Why Should I Invest In Bonds

Post on: 16 Март, 2015 No Comment

Why invest in bonds? We hear so much about stocks in the news but bonds dont get mentioned with the same level importance and urgency (the Dow stock index gets all the glory on the 6 oclock news). Yet bonds are an integral piece of most portfolios as well as being an important debt instrument, used to create capital for businesses and municipalities.

While the stock market is a leading economic indicator, the bond market reveals what actually happens in the current economy. Bond prices rise and fall as interest rates change over time under different economic conditions. The bond market is also a size of many times as the stock market. Issuing bonds are much easier than launching IPOs for a company (and government agencies cant exactly launch an IPO). Financing through various bond markets provide the necessary liquidity beyond any capital injection like by stock issuing. In a modern economy, even the baking system must co-exist with the bond market. For serious investors, the bond market holds certain real opportunities.

Here are some key reason to invest in bonds:

Principal Preservation

Despite the ongoing price change in any bond market, if a bond is held to maturity, investment principal is paid back by the issuer. In a low rate environment, bond prices can keep rising and bond investors will also have the chance to participate in capital appreciation. Low interest rates often persist when an economy is emerging from recovery and before it gets overheated. In the event of a bond default and issuer bankruptcy, bond investors have preferential claims over equity investors. Sometimes when a company’s common stock continues to perform poorly, in a capital restructure, bonds may be converted to preferred shares, which gives bond holders continued income payments as dividends. Although the bond maturity is put on hold, note that certain preferred shares are not perpetual.

Predictable Income

While common dividends can be suspended and scraped, preferred dividends can be put in arrear, bond interest must be paid every six months in the form of coupon payments. No dividends are excluded from personal income tax, but certain bonds are tax exempt with no tax paid on interest at either the state level or the federal level. For investors with safety in mind, bond investing is a decent choice. It offers a much higher yield than savings from banks but without raising risk considerably. Bond investing is especially suitable for retirees and savers, such as of college funds.

Portfolio Balancing

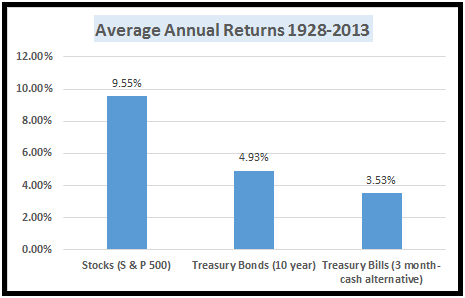

Without bonds as part of a portfolio, investment losses from time to time could be in a much higher percentage if invested in stocks alone. Although stocks can return well over the long run, in short or immediate term, they may well be outperformed by bonds, especially at certain times in the economic cycle. Another layer of bond safety is through credit ratings. While ratings on more exotic securities have failed, corporate bond rating has been fairly reliable. No other investments provide such a systematic risk evaluation, be it real estate, stocks, or commodities. Bond investors have an advantage when using bond rating as an investing guide to construct a balanced portfolio that stresses both safety and return.

Another important aspect of portfolio balancing is that bond prices tend to move opposite of stock prices in general. Investing in bonds can help ease a period of dropping stock prices.

So you see, stocks get all the glory when it comes to investing but bonds are an important tool for many businesses as well as an important piece of a balanced investing portfolio.

What do you think of bond investing? Why do you invest in bonds?

Free Newsletter to Keep you Free From Broke!Name: Email: We respect your email privacyPowered by AWeber email marketing