Why to Invest in Mutual Funds

Post on: 16 Март, 2015 No Comment

Diversification

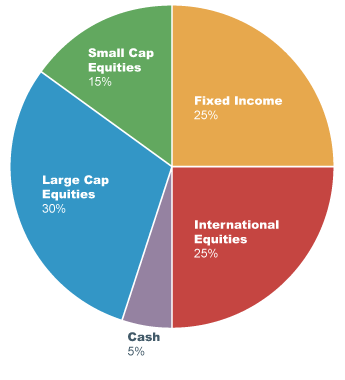

Buying individual stocks is potentially lucrative, but it can be risky as well. When you buy an individual stock you always run the risk that the company will go out of business, or that the stock will fall sharply. When you invest in a stock mutual fund, you become part owner of many different stocks. Some mutual funds hold dozens or even hundreds of different stocks, and this can spread out your risk and reduce the volatility of your overall portfolio.

Long-Term Growth

Investing in mutual funds is an excellent way to build wealth for the long term, especially if you take a dollar cost averaging approach. When you dollar cost average into a mutual fund. you invest a set amount of money each month, regardless of the current level of the stock market. Over time, you automatically accumulate more shares of that mutual fund when the market is down and fewer when it is up. This buy low and sell high approach is key to long-term success for mutual fund investors.

Current Income

References

More Like This

Why Do People Invest in Mutual Funds?

Which Is the Best Mutual Fund to Invest in for a Beginner?

Mutual Funds That Pay Monthly Dividends

You May Also Like

Mutual funds are an investment vehicle that allows a large group of investors to pool their money and allow a team of.

An increasing number of American investors have begun to put their hopes into mutual funds as investment vehicles for retirement and other.

Mutual funds are an excellent way to earn money for the future. They're a pooling of the money of many investors, which.

Contact several low-cost no-load mutual funds and ask for prospectuses for their index funds. Index funds are an excellent way to invest.

How Much Money Should You Invest in a Mutual Fund. When sitting down with your financial adviser to choose a mutual.

Growth mutual funds invest in companies that are expected to experience high growth in the near future (rather than incremental growth over.

While bond funds can play a role in a well-balanced investment portfolio, these funds have their risks as well. Good Time.

When it comes to investing, conservative can describe any number of investments, or investors. That's because people relate the word to something.

Think of fixed income mutual funds as falling into three different categories. Fixed-income funds are mutual funds that invest in money.

How Much Money Should You Invest in a Mutual Fund? An increasing number of American investors have begun to put their hopes.

What are Diversified Mutual Funds. How to Find The Best Mutual Funds. Many investment pros want to sell you the way.