Why Japan Surprised the World with its Quantitative Easing Announcement Nicholas Vardy Townhall

Post on: 16 Март, 2015 No Comment

Just when you thought the financial world would take a much-needed break from quantitative easing (QE), the Land of the Rising Sun comes in and juices up the markets with more QE.

The irony here is telling.

In the same week that the U.S. Federal Reserve shut down what was effectively “QE4,” with its announcement on Wednesday that its bond-buying program had ended, the Bank of Japan (BoJ) announced that it was turning up its printing presses.

The BoJ’s move took most market watchers including myself by surprise.

Specifically, Japanese policymakers announced that the BoJ’s annual target for expanding the monetary base would rise to 80 trillion yen ($724 billion), up from 60-70 trillion yen.

What does the BoJ’s move mean in practice?

It means that Japan’s central bank has committed to purchasing the equivalent of more than double the value of new bonds actually issued by the government. That’s a far greater amount than for any of the other bond-buying programs that have become fashionable among the world’s central banks, including the massive QE programs of the Federal Reserve.

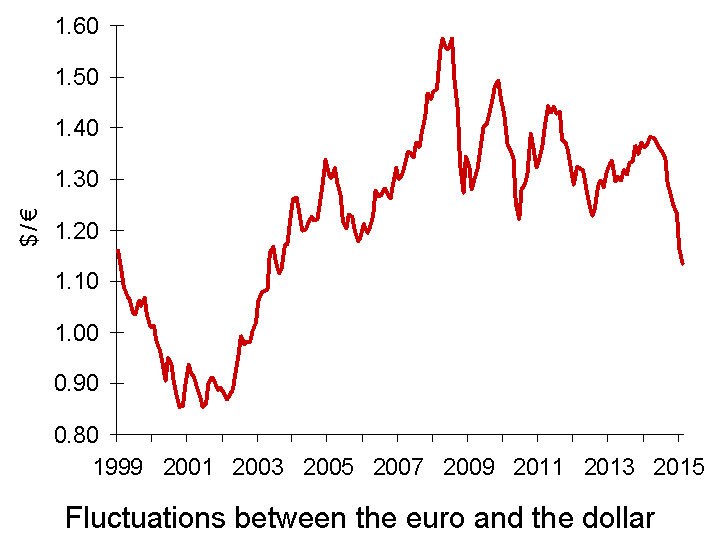

Reaction to the BoJ’s move pushed the yen to a six-year low and sparked a rally in the Japanese stock market. It also helped fuel the big gains we saw on Friday in both the U.S. and global stock markets.

While the BoJ’s new monetary base expansion target dominated the headlines on Friday, we also learned that Japan’s Government Pension Investment Fund, the world’s largest pension fund, holding about $1.1 trillion in assets, also increased its allocation to stocks. Japanese and overseas stocks will now have a 25% weighting each, up from 12%.

This move, too, puts upward pressure on the Japanese stock market, especially over the long term.

A Furious Short-Covering Rally

The unexpected policy shift by the BoJ set off a furious short-covering rally in the Japanese stock market.

Prior to Friday, a whole lot of investors were betting against Japanese equities. In fact, as recently as Oct. 16, bearish bets made up 36.6% of all transactions on the Tokyo Stock Exchange. That was the highest level since the exchange started keeping records. Such a high degree of pessimism has been, without exception, bullish for the market. Historically, Japanese equities have rallied 9.7% on average over the following three months after a jump in bearish bets.

Sure enough, on Friday, the Nikkei 225 Average leapt 4.8% to a seven-year high, as the yen tumbled to its lowest level against the dollar since January 2008.

So, is this short-covering rally in the Nikkei a mere anomaly, or should the BoJ’s move be read as a long-term bullish force to reckon with?