Why LongTerm Investors Should Buy Indices Not Stocks

Post on: 27 Июнь, 2015 No Comment

Stay Connected

There is an ongoing discussion regarding whether it is better to trade, or buy and hold stocks. It is debatable as to whether buying and holding stocks ever worked, even in good markets. Why? We live in a continuously changing world: What was reality yesterday quickly fades and the present is upon us and we move on. What does this have to do with investing and making money? Actually, plenty. We invest in companies, and they are constantly changing in order to keep up with the demands of the marketplace. When they falter, theyre quickly left behind. Its pretty common today to say that the world is changing, faster than ever. But most likely the rate of change seemed as quick to people in the cave-dwelling days as it does to us today.

In my book Winning With ETF Strategies (Minyanville/FT Press, 2012), I pointed out that I live in San Francisco, and hanging on the wall at my gym are photographs of downtown San Fran in the early 1900s. The first photo was taken in 1905; it shows people walking on crowded sidewalks, passenger-filled cable cars rolling on tracks down the middle of the street, and horse-drawn buggies. The next photo was taken several years later and shows the same downtown area, with wagons drawn by bridled horses, but also a few box-shaped automobiles with their tops down. The cars looked strange; people likely looked at them as a novelty as they got around by walking, riding in buggies, and guiding their horses by tugging on the reins. The next photo showed buggies and many more cars on the street. The one after that showed a lot of cars and a few buggies, and the next picture showed a street filled with cars; the horse-drawn buggies were gone.

The surprising thing was the length of time between the first photograph and the last. Was it 25 or 35 years? Nope — only about 15 years. It only took 15 years for the entire mode of transportation to change. People’s perceptions rapidly changed too, and they forgot how to place a bridle on a horse. Change, of course, has only continued. It was only about 20 years ago that few people used computers, and now almost everyone does. It is now hard to believe that nobody used cell phones about 25 years ago. People stood in line to use public coin phones, and put in a dime to make a call.

What does this have to do with investing and why its better to buy indices than individual stocks for long-term investments?

Consider this: If you had been investing back in 1900, you might have bought stocks in buggy whip companies, with horse-drawn buggies being the primary mode of transportation. You might not have seen that the buggy-whip company would become worthless unless the company diversified and changed.

If you buy and hold stocks and don’t pay attention to those stocks, you are at risk as times change. It is doubtful that there was ever a time that you could simply buy stock in a company and hold it forever. But if you hold indices, the index portfolio managers makes changes as conditions warrant.

Why You Should Buy Indices for Long-Term Investing

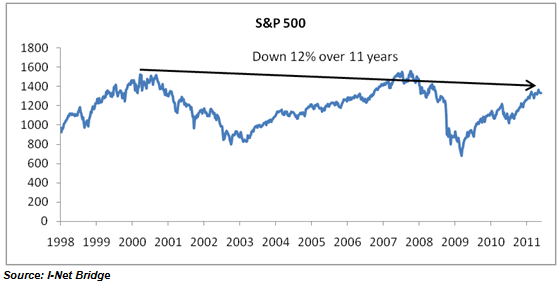

Rather than holding stocks for the long term, you can hold indices in the form of ETFs, and the portfolio managers will make changes as economic conditions and industries change. For a broad-based, long-term investment, for instance, you could buy an S&P 500 Index (INDEXSP:.INX) ETF, such as SPY (NYSEARCA:SPY ) or IVV (NYSEARCA:IVV ). SPY or IVV offers industry diversification, since the index is divided into 10 sectors. The more important a sector is to the US economy, the greater weight the sector will have in the index, and as its importance changes, weightings will be adjusted.

This money management is done at a low cost. The S&P 500 Index portfolio managers meet monthly to keep up with corporate events, and make changes in the index as necessary. And this happens frequently: Between 1964 and 2000 there were about 20 company changes per year in the index.

Investing for a Risk-On Market

The PowerShares High Beta ETF (NYSEARCA:SPHB ) is structured to capture movement of the highest beta stocks. The index consists of the 100 stocks from the S&P 500 Index that had the highest movement, or beta, over the last 12 months. Beta measures the rate of change of a security’s price, and is therefore a measure of relative risk. The three biggest sectors in the index are energy, technology, and financials. One way to capture high beta, which is desirable in an up market, is to buy SPHB or pick other stocks or ETFs in these sectors.

The financial sector has been outperforming, especially on a year or less basis. For representation in financials, RevenueShares offers an ETF that contains the same stocks as the S&P financial sector, the RWW (NYSEARCA:RWW ). The difference between RWW and the S&P financial sector index is the weighting used. RWW puts names into its index according to their top line revenues. The higher the revenues, the greater the weight each name gets. S&P weights its index according to capitalization. RWW has outperformed the cap-weighted index over the last year.

In the energy sector PowerShares has an interesting ETF, the PXE (NYSEARCA:PXE ), that has about 65% of its weighting in small-cap and mid-cap. The smaller cap-size companies have a distinctively different flavor than the large-cap companies that comprise the S&P 500 financial sector. The smaller cap companies operate more domestically, and have operations such as service and drilling — not just producing and exploring — for oil and gas, which is what the bigger companies do. Actually, companies that comprise the S&P 500 energy sector could be domiciled anywhere, since they are mostly huge companies operating all over the world. With the boom in natural gas in the US, the smaller cap companies, which operate more in the United States, have revenue and earnings leverage, perhaps more than the giant companies.