Why I Use Index Mutual Funds Instead of Index ETFs

Post on: 24 Июль, 2015 No Comment

Last Monday, I discussed my first 2 dividend stock picks of 2011 . At the same time, I have produced a complete picture of my holdings (that can now be found in the dividend holdings section in the top bar of this site). A part of my portfolio is always invested in index mutual funds. Why is that? Sometimes I feel that I don’t have enough liquidity to buy another dividend stock. Sometimes I just don’t feel like rushing my investment strategy and prefer to take a few weeks before making another trade. In both cases, I hate having money sit idle in my account. This is why I have decided to invest my liquidity in an index mutual fund.

Index Mutual Fund vs Index ETF

I have looked at both options for a while. I wanted to make sure my money was invested at all times and that I was able to cash it in to make trades if needed. Therefore, investing in a stock index seems like a reasonable option. I take less risk than concentrating on a specific stock while I still have a good chance of performing if this money is there for a few months up to a year. But why choose a mutual fund over an index ETF? The answer is below:

Index Mutual Fund = Flexibility at a Very Low Cost

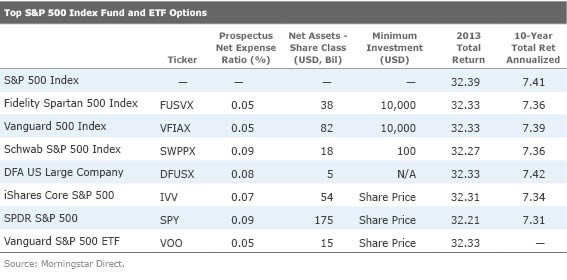

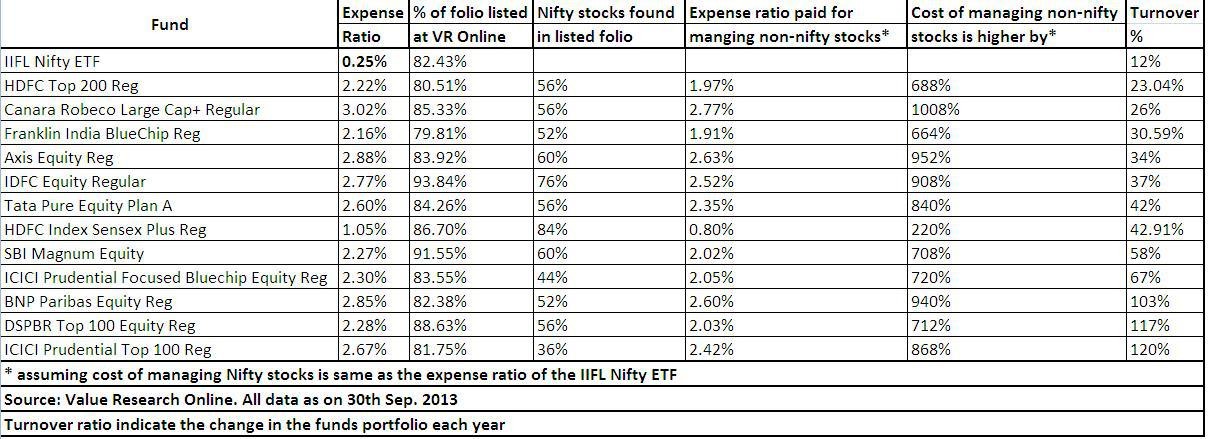

I have run into an interesting debate about ETF and index mutual funds over at another one of my blogs. My main point about going with an index mutual fund is that you can buy and sell them without trading fees. Even better than that, you can find index mutual fund at a very low MERs.

The mutual fund company I use, Altamira, offers 3 main index funds:

Canadian Index Mutual Fund

American Index Mutual Fund

International Index Mutual Fund

Their main strengths are:

#1 Their low MERs (between 0.50% and 0.60%)

#2 No front end or back end trading fees

#3 Currency hedge options (for American and International index funds)

#4 Being part of the top performers in their universes

Since I don’t want to invest more than $1,000 in a stock index product (I usually make a trade when I hit $1,500 of liquidity), buying and selling a low MER index mutual fund seemed a great alternative when compared to a regular ETF (with lower MERs but considering trading fees).

I have chosen a Canadian index for now as I believe that Canadian economic perspectives are better for 2011 than in the US. However, I might change my mind over time.

Index Fund vs Money Market Fund

Instead of putting my money on the sidelines in a money market fund at 1%, I would rather take the risk to live with fluctuations. In the end, I am looking at a 100% equity asset allocation right now. Depending of the type of investor you are, you may prefer to invest your temporary liquidity somewhere safe in order to be able to keep your money for your future trade. In my current investing strategy, I might benefit from a market surge and pick stocks faster than expected… or I can suffer from a global market loss and get stuck having to wait longer before adding another company to my portfolio. Since I’m mainly trading with my retirement account, I’m not in a hurry for profit. I guess it all depends on what you want to do with your money ;-).