Why PEG Ratio Analysis Is A Silly Tool

Post on: 4 Июнь, 2015 No Comment

Listening to a popular stock commentator tonight, I was reminded of something I have been meaning to address. Over the last month or so, Jim Cramer has been highlighting PEG Ratio as a tool to choose between stocks. This evening, for instance, he was looking at Best Buy (NYSE:BBY ), RadioShack (NYSE:RSH ) and HHGregg (NYSE:HGG ), suggesting that despite low PE ratios that they are expensive due to low growth. I am a big fan of Mr. Cramer’s, but I cringe when I hear him go down this path.

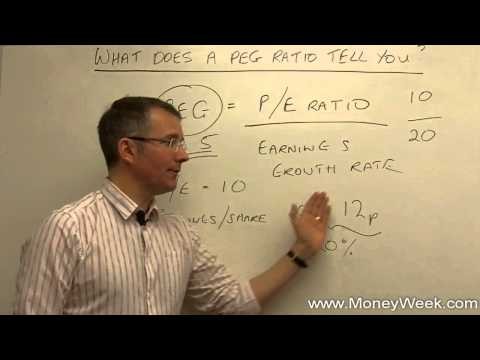

The PEG Ratio is a way of comparing stocks by looking at the PE ratio in the numerator and the growth rate in the denominator (PE divided by growth — PEG for short). The thought is that the lower the number, the cheaper the stock. I used to use PEG Ratio analysis but quickly realized how flawed the whole exercise can be. It’s difficult to define, and it’s not linear. The bottom line is that it is not a real helpful tool.

Defining the PEG Ratio presents any number of challenges. First, which PE? Should we look at trailing or forward? That’s actually the least burden. The more difficult task is to arrive at a growth rate. I have seen many use just the one-year growth rate, but this is silly. It makes more sense to use a long-term growth rate. Again, do we look backward or forward? Some analysts do provide 3-5 year prospective growth rates, but a lot less thought goes into these numbers than quarterly or annual earnings forecasts or price targets.

Assuming one can properly define the PE ratio and the Growth rate, there are still definitional problems. What do we do when a company is at a peak or trough in earnings? You might get the exact wrong answer! The best time to buy cyclicals is NOT when the PE (and PEG Ratio) is low — it’s when the earnings have collapsed and the PE (and PEG Ratio) is high.

Looking at a growth company, PEG ratio can leave you making a bad decision coming out of a slow economy, when earnings may be depressed temporarily and investors are willing to pay a high multiple because they are looking out further than a year. McDonald’s (NYSE:MCD ) saw its PE rise (and its PEG ratio) sharply in mid-2003. The year was phenomenal for the company, with the stock price rallying from a depressed 16 at the end of 2002 to almost 26. The PEG ratio spiked above 2.0, which might have triggered a sale by those who use that type of analysis. As you can see in the attached chart (from Zack’s Investment Research), PEG hasn’t been particularly helpful in giving sell signals — sometimes they work, sometimes they don’t. If you had sold high PEG MCD in late 2007 to buy a low PEG homebuilder, boy would you have been disappointed.

(Click chart to expand)

What happens when a company has a projected loss? Is a negative PEG Ratio bad? Does it have any meaning? What about a real high flier that is just barely profitable. Let’s look at SuccessFactors (NYSE:SFSF ), for instance. It was just acquired by SAP. Two years ago, it’s forward PE was about 350, with a price of 15. According to Baseline, the PEG Ratio was about 20, which is considered off-the-charts by those who use this tool. Even if one were using a 100% long-term EPS growth rate assumption, the PEG Ratio would have been 3.5, still egregiously rich.

What about a company that just isn’t growing? The growth rate for Cramer-favorite Bristol-Myers Squibb (NYSE:BMY ) is zero (according to the ThomsonReuters consensus, which includes 7 analysts). That’s an ugly PEG ratio no matter what PE!

So, these short-comings all illustrate the challenges of PEG Ratio analysis in terms of defining the exact PE ratio, the growth rate and how to account for losses or low earnings.

The second point I mentioned is that the analysis is linear, which is flawed. Let’s just do a mathematical example.

- Company A has a 10 PE and a 5% Growth Rate: PEG = 2.0

- Company B has a 30 PE and a 15% Growth Rate: PEG = 2.0

PEG Analysis would suggest that these two stocks are equivalent (and perhaps expensive). If we assume that the future plays out as expected, Company A will grow its earnings by 27.6%. Company B will grow its earnings by 101%. If we assume that Company A maintains its PE, the stock will appreciate by 27.6%. If we assume that Company B will see its PE decline to 20 as it gets larger, the price will increase by 34%. The point is that the way growth compounds, it’s not clear that PEG Ratios work across vastly different growth rates.

Let me come at this point another way. Those who adhere to this type of analysis love to find stocks where the PE is equal to or less than the long-term growth rate, producing a ratio of 1.0 or less. Under that scenario, a stock is cheap if it trades at 10PE if the growth rate is 10%. What about a stock that grows only 5%? Should it trade at 5PE? If so, sell your Utilities! The typical Utility trades at 15PE with a growth rate of 5%.

I think that a company that can grow 20% or more for the next 5 years could very well be worth more than 20 PE due to the compounding effect. The simple assumption that the PE is somehow linearly related to earnings is absurd, which gets me back to observation that inspired this post.

Cramer thinks that RSH is expensive because it has a high PEG ratio. I am not sure of the exact numbers he used, but if you really believe that RSH can grow earnings at even 3% for the next five years (the consensus), it may be very cheap at 6 PE despite this being a 2.0 PEG Ratio. Think about it. Why do investor pay 15PE for the Utilities? In the case of RSH, which I am mentioning only for purposes of illustration, it pays a fat dividend. If the earnings are going to grow at 3% for the next few years (and I know that’s a big if), it seems likely that the RSH price won’t go down much. In the meantime, the owner will collect 5.8% yield.

A really good way to think about this is that the earnings yield (inverse of PE) on RSH (at 6 PE) is over 16% (1 divided by 6). That 5.8% yield seems very safe — it’s about a 35% payout. In our little example, it is safe, because they are assumed to grow earnings at 3% for the next 5 years. Further, the company’s current cash balance is equal to debt, and Capex is consistent with D&A. (Note to self — look closer at this cheap stock!).

The point I am trying to make is that there is a floor on PE (related to the level of interest rates) that makes PEG Ratio analysis useless. As a matter of fact, those who do use the analysis should consider that the level of interest rates matters across the spectrum. In a period of low interest rates, investors should accept a lower earnings yield (higher PE), which implies a higher PEG ratio. If interest rates are 10%, 10% earnings growth isn’t so special. In the current environment of 5% corporate bonds, 10% looks awesome. A 1 PEG ratio in 1982, when rates soared, may not have been a good deal, while a 1.0 PEG ratio today may be a fantastic deal. If you really think a company can grow 10% over the next five years, it is probably cheap at 16 or 17 PE (PEG 1.6-1.7)

While it makes sense to incorporate the idea that a higher expected long-term earnings growth rate should dictate a higher PE ratio, PEG analysis is a short-cut that is simple but not very helpful due to limitations. There are just too many other factors that impact PE ratios, like the consistency of earnings, where the company is in its earnings cycle, and the level of interest rates. If you are going to use it, it works best on similar companies, with similar capital structures and roughly similar growth rates.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.