Why Invest in Bonds

Post on: 16 Март, 2015 No Comment

Peter Gridley / Stockbyte / Getty Images

For years, investors were told that stocks were the best vehicle for long-term savings, and that sentiment persists today even in the wake of two market crashes thus far in the millennium. But those who downplay the role of bonds may be missing out on significant opportunities. In fact, bonds are as important today as ever. Here is a brief overview of four important reasons to consider an allocation to bonds:

While many investments provide some form of income. bonds tend to offer the highest and most reliable income streams. Even in times when prevailing rates are low. there are still plenty of options (such as high-yield bonds or emerging market debt ) that investors can use to construct a portfolio that will meet their income needs. Most important, a diversified bond portfolio can provide decent yields with a lower level of volatility than equities, and with higher income than money market funds or bank instruments. Bonds are therefore a popular option for those who need to live off of their investment income.

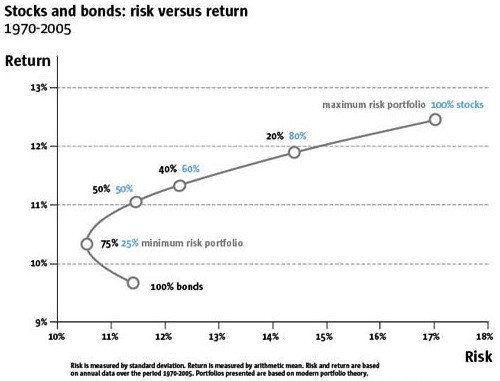

Diversification

Almost every investor has heard the phrase “don’t put your eggs in one basket.” It may be a clich, but its time-tested wisdom nonetheless. Over time, greater diversification can provide investors with better risk-adjusted returns (in other words, the amount of return relative to the amount of risk) than portfolios with a narrower focus. More important, bonds can help reduce volatility – and preserve capital – for equity investors during the times when the stock market is falling.

Protection of Principal

Fixed income investments are very useful for people nearing the point where they will need to use the cash they have invested – for instance, an investor within five years of retirement or someone who needs to tap their child’s college fund to pay for school. While stocks can experience huge volatility in a short period – such as the crash of 2001-2002 or the financial crisis of 2008 – a diversified bond portfolio is much less likely to suffer large losses in a short period. As a result, investors often increase their allocation to fixed income, and decrease their allocation to equities, as they move closer to their goal.

Potential Tax Advantages

Certain types of bonds can also be useful for those who need to reduce their tax burdens. While the income on bank instruments, most money market funds, and equities are taxable unless held in a tax-deferred account, the interest on municipal bonds is tax-free on the federal level and, for investors who own a municipal bond issued within the state in which they reside, on the state level as well. In addition, the income from U.S. Treasuries is tax-free on the state and local levels. While it isn’t always wise to invest in tax-advantaged securities, especially for investors in lower tax brackets, the fixed income universe offers a number of vehicles investors can use to minimize their tax burden.

The Bottom Line

Bonds don’t make for interesting conversation at dinner parties, and they don’t receive proportionate coverage in the financial press relative to stocks. Still, bonds can serve a wide range of uses for investors of all stripes.

Disclaimer. The information on this site is provided for discussion purposes only, and should not be construed as investment advice. Under no circumstances does this information represent a recommendation to buy or sell securities. Talk to a financial advisor and tax professional before you invest.