Why Some Companies Do Not Pay Dividends

Post on: 26 Май, 2015 No Comment

Why Some Companies Do Not Pay Dividends

Dividends are distributions of a portion of a company’s earnings made to investors. The amount of dividend payable is determined by the board of directors of the company. These payments are usually made on a quarterly basis in the form of cash or additional shares of stock. If they are paid as cash, the investor has the option to take the money or reinvest it in the company by purchasing more stock. It should not be assumed that all publicly traded companies pay dividends because they do not.

A young company experiencing rapid growth usually does not pay dividends because the entire amount of profit is needed to grow the business. The act of paying dividends is frequently considered to represent confidence in the business and is used to reward shareholders. Dividends provide investors with a steady flow of income even when a company is not growing and they also have various tax benefits.

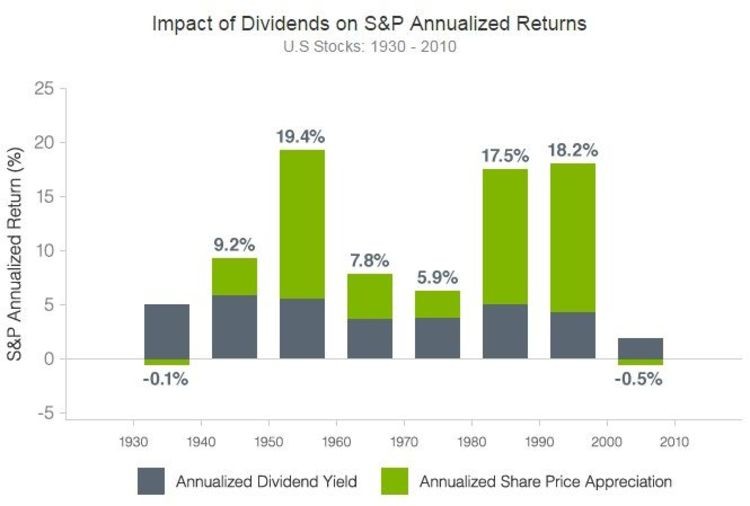

Investors in companies that do not pay dividends earn money only through the sale of shares that have an appreciated value. Shareholders in companies that pay dividends can earn a return on their investment without selling any shares. However, investors have the ability to create their own “dividends” by making adjustments to their portfolios. Some elect to invest in interest-bearing bonds rather than shares of companies that pay dividends.

Many large companies such as Cisco, Dell, Google, and Microsoft do not pay dividends. These companies often engage in stock buybacks in order to increase demand for the stock and drive up prices. This practice also makes earnings per share figures more attractive because there are then fewer shares amongst which to divide the earnings.

These companies are sometimes forced into a buyback due to the number of employee stock options they distribute. Each time an employee exercises an option, it increases the total number of outstanding shares. Other companies that do not pay dividends have the methodology that the taxation on the dividend is higher than that on a capital gain. If the company reinvests its profit, it will increase its value, which will raise the market value of its stock, an attractive situation for its current investors.

I’ll Personally Email You

Dividend investing is the only way I invest, and here’s why: dividend stocks create a secure, passive income, and are less risky than non-dividend investing.