Why The Fed Interest Rate Affects The Stock Market

Post on: 28 Май, 2015 No Comment

In laymans terms, which is what the title was put in, the reason why the interest rate, dictated by the Fed, affects the stock market is because it affects the interest rate on loans that businesses can get to grow their businesses. When the interest rate goes up, loan rates go out and businesses have to pay more on their loans and thus have less to put back into the business. The interest rate also affects consumers because the rates on their loans are going to go up and thus their ability to spend money is going to go down. If consumers are spending less, businesses are making less; yet another hit to the future growth potential. Since the stock market is supposed to track the business, rate hikes affect growth projections and thus the price of the stock. The price of a stock is based on those projections, so increased costs (rate hike) means potentially decreased future growth, and so the price goes down. Rate hike means stocks weaken, rate drop means stocks strengthen. Thats the laymans version and thats basically like explaining the waves at the top of the ocean without looking at the multitude of forces at play below the surface.

The Fed

In actuality, when people say the Fed, short for Federal Reserve, they actually mean the Federal Open Market Committee. The committee consists of the Board of Governors of the Federal Reserve System, the President of the Federal Reserve Bank of New York, and four of the eleven remaining Federal Reserve Banks on a rotating basis. The FOMC meets eight times a year and Ben Bernanke is the Chairman of the Board of Governors. The Board of Governors is in charge of setting the discount rate (what people commonly call the interest rate) and the reserve requirement .

The discount rate is what the Federal Reserve will charge banks to borrow money from them. The reserve requirement is how much, percentage-wise, a bank must hold in its reserves to cover deposit requirements. This idea kind of blew my mind when I first heard about it like ten years ago. So when you deposit $100 at the bank, if the reserve requirement is 10%, then the bank must keep $10 on hand but it can lend out the $90. Lets say they lend that $90 to another bank. The second bank must keep $9 in reserves but it can lend out the $81. This can happen, in theory, forever and so the original $100 actually ends up becoming really really close to $1000 in total value across however many instruments when its all said and done.

The Discount Rate

So, how does the discount rate affect the interest rate? Well, as mentioned earlier, the discount rate is the rate at which commercial banks can borrow money from the Federal Reserve. If the rate increases, then the cost to banks increases and that cost is passed onto its borrowers. Then the borrowers, who are themselves consumers of the products and services of businesses, will be spending less in stores and thus reducing the revenue stream of the businesses they frequent. Businesses are hit with a double whammy if they need loans, those are more expensive; plus their customers are spending less. Businesses that are earning less, hire less people, those people who are thus not hired will find themselves spending less and so you can see how the cycle can feed itself. The public barometer that the Fed uses to see how well this cycle is operating is inflation. The hard part about dealing with inflation is that interest rate changes are the cause but the effects arent seen for years, so its a difficult game to be playing.

Update: In addition to the discount rate, the Fed also sets the federal funds rate but it generally moves lockstep with the discount rate. For a discussion on the difference, please refer to this article on the differences between the discount rate and the Federal funds rate .

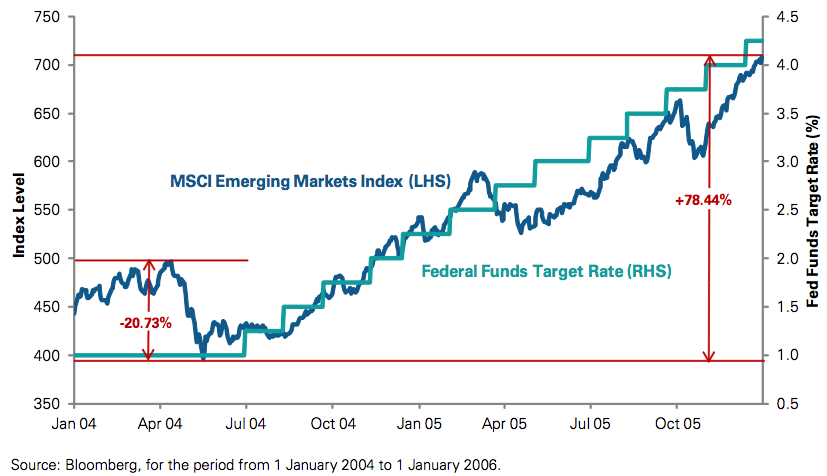

As you can see, the basics are pretty easy to understand: rates go up, market goes down; rates go down, market goes up (in general). However, there are so many factors at play in there that to boil it down to that one liner doesnt do it any justice.