ARE MADE WITH RESPECT TO FUTURE PROFITABILITY. ALL INVESTMENTS ARE RISKY AND SUBJECT TO LOSSES.

NOTHING ON THIS WEBSITE SHOULD BE CONSTRUED AS AN INVESTMENT RECOMMENDATION. THE WEBSITE IS FOR EDUCATIONAL PURPOSES. IT DEMONSTRATES HOW A PARTICULAR ALGORITHM SELECTS ETFs BASED ON CERTAIN MOMENTUM AND VOLATILITY SCREENS AND FOLLOWS THE RESULTS OF SUCH CHOICES.

QUALIFIED AND LICENSED FINANCIAL ADVICE SHOULD BE OBTAINED WHENEVER MAKING FINANCIAL DECISIONS.