Why Investing In Real Assets Is A Sound Portfolio Strategy Using REITs To Gain Exposure

Post on: 3 Май, 2015 No Comment

Summary

- Investing in Real Assets can help further optimize your investment portfolio.

- Diversifying direct real estate investments can be difficult.

- Using REITs for investing in real estate provides diversification, liquidity, and broad real estate exposure.

If you’re an investor, then you’ve probably already been confronted with one of the well-known financial dilemmas: making short-term investment moves while pursing long-term goals. And it doesn’t help that most of what you hear in the media is geared towards short-term, or rather, potential short-term profits. This is evident by the use of the word ‘trade’ to describe an investment idea. A long-term investment, media pundits, is not a trade, its an investment!

In any case, there is one asset class that is difficult to ‘trade’ on a short-term basis and actually provides the potential for attractive risk-adjusted returns over the long-term. That asset class is real estate, and while this type of investment would be a shift away from traditional investment strategies, it gives access to a number of attractive benefits such as the potential for higher rates of income and long-term price appreciation, with lower volatility.

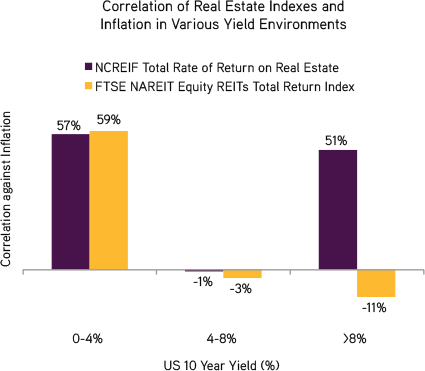

Real assets reduce portfolio volatility

According to a research study that was published by J.P. Morgan Asset Management, adding real assets to your investment portfolio may not only increase your overall rate of return, but also reduce volatility by a meaningful amount. The extent of the impact of such an addition depends on the level of exposure to real assets and the occasional increase in volatility that affects all assets simultaneously, as occurred in 2008. Perhaps the most attractive benefit of real assets is that they offer both fixed-income return rates and long-term stability.

Illiquidity Premium

But as with any investment that may offer outsized returns, investments 101 dictates that higher expected returns come with higher risks. In the case of real assets, and more specifically, real estate, one of the higher risks investors must be willing to accept is lower liquidity. Traditionally, investors have always preferred to stay away from illiquid assets since these can’t easily be turned into cash. In 2008, for example, if you had an investment in real estate that you wanted to sell, you would have either found no buyers at prices you were willing to sell, or you would have been forced to sell at a steeply discounted price. Despite this illiquidity, real assets tend to have more stable price stability and provide added diversification to a traditional investment portfolio.

Investing in Real Estate

The challenge of investing in real estate is that not all investors have the resources or capabilities to invest directly in real estate. Not only does it require a substantial amount of cash, it also requires the ability to obtain attractive financing terms and the capability to manage a property or incurring additional property management expenses. Furthermore, it is not easy to invest in a diversified portfolio of real estate that is uncorrelated not only to other asset classes, but that has individual real estate holdings that are uncorrelated to each other as well.

The individual investor that has been successful investing in real estate typically has most or all investments within a specific region or even a specific city. In the event that the region faces a challenging economic environment that affects housing, the investor’s real estate portfolio, regardless of how many individual properties, will be negatively impacted.

REITs to the Rescue

For investors interested in investing in real assets that are hindered by an inability to diversify properly or prefer to invest passively in the asset class, Real Estate Investment Trusts (REITs) may be a very viable option.

REITs are securities traded like stocks that are issued by companies that own and operate real estate in a variety of different real estate sub-categories, such as residential, office, storage, hotels, etc. By investing in REITs, investors can obtain some exposure to real estate and a relatively low cost and with daily liquidity. To be clear, investing in REITs does not offer all the benefits of investing directly in real estate, but is certainly a reasonable substitute for investors looking for exposure to real estate.

For one thing, because REITs are traded on an exchange and can be purchased and sold at any time that the exchanges are open, they will tend to exhibit higher volatility than a direct investment in real estate. Prices of REITs will change according to the minute to minute supply and demand dynamics of investors perception of each specific REIT. This is markedly different from a direct investment in real estate which does not fluctuate in price on a daily basis and therefore may exhibit more stable price stability. Note, however, that the underlying assets of a REIT have the same price stability of a direct investment in real estate and that only the price of the exchanged traded REIT fluctuates considerably. If as an investor, you can live with that temporary price fluctuation knowing that the underlying assets are stable, REIT investing may be a good alternative for you.

There are well over 100 exchanged traded REITs that one can invest in with each REIT having its own fundamental differences. Choosing the right REIT to invest in is not unlike evaluating the stock of an individual company. For a novice investor, however, this could be a daunting task.

There is a broad market solution however, in the form of exchange traded funds that invest solely in REITs. One such ETF is the Vanguard REIT ETF (NYSEARCA:VNQ ). which holds a diversified portfolio of REITs across all sub-REIT categories, including mall owners, healthcare facilities, hotel and resorts, retail, office, and other specialized categories of real estate. For the novice investor, investing in VNQ may be the best option to gain exposure to REITs.

However, not all REITs perform similarly. Some real estate asset classes have unique fundamental characteristics that drive performance to be different than the overall REIT asset class.

For example, hotel REITs have the ability to adjust rates daily to reflect supply and demand dynamics and/or economic changes, such as inflation. In a rising rate environment, therefore, hotel REITs may be more attractive than office REITs, whose tenants sign long-term leases and are therefore much more difficult to adjust to a rapidly changing environment. Some of the larger hotel REITs include Host Hotels & Resorts (NYSE:HST ), Hospitality Properties Trust (NYSE:HPT ), and RLJ Lodging Trust (NYSE:RLJ ) .

There may also be secular trends that will benefit some REITs over others, such as the growing population of retiring baby boomers that my eventually end up in senior housing. These types of trends may benefit healthcare REITs more than the average REIT. Some notable senior housing REITs include Health Care REIT Inc. (NYSE:HCN ), Ventas (NYSE:VTR ), HCP (NYSE:HCP ), and Senior Housing Properties Trust (NYSE:SNH ) .

Summary

As we begin a new year and evaluate our progress to date and new plans going forward, it is important to take a close look at your investment portfolio to determine if it truly has an adequate level of diversification. Diversifying across a greater number of equity and fixed income asset classes certainly helps, but an allocation to real assets can provide even further diversification and enhance the return on your portfolio.

If you already have direct investments in real estate, you are ahead of the curve in that regard, but it may still be worthwhile to evaluate how investing in REITs may further optimize your portfolio in light of the greater liquidity of REITs and its exposure to a wide variety of real estate assets.

For more information on REITs, check out:

For more information on investing in REITs, check out some of the other articles written by PM101.