Why the Alibaba IPO Could Help – But Shouldn’t Hurt – the High Growth IPO Market

Post on: 9 Апрель, 2015 No Comment

Why the Alibaba IPO Could Help – But Shouldn’t Hurt – the High Growth IPO Market

September 2014

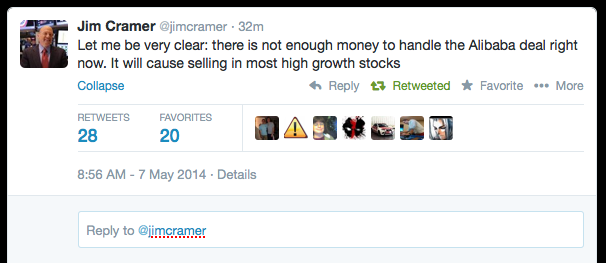

The upcoming Alibaba IPO – and its potential impact on the high growth IPO market for the rest of the year – is high on the radar for private company CEOs who are considering going public in the next 3-4 months. Many of these CEOs are looking to the Facebook IPO in 2012 and the “perceived” impact it had on the high growth IPO market then and wondering what is the best course of action for his/her company.

What I said as a banker in 2012 about Facebook, and will repeat now, is that Alibaba is a very unique situation and should be thought of in that way. At the time Facebook was going public, there had never before been a company with such size and scale characteristics in the IPO market. Specifically, Facebook was:

- Going public at a valuation of around $100 billion;

- Going to be the 2nd largest US IPO ever, even though they were selling only a small portion of the market capitalization; and

- Only eight years old when it went public

The only thing that was close to comparable to Facebook’s IPO was the Google IPO in 2004, which raised less than $2 billion and came public at about a quarter of the valuation of Facebook. While the Google IPO did create a fair amount of “buzz” at the time of the IPO, it was nowhere near the wall-to-wall coverage we saw with Facebook (including CNBC covering much of the IPO process – from cameramen chasing bankers going in/out of the “rumored” bakeoff, to reporting live from many of the venues along the two-week IPO road show.)

Comparing Facebook or Alibaba to the typical high growth company (with a market cap of $1-2 billion) doing a $100-150 million offering isn’t and shouldn’t be relevant in terms of market receptivity and/or investor sentiment.

Institutional investors still need to generate returns and beat their benchmark, and the high growth IPO market has generally been a consistent place to generate portfolio “alpha” (outperformance). Institutional investors will continue to look to put money to work in good companies that they expect to perform well, unless the trend of the recent IPOs they had participated in has not done well and/or comparable stocks have not performed. The decision to buy an IPO of a company valued at $100 billion+ – as with Facebook and now with Alibaba – is a much different proposition for institutional investors than buying the IPO of a typical high growth company valued at around a billion dollars.

And so, whether Alibaba’s IPO does well or not – though you would prefer it does well – it should not impact the attractiveness of the typical high growth company looking to go public in the next several months. Private company CEOs considering going to market in the near term should focus these four key themes before making their decision:

- The Company/Comparable Company Performance: The most relevant factor to consider is how the company is performing, and how the company’s comparable companies are also performing (both in terms of stock price and financial performance.)

- The Relevant Sector Performance: Another big factor is sentiment in the IPO market in the segment most relevant to the company, and how comparable deals performed, etc.)

- The Overall Market: While the market has been a bit choppy in recent weeks largely due to concerns internationally – i.e. Ukraine tensions, Europe potentially slowing, etc. – the market has generally shrugged it off and has now reached new highs on the S&P. Also, the post-Labor Day period in recent years has generally been quite positive for the overall market (and specifically, for the IPO market.)

- The Investors: Many institutional investors through the first half of 2014 still trailed their benchmarks, so will feel inclined to be aggressive to catch up/exceed their benchmarks. They will continue to look to put money to work in companies they expect to outperform (often in the high growth IPO market).

David Erickson joined Bessemer in 2014 as an operating partner and is responsible for providing guidance and consulting on public capital raising to portfolio companies and BVP. Having retired from Wall Street after 25 years in 2013, David most recently was co-head of global equity capital markets at Barclays where he was responsible for all of their corporate equity capital raising globally. Since retiring from Wall Street, David has been a guest lecturer on capital markets and entrepreneurial finance at the business schools of Stanford and Kellogg and is currently a Senior Fellow and Lecturer at the Wharton School of the University of Pennsylvania.