Why These Fundamental ETFs Should Make Up Your Core Portfolio PowerShares FTSE RAFI US 1000

Post on: 15 Июнь, 2015 No Comment

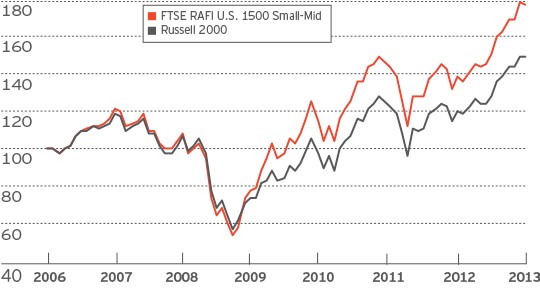

(Click to enlarge)

Powershares FTSE RAFI US 1000 Portfolio Fund (NYSEARCA:PRF ) vs iShares Russell 1000 Index (NYSEARCA:IWB )

There’s no shame in holding index funds. Heck, the majority of managed funds doesn’t even beat the market index so it’s not surprising that even Warren Buffett has made a wager on index funds over the aggregate talent of hedge fund managers. However, if there ever were a fund that could beat the market in the long-term, then the iShares US Fundamental Index Fund (TSE- CLU) or the U.S. equivalent Powershares FTSE RAFI US 1000 Portfolio Fund and the iShares International Fundamental Index Fund (TSE- CIE) would certainly come close. I call these, the Chuck Norris of ETFs. And here’s why.

The investment classic, Stocks for the Long Run written by Wharton professor Jeremy Siegel addresses the superior returns of stocks over any asset class with compelling empirical data. I’d highly recommend the book by the way. His intuitive, yet often overlooked advice also includes other findings so that the investor should expect higher returns than a vanilla index fund. These ETFs exhibit the following recommendations from the book:

- Low Fees: Canada is notorious for a high management expense ratio (MER) although CLU and CIE could fare better (0.73% MER). However, I am willing to overlook this as the average MER in Canada is at least 1%. Contrary to popular belief, you don’t have to spend a lot of money to make money.

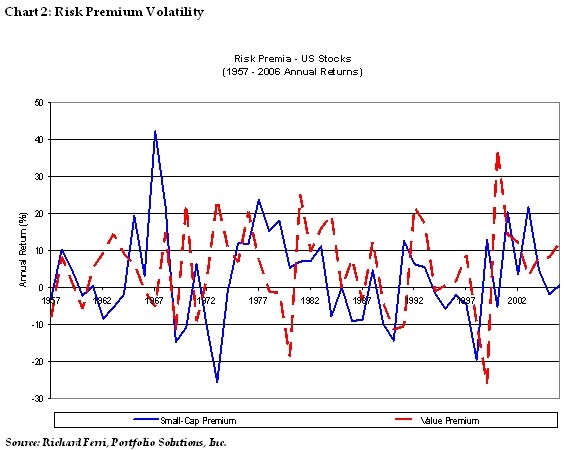

- (Passive) Fundamentally Weighted Index: Weighted indexes are theoretically flawed. As a company gets more overvalued, the index must buy more shares to satisfy its proportion in the index, thus buying at higher valuation multiples. For a regular index fund with a dollar cost averaging strategy (investing automatically every week/month), the inherent flaw is that you’d be consistently investing at higher prices since one expects the market to rise in the long run. With a fundamentally weighted index, this isn’t much of an issue as stocks are automatically rebalanced when the market gets dicey.

- I nternationally Diversified: The global economy will inevitably outpace the U.S. and one should embrace diversification. Even the S&P 500 does not adequately represent the U.S. economy as there are about 15,000 publicly traded companies with only about 5000 traded on the exchanges. With the CLU and CIE, you can also adjust how internationally exposed you’d want to be.

These ETFs track the FTSE RAFI Indexes, which is composed of the largest 1000 listed companies ranked by 4 fundamental measures of size: sales, cash flows, book value and dividends, adjusted by the average of the prior five years. At face value, this seems like a solid strategy, but some crucial issues that could be addressed includes, but not limited to, the following:

- Sales? What about profits?! A company with growing sales but no profit may potentially be overlooked. Think tech companies.

- How About Free Cash Flow Instead? Operating Cash Flow is nice, but what’s ideal is FREE Cash Flow, which is simply Operating Income plus Depreciation MINUS capital expenditures (to sustain normal business operations and growth). Capital intensive industries such as manufacturing may potentially be overweight because of this.

- Book Value =/= Intrinsic Value: Warren Buffett has mentioned in his annual letters that P/B (and P/E) is in no way an indication of value (less applicable to banks, REITS, liquidating firms etc.), as book value is based on historical costs. Accounting shenanigans and an overflowing amount of goodwill/intangibles on the balance sheet can also distort book value from real value.

- Not All Dividends Are Created Equal: A constant stream of dividends may inhibit growth and possibly raise the cost of capital when internal funds are low. The capacity to pay dividends (see free cash flow) is a better indication of value. Take for example, Allied Capital, who’s unsustainable stream of dividends was supported through a constant issuance of new equity stock, exposed by David Einhorn. There’s a name for that.

- Is It So Different From An Index Fund? I wouldn’t suggest that they are radically different. Comparing PRF and the Russell 1000 index. the P/E (TTM ) is 13 and 14, and the dividend yield 1.92% and 1.95%, respectively, as of 1/30/2013.

- Other Criteria To Consider: One thing that could make the FTSE RAFI even better is to include a measurement of profitability. I would like to see, for example, companies with a higher return on invested capital ( ROIC ) to be given a higher weight although not every industry would be applicable to this ratio.

But enough with the bad news. Some of these flaws are perhaps insignificant through diversification and the combination of these criteria altogether. Another reason that I like these two ETFs is because Scotia’s iTrade platform offer commission free ETFs. Qtrade also has commission free ETFs except CIE, plus many others as well. When my costs are low, my enthusiasm knows no boundaries. This is an incredible opportunity for small investors and I hope the entire industry follows suit.

The performance in the past few years has been intriguing to say the least, and there isn’t any guarantee that this strategy will exceed my expectations going forward. In fact, the FTSE RAFI index is relatively new to make any long-term comparison. However, PRF has been able to beat its comparable, the Russell 1000 since 2006 (see graph). In addition, professor Siegel had this to say:

The historical evidence to support fundamentally weighted indexation is impressive. From 1964 through 2005, the compound annual return on a dividend-weighted index based on virtually all U.S. stocks was 11.88 percent per year, 123 basis points above a like capitalization-weighted portfolio based on the same stocks while the volatility and beta of the dividend-weighted portfolio was less than the capitalization-weighted portfolio. -Stocks For The Long-Run pg 357

Recommendation (BUY): If you’re adamant as I am on the principles of value investing but extensive fundamental research isn’t within your capacity, then the CIE and CLU (or PRF) ETFs can be great building blocks for your portfolio. The bottom line is this, these ETFs have low costs (including no commission fees depending on your broker), adequate diversification and a passive and proven investment strategy. Almost everything that matters with investing.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Conduct in-depth research on PRF and 1,600+ other ETFs with SA’s ETF Hub