Why Is Cornerstone Progressive Return Fund So Attractive Cornerstone Progressive Return Fund

Post on: 16 Март, 2015 No Comment

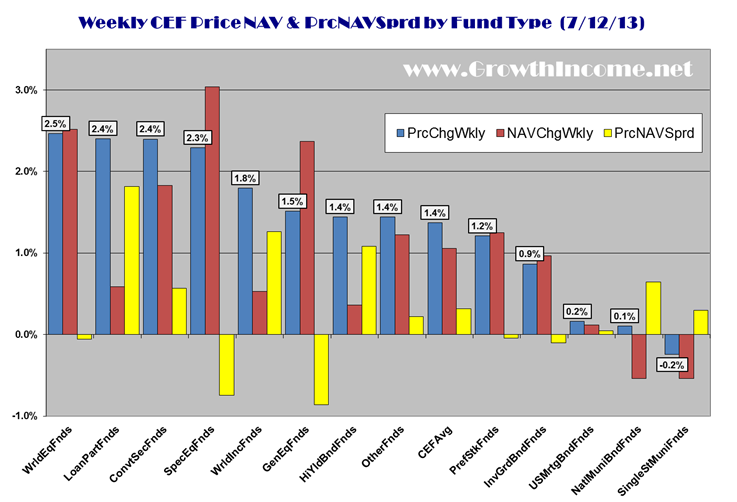

Cornerstone Progressive Return Fund (NYSEMKT:CFP ) has an annual monthly distributions yield of 17.0% and a share price to net asset value (NAV) premium of 36.0%. By contrast, the CEF Industry has an average yield of 6.8% and a discount of 5.9%.

What’s going on here?

Distributions Metrics: During the first seven monthly distribution periods of reduced distributions in 2013, the winning strategy has been to pick up CFP on the ex-date and ride it to the day before the following ex-date. The total return of this strategy during this period would have been 27.6% on a cumulative basis.

Metrics: Take the distribution period of Jan 2013 for example. If you would have purchased CFP on 1/11 (ex-date) for $5.51 per share and sold it on 2/12 (day before Feb ex-date for $5.85, your return would have been 6.2% (without commissions). It is a similar story for each of the seven month distribution periods of 2013. However, the May, June and July quarters were a bit weak. This may be due to the postponement of a Rights Offering in late-June, but we will return to that shortly.

(Click to enlarge)

Why is the Yield so High! CFP’s CEF holdings, which make up close to 89% of its portfolio, produce an actual distribution yield of no more than 6% annualized [income and return-of-capital (ROC)]. CEF’s price to NAV discount is 7.7%.

As a result, in order to accommodate its distribution yield to its shareholders, CFP has to redeem capital from its portfolio. If CFP pays out a 17.0% yield to its shareholders but only receives 6.0% from its holdings, there is an 11.0% gap that needs to be made up. When times are good, it’s able to do that from its portfolio appreciation. But in order to do that, times have to be really really really good.

Right Offerings: So how else can they provide this yield to their shareholders? This is through regular Rights offerings. However, these Rights offerings may likely provide the wearing away of capital and induce the shareholders to play with their own money. This is because the share price is greater than its net asset value (NAV). Traders can bank-on this secret!

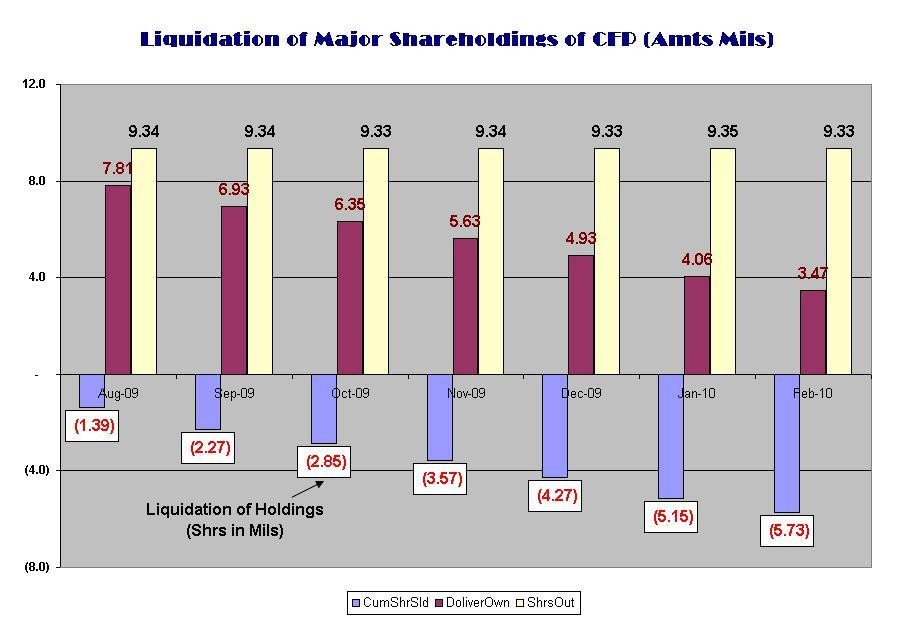

Funds Analysis: What I’m about to do is take you through the net Change of Assets so you can be aware of the juggling that is going on.

(Click to enlarge)

What I’ve highlighted is the value of the stock price refund (F) that would need to be taken out of CFP’s NAV to cover the distributions to shareholders. This is separate and apart from the Return of Capital (ROC) that CFP receives in distributions from its holdings.

Distribution of Capital: In looking at CFP’s SEC Form N-CSR filing, we find that for 2012 the total from Investment Income, Net Gain from Investments and Capital Gain from Regulated Investment Companies was $8,011,893 (see A in the chart above). The Net Change in Unrealized Appreciation (C) was $7,677,296 and the return of capital from CFP’s holdings (Return-of-Capital for Distributions of Shares) was $2,206,000 (B), which makes up $9,883,296 (D). (The return-of-capital of CFP’s holdings was generated by taking its average NAV for 2012, multiplying it by the 6.0% yield generated by its holdings and subtracting the $3,723,374 classified as Dividend and Investment on its N-CSR Form.)

Cutting into Capital: However, the distribution (from Investment income, net capital gains, return of capital and unrealized capital appreciations) only amounts to $17,895,189, which still leaves $4,349,019 (F) of additional funds to cover its $22,244,208 in total distribution payouts to shareholders.

This is the true real-return of capital that is reducing CFP’s NAV net of gains. The average outstanding shares for 2012 were 21.7 million resulting in a $0.20 per share devaluation. This is 3.5% decline in the base capital (F).

Bring back the Rights Offering: However, the Rights Offering brings assurance that the 17% yield will cover both appreciation and the true return of capital — subject to further appreciation of the share price.

Traders: Rights Offerings allow traders to inflated share price values over NAV. This is likely where your extra-divided will be coming from.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Since you’ve shown interest in CFP, you may also be interested in