Why Invest In International Equity Mutual Funds

Post on: 16 Март, 2015 No Comment

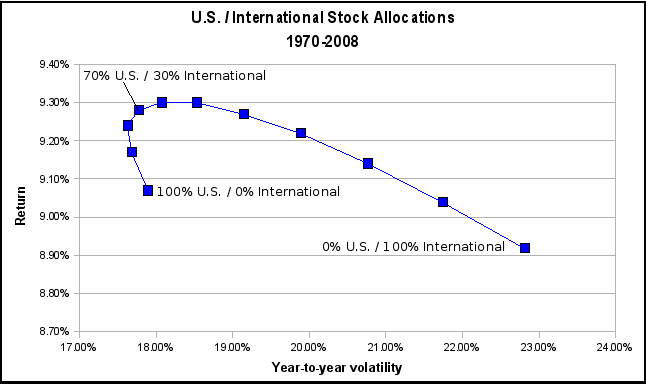

With many of the most attractive investment opportunities existing outside the United States, U.S. investors cannot afford to limit themselves to investing only in domestic stocks. The United States no longer dominates world stock markets; in fact, its share of global stock market capitalization steadily declined from 2002 to 2007. Furthermore, studies have consistently shown that investing in a mix of U.S. and foreign stocks has produced better returns — with less risk — than investing in the U.S. equity market alone.

Globalization. which encompasses increased sharing of global resources, commerce across national borders and integration of international financial systems, was a key contributor to global growth in 2007. In fact, global equity markets enjoyed a five-year boom from 2002 through 2007. Despite short-term volatility. international equity markets have favorable prospects for sustained growth on a fundamental basis.

Surge in Demand for Power Supply and Infrastructure Spending

As the economies of developing countries experience growth, their need for increased power generation becomes critical to their further expansion. The shortages of power plants and the grids to distribute power are apparent as they build out their infrastructure.

Electric-power equipment manufacturers, which serve both public utilities and private industry, are examples of businesses benefiting from this economic growth. (Read more in Build Your Portfolio With Infrastructure Investments .)

The needs are different for developed economies, such as Europe and the United States, where much of the infrastructure is already in place, but either due to aging electric grids or lack of proper maintenance, it needs refurbishing to become more efficient. These developed markets are in a replacement cycle, as their power plants are aging. Companies that support this refurbishing may include:

- builders of electric-power networks that update power grids

- global manufacturers of power-generation equipment

- businesses that provide cables and cabling systems for power transmission and distribution (Learn how you can invest in the energy sector in ETFs Provide Easy Access To Energy Commodities .)

On the infrastructure side, globalization has led to increased demand for the services of companies providing the following services:

- oil and gas exploration companies (Read more in Unearth Profits In Oil Exploration And Production .)

- suppliers of water (Read more in Water: The Ultimate Commodity .)

- electricity and natural gas

- waste-management companies (Read more in Less Trash For More Cash .)

- companies that help construct roads, railways, ports and airports

An example of the infrastructure boom is Beijing, China, where three new subway lines were built at a cost of $3.2 billion, in time for the city to host the 2008 Summer Olympic Games. ( Investing In China provides more information about investing in this emerging market.)

Growth in Demand for Cell Phones

The growth in global demand for cellular telephones has been strong, particularly in developing countries and regions, such as India, China, Central America and Africa. Basic landline telephone service in these regions is often inadequate, and economic development and rising personal income levels are creating increasing demand for communication services. Both increasing penetration rates (number of mobile-phone subscribers) and escalating usage have fueled this growth. (Read more in Great Expectations: Forecasting Sales Growth .)

The potential for growth in the subscriber rate is enormous for a nation like India, which had been adding about 6 million wireless-service subscribers every month and had a mobile penetration rate of approximately 22%, versus a rate of more than 100% for some developed nations as of October 2007. In countries like Russia, although the subscriber rate is high, usage of data from the internet and demand for add-ons, such as ring tones has been rising. Companies that benefit from growth in demand for cell phones, include wireless operators and global telecom companies.

Increased Demand for Alternative Energy Sources

As the world becomes more concerned about the environmental impact of carbon emissions, demand is urgent to uncover cleaner, more efficient alternative energy sources. (Read more in The Biofuels Debate Heats Up .)

The power-utilities industry has been undergoing a huge shift in its readiness to address the issues of energy efficiency and cleaner fuels. Utility companies worldwide expect wind and nuclear power to account for an increasing share of their market’s energy consumption in the years ahead.

- In a utilities global survey conducted by PricewaterhouseCoopers in 2006, only 17% of utilities viewed wind, and 19% nuclear power, as increasing fuel sources.

- By the time of the 2007 survey, 48% and 45% of respondents, respectively, mentioned wind and nuclear as growing power sources. (Read more in Top 10 Green Industries .)

Companies that stand to profit from the increased focus on cleaner power and energy efficiency include manufacturers of wind turbines, solar energy panels, diesel particulate filters, which reduce exhaust emissions from diesel auto engines and businesses that make components for nuclear-power facilities. Nuclear energy is regarded as a clean, safe and reliable energy source that does not emit carbon dioxide or other atmospheric pollutants. (To learn more about alternative energy sources and how they can apply to your investment portfolio, check out our Green Investing Feature .)

Rising Affluence

In both emerging and developed markets, rising global living standards trigger increased consumer spending. As the world benefits from global growth, living standards and affluence levels rise. Not only do consumers spend more, but their need to manage their money also increases. Department stores, supermarkets and other retailers benefit from the increased spending power of consumers. (Read more about the relationship between standard of living and GDP in Genuine Progress Indicator: An Alternative Measure Of Progress .)

Increasing affluence levels also result in growing demand for wealth-management services, such as banks and asset-management firms. Credit card companies also benefit from the development of a larger middle class. Rising affluent classes increase the demand for luxury goods, and producers of luxury items, from designer clothing and jewelry to luxury automobiles, are expanding into these new markets. (Get the full story on these new markets in our related article Re-Evaluating Emerging Market s .)

Investing in International Equities

The simplest way to invest in international equities is through a mutual fund. which offers investors the following advantages:

Diversification

Diversification helps reduce the risk of loss associated with any single investment. While diversification cannot eliminate risk entirely, it smoothes portfolio performance during periods of market volatility. (For more on the basics and benefits, read Introduction To Diversification .)

Professional Management