Why is Rob Bennett opposed to the buyandhold strategy for investing in equities

Post on: 8 Май, 2015 No Comment

Related Topics

Finally a question re which I can feel confident that I possess the expertise needed to rise to the task of venturing forward with a response!

The backstory here is that I was a Buy-and-Holder myself until the evening of August 27, 2002. The Buy-and-Holders did something very important that had never been done before — they developed a long-term investing strategy suitable for use by ordinary people (non-experts) that was rooted in the peer-reviewed academic research in this field. The idea of doing that was a hugely liberating idea for all of us. We all owe the Buy-and-Holders a huge debt of gratitude.

I came into the story on the morning of May 13, 2002. I had been posting on saving strategies at the Motley Fool site for several years and had become the most popular poster at the site as a result of those posts. I posted at a board at which a fellow who had published a retirement study also posted. I noticed that his study did not include an adjustment for the valuation level that applied on the day the retirement begins. There was at that time 20 years of peer-reviewed research showing that such an adjustment is needed. I put up a post pointing out that there appeared to be some problems with the study.

The discussion that followed has over the years become the most controversial debate on a personal finance topic ever held on the internet. There have been MILLIONS of posts advanced on both sides. If Nobel Prize Winner Robert Shiller is right that valuations affect long-term returns, just about everything we hear about how stock investing works on the internet and in books and in speeches and in calculators is wrong. Shiller's breakthrough findings turn the world of investing analysis on its head. On the other hand, if Nobel Prize Winner Eugene Fama is right, then Buy-and-Hold is the ideal strategy and there is no problem. But which is it?

We saw scores and scores of amazing threads back at the old Motley Fool board. It was the greatest learning experience that any of us at that board had ever enjoyed. At some point, the Buy-and-Hold camp decided that they couldn't bear being challenged any more. On the night of August 27, 2002, the author of the study that I questioned threatened to kill my wife and children if I continued to cross him by posting about the Shiller research. 200 community members (people who had been friends of mine) endorsed his post. I found this very, very, very, sad. I concluded on that night that Buy-and-Hold is the most emotional investing strategy ever concocted by the human mind (unintentionally so, but still. ).

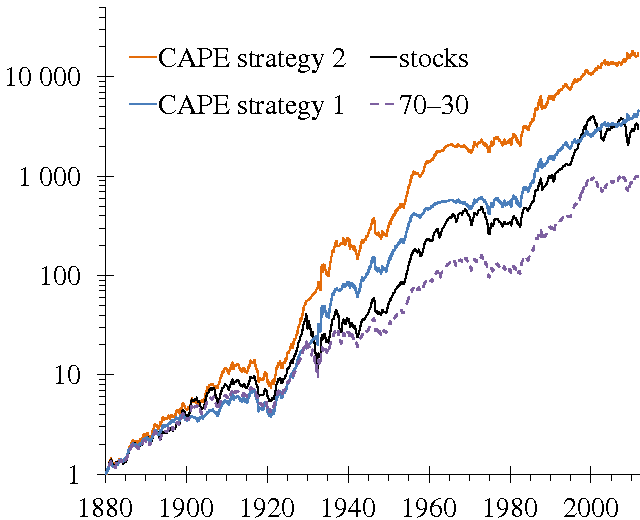

I believe that Shiller is right. I believe that investors need to take valuations into consideration in every strategic choice they make. I don't believe that it is possible to invest effectively in the long term if you don't do this. I am now the co-author of peer-reviewed research showing this to be so in a most compelling way. Wade Pfau (Wade has a Ph.D. in Economics from Princeton) and I spent 16 months together developing research showing that investors who are willing to take valuations into consideration when setting their stock allocations are thereby able to reduce the risk of stock investing by nearly 70 percent while also dramatically increasing returns. That's the fountain of youth for stock investors! That's investor heaven!

A good percentage of the Buy-and-Holders who see that research end up converting to Valuation-Informed Indexing as a result. The abusive Buy-and-Holders were so upset by how people reacted to it that they threatened to send defamatory e-mails to Wade's employer in an effort to get him fired from his job. Wade agreed to stop promoting the research in an effort to appease these people.

All bull markets are the result of investor emotion. People naturally want to see their portfolio values rise and so most applaud during times of rapidly rising prices. But the entire 140 years of stock market history shows that we always pay back any gains experienced beyond those justified by the economic realities (the economic realities support a gain of 6.5 percent real per year). So all that we are doing in bull markets is borrowing from our future selves.

When we borrow too much from our future selves, we bring on an economic crisis by putting such a payback burden on our future selves. There has never been a single exception in the 140-year history of the U.S. market. In 2000, stocks were overpriced by $12 trillion. As that money disappeared from our portfolios (it usually takes about 10 years for this process to complete itself), we became less and less able to spend on goods and services and thousands of businesses failed and millions of workers lost their jobs. Bull-market fantasies hurt lots of people in very, very serious ways.

Lots of people know this, at least in part. Shiller was awarded the Nobel Prize in Economics for his work. But most people who have tried to tell the story have found that the Buy-and-Holders become very, very upset to hear what the last 33 years of peer-reviewed research says. So most tell the story in tentative ways that don't persuade too many people. We need to make those who believe in Shiller's version of the story to feel every bit as comfortable expressing their sincere views as we make those who believe in Fama's version of the story.

It is fair to characterize me as the most severe critic of Buy-and-Hold alive on Planet Earth today. But the totally fair way to tell the story is to say that the reason why I am so opposed to the version of Buy-and-Hold promoted today is that it conflicts so sharply with the original aim of the Buy-and-Hold Project. The initial idea was to root one's strategies in the peer-reviewed research. When the research findings changed, the strategy should have been updated to reflect the new findings. John Bogle still recommends the same strategies he recommended in 1980, the year before Shiller published his revolutionary (Shiller's word) research.

I oppose Buy-and-Hold as it is promoted today because Buy-and-Hold as it is promoted today is anti-research. Valuation-Informed Indexing incorporates every aspect of the Buy-ad-Hold strategy but one, the one that has now been discredited by 33 years of peer-reviewed research. I promote Valuation-Informed Indexing, the NEW Buy-and-Hold, Buy-and-Hold 2.0.

It's not possible to believe in both the old Buy-and-Hold and the new Buy-and-Hold because they are opposites. Whether you take valuations into consideration when setting your stock allocation or not makes a HUGE difference. Sticking with the strategies that have now been discredited by 33 years of peer-reviewed research will cause you to delay your retirement by many years while taking on far more risk than is necessary, according to the peer-reviewed research of the past 33 years.

I of course believe that we all should feel gratitude to our Buy-and-Hold friends for the many wonderful insights they have developed and shared with us. But I very strongly believe that we need to move forward. I believe that deep in their hearts that's what our Buy-and-Hold friends want us to do. I believe that it was a belief that the peer-reviewed research can help us that got them started on their journey. So I believe that moving forward by correcting the perfectly understandable errors that were made in earlier days helps us all.