Why LowBeta Strategies are Worth Another Look

Post on: 16 Март, 2015 No Comment

Just last month Geoff Considine wrote an article about why investors may want to explore low beta strategies in a highly volatile market.

Here at the Portfolioist, we thought wed re-post the article in reponse to this weeks wild ride on Wall Street.

The recent volatility in the stock market has many investors trying to figure out how to maintain some exposure to equities, while limiting their exposure to the big ups and downs of the major equity indexes.

One alternative is to manage a portfolio’s beta, a measure of how a portfolio tends to respond to movements in a broad index (most commonly the S&P 500 Index).

Stocks with values of beta less than 100% (1.0) tend to react less to changes in the broader market. (For example, utility stocks typically have betas less than 1.0, because their earnings are largely independent of broader market volatility.) Low beta stocks tend to have lower volatility than the market as a whole; however, the terms “low-beta” and “low-volatility” are not entirely synonymous.

In recent months, we have seen the launch of new ETFs that invest in low-beta/low volatility stocks. I am intrigued by these new funds because there is high-profile research dating back to 2003 that discusses how low-beta investing can deliver attractive returns. So it’s surprising to me that there have not been more funds focusing on a low-beta strategy.

Three brand new funds that target low beta (and low volatility) are:

www.invescopowershares.com/ ).

www.invescopowershares.com/ ).

www.invescopowershares.com/ ).

Are ETFs just a conservative play for the risk-averse investor? Or is there another reason that low beta stocks might make sense?

The Case for Low Beta Investing

Why would investors be interested in investing specifically in low volatility/low beta stocks?

If we believe that markets are efficient, and that the return from a stock portfolio is determined by the amount of risk (or volatility) in the portfolio, then it would not make a sense for investors to invest in a portfolio of low volatility/low beta stocks. However, there is considerable evidence that low beta stocks tend to outperform.

In an article published in 2010, I explored a range of research into the risk-return relationship that suggested the traditional views of how returns are related to various sources of risk, are not correct. Research performed by professors at Princeton, Yale, the University of Chicago and Dartmouth suggest that portfolios selected on the basis of low beta will not only be less sensitive to market swings, but have historically delivered higher returns than what traditional financial theory predicts.

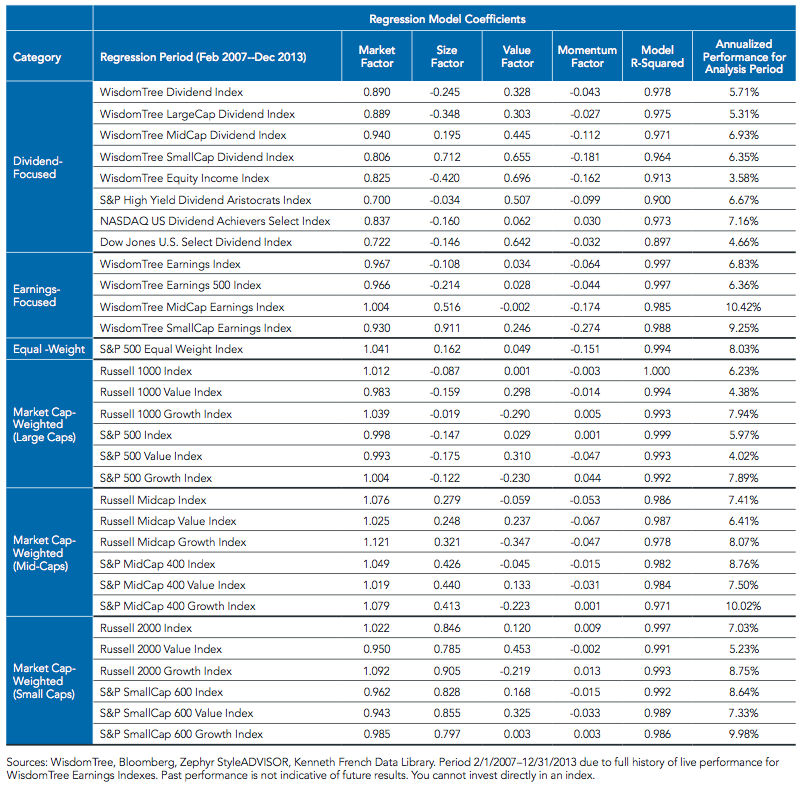

Research by Eugene Fama (Chicago) and Ken French (Dartmouth) popularized the idea that value stocks and small cap stocks generate out-sized returns (the so-called size and value factors). What is less well-known is that their research also found that stocks with low beta tend to out-perform :

funds that concentrate on low beta stocks, small stocks, or value stocks will tend to produce positive abnormal returns even when the fund managers have no special talent for picking winners.

A more recent academic study written in late 2010, also finds that low beta stocks tend to outperform. This study examines a wide range of non-U.S. equity markets, corporate bonds, and futures.

Folio Investing’s Low Beta Strategy

ETFs that target low beta stocks as the core of their portfolio strategy are very new. In fact, the three funds that I discussed above are less than three months old.

However, back in February 2008, Folio Investing started tracking a low beta strategy that I designed. The research that motivated this portfolio suggested that a low beta approach would not only help protect portfolios against market downturns, but could also potentially outperform the broader market.

In fact, Folio Investing’s low beta strategy outperformed the S&P 500 Index over the past three years. Here are the latest performance figures: